Strategies for Business Owners

Your personal needs and your business needs can often intersect.

We understand that many of our clients are founders and business owners. Being a business owner presents unique challenges and opportunities, including exit strategy, succession planning, and employee benefits considerations. For family business owners, the needs of both family and business often intertwine as you shape the best outcome for everyone involved and strive to leave a meaningful legacy.

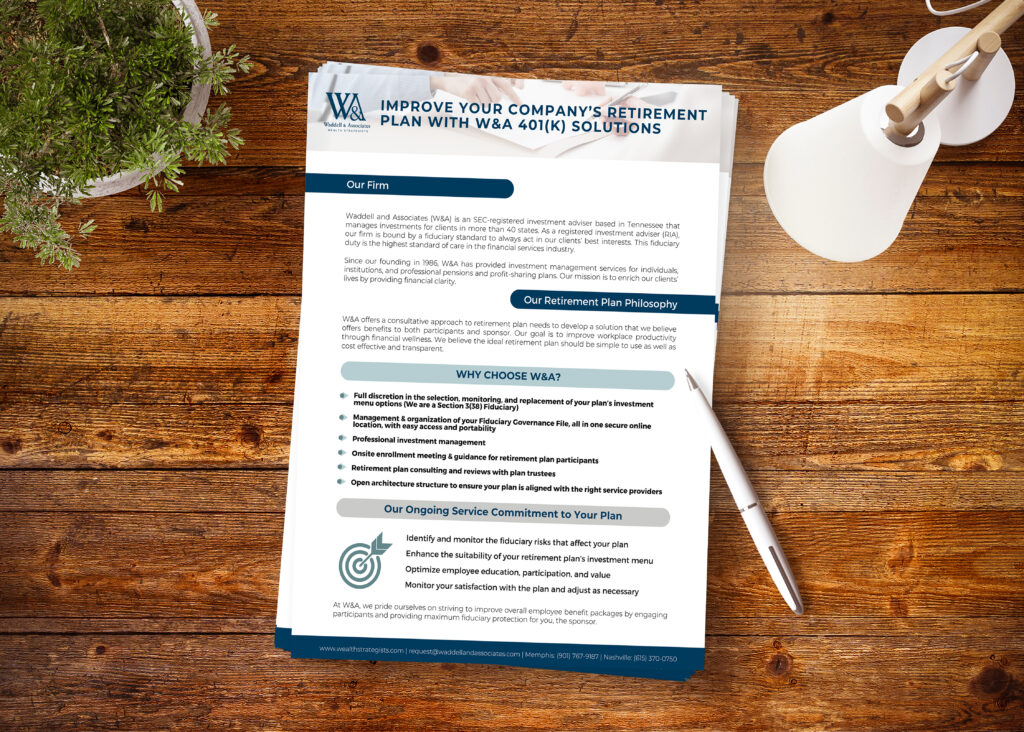

Retirement plans

Attracting and retaining exceptional employees requires offering competitive retirement plans. At W&A, we prioritize your employees’ needs, just as we prioritize your interests. Our goal is to help you maintain a competitive edge by providing cost-effective and transparent retirement plan solutions. We focus on helping your employees build wealth while ensuring fiduciary protection for you. With Waddell & Associates, you can trust us to provide the most suitable plan structure, investment options, and reliable providers, all from a team you can rely on.

Business succession

As your business reaches a stage where it surpasses your individual presence, the decisions you make have a profound impact on your family and employees. It becomes crucial to have a succession plan that aligns with your personal goals, values, and dreams for both your family and the dedicated individuals who have contributed to your business’s growth. Our team helps you navigate the challenges and explore effective solutions as you plan for your exit. Whether you envision passing the reins to a family member, your loyal employees, or finding a suitable buyer, we are here to assist you. Working closely with your legal, accounting, and valuation teams, we guide the implementation of a comprehensive plan that facilitates a successful transition, all on your terms.

Employee benefit planning

Executive benefit planning

Executive benefits packages play a pivotal role in attracting and retaining key leaders who are vital to the long-term growth and success of your business. We specialize in helping you and your leadership team build wealth while implementing sophisticated strategies for retention and financial independence. Our expertise encompasses equity-based approaches such as stock options, restricted stock grants, and deferred compensation or bonus structures. We can tailor executive benefit plans that align with your organization’s objectives and empower your leaders to achieve financial security and independence.