On Wednesday of this past week, the Federal Reserve concluded their eighth and final FOMC meeting of the year. With a record Government shutdown suspending vital data releases (inflation, GDP, and job creation), the official statement, the summary of economic projections and Powell’s presser took on outsized significance. This week we will dig into each, translate, and determine whether the brew adds fuel to Santa’s sleigh.

The Official Statement

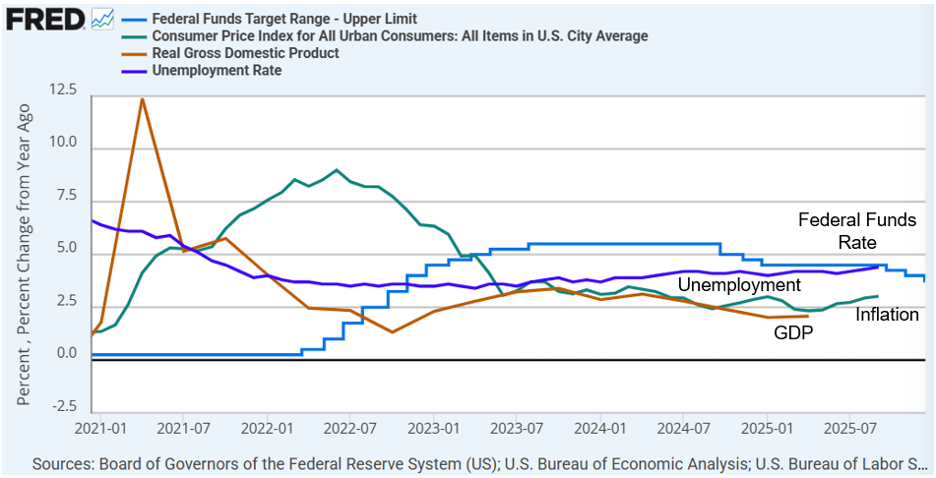

The Federal Open Market Committee sees economic growth expending at a moderate pace, though the unemployment rate has drifted higher. Inflation remains stubborn and elevated above the 2% target but of lower risk than rising unemployment. As such, they lowered the target federal funds rate by .25% from 4% to 3.75%. The committee remains open to further cuts, as justified by incoming data patterns, as shown below:

The committee also noted signs of stress in short-term funding markets and committed to purchasing short-term treasuries to inject additional liquidity.

Translation:

Rates have now fallen 1.75% from their high point. This significant reduction has occurred while economic growth and inflation remain within acceptable ranges. However, worries about the labor market have increased warranting an interest rate cut for “insurance”. More cuts are possible but need firmer justification from upcoming data releases. Concern about market liquidity measures prompted additional monetary easing in the form of treasury purchases.

Market impact:

Rate cuts mean cheaper money, higher earnings, and higher valuations. The market expected the rate cut, but the official statement eliminated any doubt. The market did not expect the Fed to begin immediate Treasury bill purchases to shore up short-term funding markets. The certainty of the rate cut and the positive surprise of additional liquidity added uplift to the rally and support for its continuation.

The Summary of Economic Projections

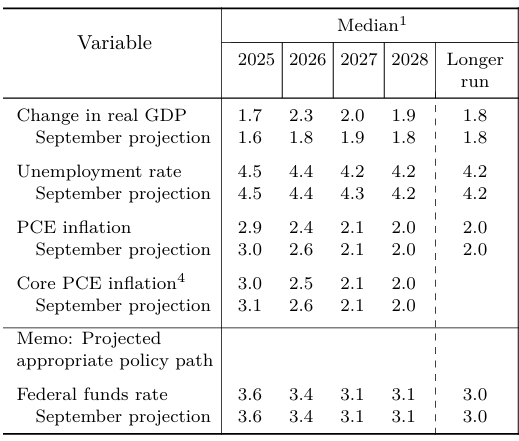

For full year 2025, the FOMC survey participants raised their GDP growth expectation by .1% while lowering their core inflation projection by .1%, compared with the September survey. For 2026, the FOMC survey participants raised their GDP growth expectation by .5% while lowering their core inflation projection by .1%. Expectations for the unemployment rate falling from 4.5% to 4.4% went unchanged. Expectations for lowering the Federal funds rate another .25% also remained in place.

Translation:

The Fed raised its expectations for both a stronger economy and a lower inflation rate, while maintaining its intention to cut interest rates further in 2026. The magnitude by which the Fed revised its GDP growth expectations upward provided further rally fuel for markets, as higher GDP equals higher revenues, while lower inflation equals higher profit margins and higher earnings. For equity investors, their SEP forecast couldn’t have been better, adding even more resolute rally support.

Powell’s Press Conference

Here are the most material quotes from Powell’s press conference:

On Growth:

“Fiscal policy is going to be supportive. AI spending will continue. The consumer continues to spend. So it looks like the baseline would be solid growth next year.”

On Inflation:

“The story with inflation is that…if you get away from tariffs, inflation is in the low 2’s.”

On Labor:

“The downside risks to employment appear to have risen in recent months.” “Surveys of households and businesses both show declining supply and demand for workers.”

On AI:

“I never thought I would see a time when we had 5-6 years of 2 percent productivity growth. This is higher. This is definitively higher”

On Rate Cuts:

“We are at the high-end range of neutral, I would say.”

Translation:

Powell expects inflation to fall materially over the next six months as one-time tariff adjustments flow through. He has concerns about the labor market being softer than it appears. This shifts the balance toward further rate cuts as Powell himself sees us at the high end of the neutral range.

Powell also seems fascinated by the tech-enabled upgrades to productivity. This unlocks higher growth and lower inflation—the opposite of the Stagflation people feared entering 2025. For those who thought Powell would provide hawkish testimony on Wednesday, the opposite occurred. Powell believes the productivity gains within the economy will boost growth and temper inflation, and he expects rates to fall further. With this additional Powell promotion, the Dow, S&P 500, and Russell 2000 index all hit… all-time highs.

Have a great week!

—David

Sources: Federal Reserve Bank of St. Louis, Federal Reserve Board of Governors, Summary of Economic Projections

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.