In recent decades, corporate stock buybacks have become a force in the financial landscape. Once rare, buybacks are now one of the most common ways corporations return capital to shareholders, alongside or even in place of dividends. Most importantly, under the current market structure, buybacks provide market liquidity and naturally support equity prices. But while buybacks are a shareholder and investor-friendly move, they also raise critical questions about financial engineering, or a fancy way of making the math friendlier to company financial metrics.

Buy, Buy, Buy Back!

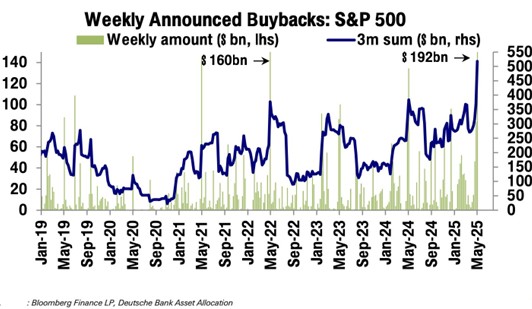

Q1 2025 earnings growth of the S&P500 sits at 12.1%, and while companies have cut guidance and expectations for Q2 and Q3, their management teams have also agreed to hit the buy button on their own company stocks. Corporate buybacks, or when a company repurchases its own shares in the open market, are hitting record highs:

Corporate buybacks are important to investors for a few different reasons:

- Buybacks are positive flows and provide liquidity to markets when they might otherwise not have it.

- They suggest management confidence in a company’s growth prospects.

- Buybacks could indicate that management perceives a valuation discount on the current market price.

The Invisible Hand

I’ve written here before about market structure and its dynamics, but not specifically on buybacks. Markets, and specifically equity prices, are a constant valuation of supply and demand. Buybacks have been around for a few decades; however, the practice has grown substantially over the last fifteen years:

Though measured quarterly, you can see that in 2009, just roughly $150 billion was spent on share repurchases. In 2022? Well over $1 trillion. US companies are scooping up their own stock at depressed prices. These buyback flows prove supportive to equity prices on both sides of supply and demand, as the actual number of shares outstanding decreases, while simultaneously driving demand higher as they purchase the shares themselves on the open market.

Management Confidence

The underlying strength in buybacks during periods of market distress can help guide us through corrective phases in prices. Peaks in recent share repurchases came in 2018, 2020, 2022, and now 2025. As US companies generate record profit margins, they increasingly deliver capital back to shareholders through repurchases. Management teams have been some of the best price dip buyers over the last decade. If the recent record increase in announced buybacks in the S&P is any indication, we should have positive flows in the market supporting equities over the intermediate term as the announced plans are executed.

It’s Just Math

Though corporate buybacks are positive for investors, there are some who argue that corporate buybacks are glorified financial engineering, because corporate buybacks augment underlying valuation metrics. Let’s explore.

When a company decides to buy back its stock on the open market, it reduces the shares outstanding for the company. If net income remains constant, it will increase the company’s earnings per share metric:

Earnings Per Share = Net Income / Shares Outstanding

For example:

$100 million net income / 50 million shares = $2.00 Earnings Per Share

After buying back 10 million shares:

$100 million net income / 40 million shares = $2.50 Earnings Per Share

Voila! An increase in EPS!

Even further, an increase in EPS is supportive of valuation metrics like P/E ratios (price/earnings). Again, this is just math, but follow me here. If EPS increases via a corporate buyback, and stock prices remain unchanged, the P/E ratio will fall simply because the denominator (EPS) has increased. Given the decrease in P/E, a company’s stock or even an index could look “cheaper” from a valuation standpoint, perpetuating more buy-side demand for the stock or index. Why does this matter for investors? As I touched on last week, companies have begun reducing guidance and EPS growth for the latter half of the year, while now also announcing stock buybacks. Since companies are mathematically increasing EPS through reducing shares outstanding (denominator of EPS), if they at all beat expectations on net income in the coming quarters (numerator of EPS), and market prices stay relatively unchanged, the market could be “undervalued” from a P/E ratio perspective later this year, perpetuating more demand for equities. You can call it a buyback or financial engineering, but it’s just math, and buybacks are naturally supportive of equity prices, ultimately benefiting investors.

Have a great weekend!

-Matt

Sources: Yardeni, Bloomberg Finance LP, Deutsche Bank

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. Waddell & Associates does not provide personalized investment advice through this communication. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.