The Full Story:

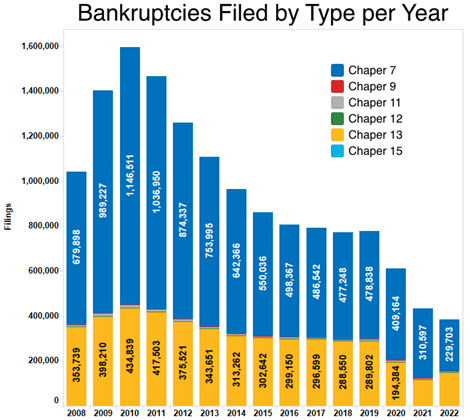

A year ago, I sat on a panel with lawyers and investment bankers in the turnaround industry. These specialists serve companies in distress at or near the point of bankruptcy. Sadly for them, they had no work at the time as the Government guaranteed all debt during the pandemic while shoveling money into the pockets of poor performers. Many of these providers had to close up shop or pivot into other vocations amidst the shrinking supply of distress:

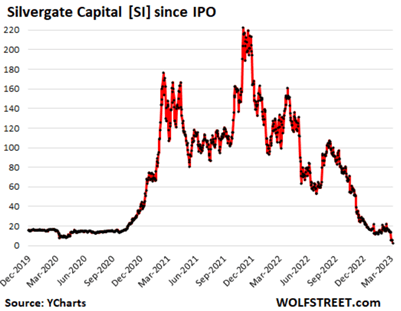

By suppressing business distress, policymakers created a “moral hazard” of inflated business confidence leading to less scrutinous deal diligence and investor overconfidence. At the event, someone asked me if this largesse would cause another Great Financial Crisis. Not likely, I responded. The largest banks before the GFC figured out how to operate beyond the regulators’ reach by setting up an entire “shadow banking system” through derivatives. In response to the GFC, regulators tightened controls, significantly increased capital requirements, and frequently subjected the systematically important banks to stress tests. When cycles turn, it’s the unregulated areas of the marketplace that inflate and pop, with regulation close behind. So, while I didn’t expect another systematic financial inferno this go-round, I did expect brush fires amidst the “moral hazard” overgrowth. The largest unregulated bubbles blown since the GFC exist in cryptocurrency and venture capital. Over the past few weeks, two banks dedicated to these industries immolated. Silvergate Bank lent money to Crypto firms:

With the market cap of crypto down 75%, massive fraud and abuse scams unmasked, and support capital scarce, it’s a wonder Silvergate lasted this long!

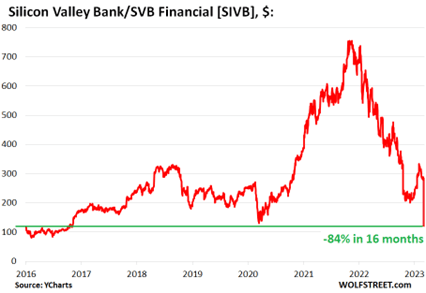

On a larger scale, Silicon Valley Bank took in deposits from venture capital-backed technology startups and then lent money out to venture capital-backed technology startups. Since venture capital-backed technology start-ups rarely make money, they require a continuous flow of credit or equity to fuel operations. When the money stops flowing (no other lenders, venture capital frozen, IPO window closed), deposits evaporate. As companies run out of capital, valuations evaporate. The combination of a collapse in deposit levels and a collapse in collateral values forced Silicon Valley Bank to try and raise more capital, a white-hot distress flare for investors:

Unable to raise capital or forestall deposit runs, the FDIC was forced to step in and padlock the doors.

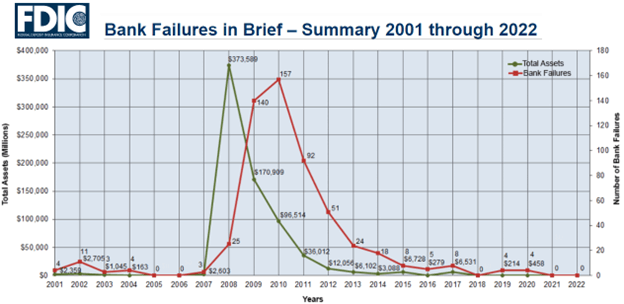

In short, overabundant capital, plus overconfidence in unregulated cryptocurrency and venture capital markets, led to misguided banking concentrations at Silvergate and Silicon Valley Bank, cueing the first bank failures since the COVID lockdowns in 2020:

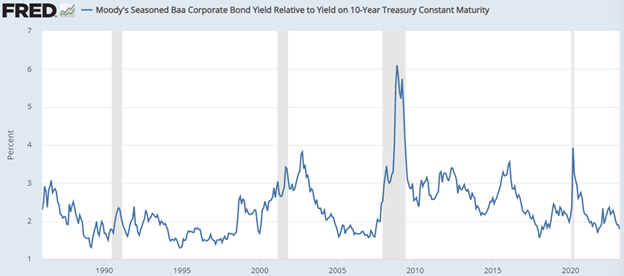

The right question to ask now is, do these two rouge lenders signal a systematic crisis on approach, as the failure of Washington Mutual signaled in 2008? I don’t think so. Distress in crypto and venture doesn’t seem to have tripped distress warnings elsewhere. To assess systematic stress levels quickly, let’s look closely at credit spreads (the difference in yields between bond categories and risk-free treasuries). First, let’s look at moderate-risk corporate bond spreads:

In 2007, this spread shot higher from 1.5% to over 6% in short order. In 2020, this spread shot higher from 2% to 4% in short order. Today this spread sits at 1.79%, down from the 2.4% reached last summer. No signs of distress here.

