Markets have certainly wished investors Happy New Year with roaring returns over the first 5 days of 2026. This may sound novel but returns over the first five days provide the first of many indicators for strategists formulating full year outlooks. Specifically, the S&P 500 rose 1.1% over the first five days hitting new intra-day highs and closing highs along the way. Let’s consider the historical outcomes after first 5-day periods:

Starting from the left, markets tend to rise 73% of the time in an average year by close to 10%. When the first 5 days are higher, positive return odds jump to 82% and average returns jump to over 14%. When the first 5 days are lower, positive return odds fall to 56% and average returns fall to 1.1%. However, the proper data set for our current situation is first 5 days with greater than 1% returns. When the first 5 days rise more than 1%, positive return odds rise to 87% and average returns climb to nearly 16%. While we find this encouraging, it’s less encouraging than what happened over the first 5 days beyond the S&P 500.

Rise of the Rest

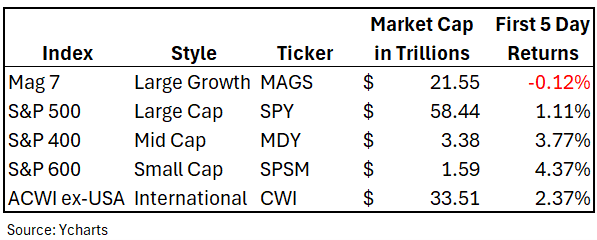

At the end of 2025 the total market capitalization of the Magnificent 7 stocks equaled $21.5 trillion dollars. We have argued that any investor migration away from the overinvestment in the Magnificent 7 cohort into underinvested corners of the market would create surprising results due to disproportionate market capitalizations. Let’s consider the below:

At the end of 2025, global investors allocated $21.5 trillion to the Magnificent 7 accounting for nearly 40% of the entire capitalization for the S&P 500. In contrast, investors only allocated $3.4 trillion and $1.6 trillion to the S&P 400 mid cap and S&P 600 small cap indices. Outside of the US, the MSCI All-Cap World ex-US held $33.5 trillion or roughly 36% of total world market capitalization, near a record low. Examining performance, it’s clear that the slight repositioning of disproportionate capital away from the Magnificent 7 sparked disproportionate gains in underinvested indices with the smallest of the market caps (S&P 600) generating the largest returns. Moral of the story, when it comes to smaller market cap indices, a little capital migration sure goes a long way!

The #1 Thing

If the promise of AI holds true, it will appear in economic productivity data. Productivity measures the economic output per worker. Economies with low technological advancement have low productivity measures. Economies with high technological advancements have high productivity measures. While productivity gains accompany “creative destruction” for some, higher productivity also drives higher earnings for corporations and higher lifestyle levels for consumers overall as inflation pressures abate as well. This week we received blockbuster productivity data for Q3. Productivity rose 4.9% as overall output rose 5.4% while hours worked increased .5%. Over a longer lookback, it’s clear that US productivity has upshifted rapidly:

We usually see surges in productivity like this during recessions as companies shed workforce faster than output falls. It hasn’t been since the mid-nineties that we have seen productivity figures this high during expansion. We suspect that this predates the lift from AI as employers have undoubtedly been hiring less in anticipation of benefits to come. Therefore, high productivity levels could prove persistent, taking the US economy, US earnings and US quality of life measures even higher. The abundance this generates benefits not only the producers of AI (the Mag 7) but also the consumers of AI (the Rest). The more investors believe in this continuing productivity boom, the more money investors will make as the superlative returns for the leading Mag 7 become the superlative returns for the lagging Rest.

Have a great week!

-David

Sources: Carson Investment Research, Yardeni Research, YCharts

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.