The first half of 2025 has been anything but dull. In my blog posts so far this year, I’ve covered everything from policy shifts in Washington to market corrections to record-setting corporate buybacks. Some of these commentaries were shaped by optimism, others by caution—but all were rooted in the goal of providing clarity. Now that we’ve crossed the halfway mark, it’s time to check the scorecard. In this “Then and Now” review, I’ll revisit three themes from earlier in the year and see how they’ve unfolded!

On Policy & Economic Outlook

From The Golden Age of America (January 24, 2025)

In January, the launch of Trump’s second term brought bold promises but also the challenges of high interest rates, tariff policy, and inflation risk:

- Then: “Trump had his ‘return to glory’ last week, but this week the focus will shift to Jerome Powell’s response to Trump’s demand on interest rates. The Fed will convene on January 28–29th… Powell will surely not budge at the President’s call for lowering interest rates.”

- Now: What began as a quiet standoff has turned into a headline-grabbing feud. Trump now calls him “Too Late Powell.” While rates remain elevated, the tug-of-war between pro-growth policy goals and Fed caution has defined much of the year’s narrative. I couldn’t dream of a better picture to come back then!

On Market Corrections

From The Madness of March (March 22, 2025)

Back in March, the market hit its first technical correction since 2022, shaking investor confidence but also opening the door for opportunity:

- Then: “The S&P 500 has experienced a 10% correction… In the short term, they serve as a reset for market structure, volatility, and valuations. More importantly, corrections create opportunities for those with cash on the sidelines and for investors who are dollar-cost averaging into equities.”

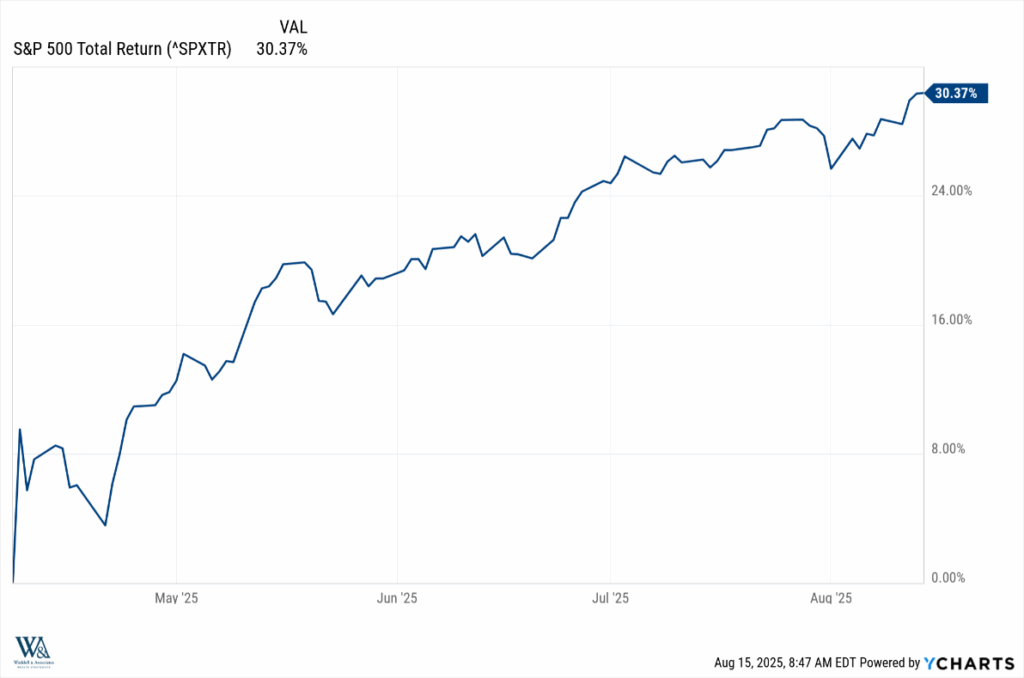

- Now: The S&P500 roars back, up roughly 30% from the lows of April 8th to new all-time highs this week, rewarding those who “avoided panic and strategically invested their cash.”

Market Support from Buybacks

From Corporate Buybacks: Inspiring Confidence or Engineering Financials? (May 9, 2025)

Earlier in the year, record-setting corporate share repurchases provided a notable undercurrent of support for equity markets:

- Then: “Corporate share buyback announcements hit record highs in Q1 2025… These supportive equity flows… signal management team confidence… You can call it a buyback or financial engineering, but it’s just math, and buybacks are naturally supportive of equity prices, ultimately benefiting investors.”

- Now: The buyback wave has only accelerated! 2025 is on pace to hit $1.1 trillion in repurchases, surpassing the 2022 record. Meanwhile, markets are at all-time highs, providing a steady tailwind despite volatility in policy headlines.

The first half of 2025 have reminded us that markets are a constant push and pull of policy, sentiment, and structural forces. The Powell–Trump rate standoff, the recovery from the March correction, and the record pace of buybacks all tell the same story: investors who kept their cool and stayed the course were rewarded. Looking back on my insights then, and now, provides an opportunity to refine perspective, challenge assumptions, and provide clarity!

Have a great week!

-David

Sources: YCharts; Birinyi Associates

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.