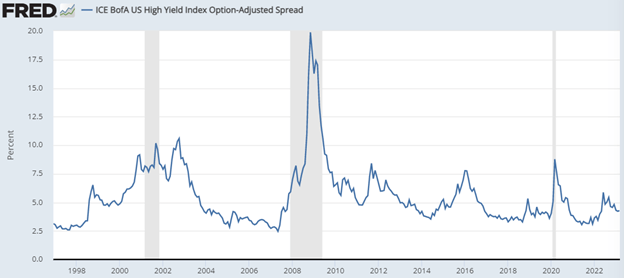

Next, let’s look at high-yield/higher-risk corporate bond spreads:

In 2007, this spread shot higher from 2.5% to over 20% in short order. In 2020, this spread shot higher from 3% to 10% in short order. Today this spread sits at 4.3%, down from nearly 6% reached last summer. No signs of distress here.

Overall, corporate America shows no imminent signs of default.

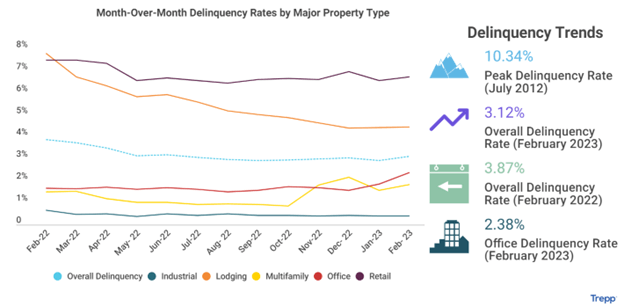

Third, let’s look at commercial real estate credit trends. Nearly everyone agrees that the banking system overall has minimal exposure to crypto and profitless tech troubles. However, with interest rates rising, real estate values falling, and banks highly levered to real estate values, rising loan delinquencies could signal oncoming banking distress.

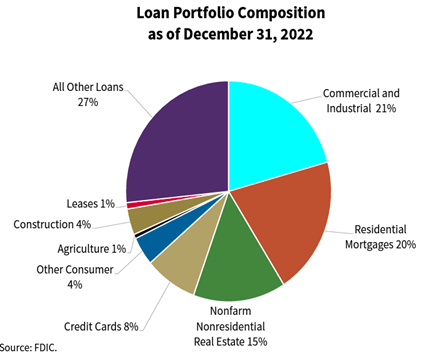

Fortunately, while rates have risen, most borrowers hold fixed-rate obligations well below today’s prevailing yields. While 30-year mortgages today charge nearly 7%, compare that with 4% a year ago and 3.0% two years ago. Given that nearly everyone bought or re-financed at fixed low rates, the surge higher in rates has less market effect than perceived. Furthermore, the no income/no job loans that preceded the GFC crisis do not exist today. Real estate owner equity levels sit far higher. While we will keep a close eye on real estate trends, at least for the moment, the downturn in prices and activity has not tripped distress wires. And in the end, it’s corporate profitability and mortgage repayment capability that underwrites the banking sector. Note that as a percentage of loans outstanding across all banks, crypto and venture capital don’t even register:

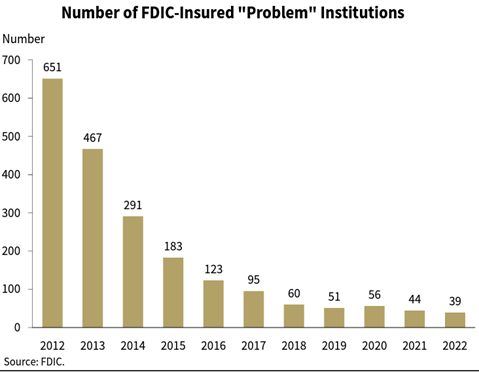

And as such, the number of banking institutions the FDIC monitors on the naughty list remains near cycle lows:

While we do not expect a wave of bank failures, banks will no longer get away with paying depositors nothing. Money Market Funds and T-Bills have quickly absorbed underpaid deposits, which does create liquidity issues for banks. Paying more to depositors than banks receive from borrowers will crimp profits and dissuade loan extensions. The Fed has worked hard to tighten financial conditions. The failure of Silvergate and Silicon Valley Bank may have done more to forward that agenda than an additional 0.25% rate hike later this month.

Enjoy your Sunday!