As we come to the end of the year, markets have fixated on two primary narratives. First, will the AI trade and Magnificent-7 (Apple, Amazon, Google, META, Microsoft, NVIDIA & Tesla) continue outperforming in 2026, and second, will economic reacceleration lead to outperformance in all new market quadrants? Good questions! Let’s explore.

2025: The Old Magnificents

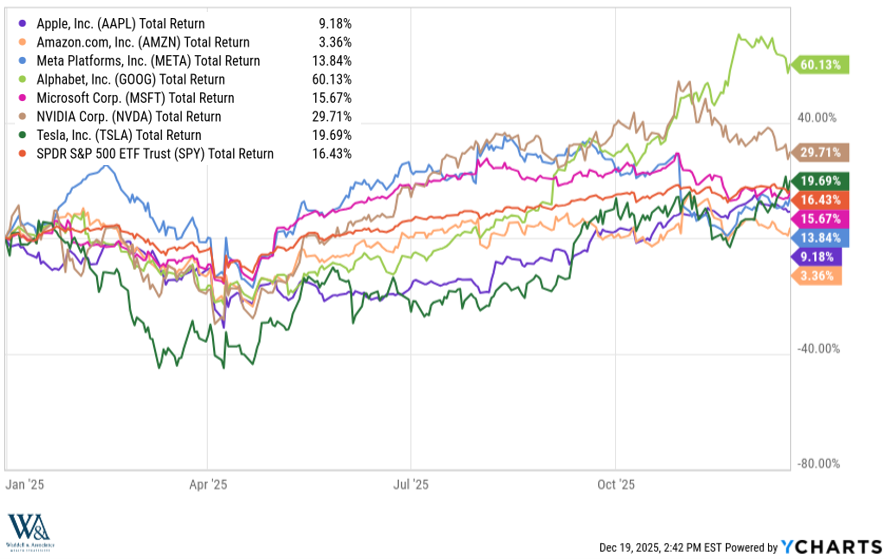

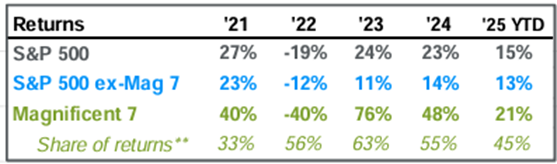

2025 will certainly be remembered as a breakout year for technology. While the S&P 500 has provided investors with 16% returns, the Technology and Communication Services sectors provided the highest returns among the investable sectors with 22% and 21% returns, respectively. Likewise, the Magnificent-7 had another year of outperformance as a cohort delivering 22% returns. By all measures, another pleasurable year for Tech investors. However, if we disaggregate the group the narrative becomes less convincing:

Google’s newfound favor with its latest Gemini launch vaulted its share price up 60% on the year, NVIDIA’s chip dominance powered its 30% return, Tesla just squeaked ahead of the S&P, but the remaining Magnificent 4 lagged in 2025 with Apple and Amazon in single digits. Overall, the median return for the group lagged the S&P 500. Furthermore, while the S&P 500 has recently made new highs, many tech stocks remain well below theirs, with NVIDIA and META 16% below their recent highs. Lastly, the margin of outperformance for the Mags vs. the non-Mags declined significantly in 2025:

In 2023, the Mag-7 outperformed the Non-Mags by 65%; in 2024, by 34%; and in 2025, by 8%. And if we use rolling returns and look back over the last 12 months, the Mag-7 have only outperformed by 2.4%, continuing this diminishing trend. With all the concerns about circular financing and credit issuance, it’s right for investors to question the Mag-7’s continued dominance and begin disaggregating the components to assess their individual merits. We suspect these dynamics will continue to disinflate the excess returns of these Old Magnificents.

The New Magnificents

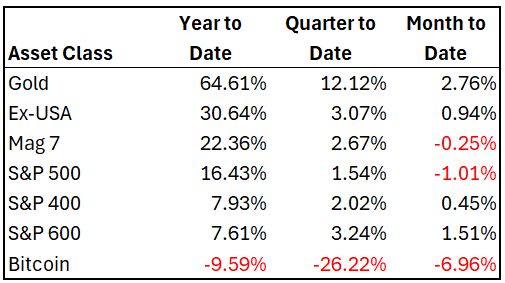

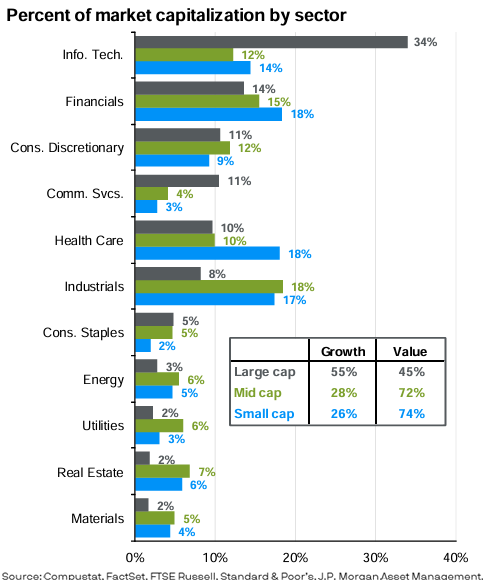

Gold shined brightest this year as the “debasement” of the US Dollar narrative and expansion of Central Bank gold holdings attracted sizable flows into a non-sizable asset class. While the Mag-7 and the S&P 500 delivered shiny results of their own, US equity returns lagged Ex-US equities. Developed and emerging equities provided investors with 30% returns, outperforming domestic stock markets even when adjusted for currency impacts. Low valuations, surprising fundamental strength, and FX tailwinds provided the lift which could persist into 2026. Here at home, small (S&P 600) and midcap (S&P 400) markets lagged again this year, but they have outperformed the Mag-7 and the S&P 500 since September, aided by rate cuts and rising earnings trajectories. The composition of these indices differs greatly from the composition of the S&P 500 with much greater exposure across economically sensitive sectors:

Note that while Technology receives a 34% weight within the S&P 500, it only occupies 12% and 14% of the mid-cap and small-cap indices. Furthermore, while industrials only occupy 8% of the S&P 500, they comprise 18% and 17% of the mid-cap and small-cap indices. As I have said before, 2025 was about putting the Trump policies in place, 2026 will be about putting them into practice. If we do see the economic reacceleration anticipated by many economists and the Fed, the smaller, lagging, but more economically sensitive sectors of this market could become… the New Magnificents!

Have a wonderful week and a very Merry Christmas!

– David

Sources: YCharts, JP Morgan Asset Management

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.