November has brought about a more turbulent stretch for markets. The longest government shutdown in history officially ended this past Wednesday, but not all sources of uncertainty have faded. The Supreme Court is set to hear arguments related to President Trump’s tariff authority over the coming weeks adding a fresh layer of policy risk. Meanwhile, earnings season has largely wrapped up, yet investor attention will be focused on Nvidia’s results Wednesday evening, a spectacle that increasingly serves as a proxy for broader sentiment on AI, capex, and mega-cap leadership.

Taken together, these forces have produced an uptick in equity volatility to start November. But when you look across other indicators of stress, the picture clears. Bond volatility is subdued, credit spreads remain tight, and currency volatility is still near cycle lows. The disconnect is meaningful: it suggests the stress in equities is not being driven by macro fears or financial instability but rather a healthy, if sometimes uncomfortable, hedge of uncertainty.

Stocks, Bonds, and Currencies

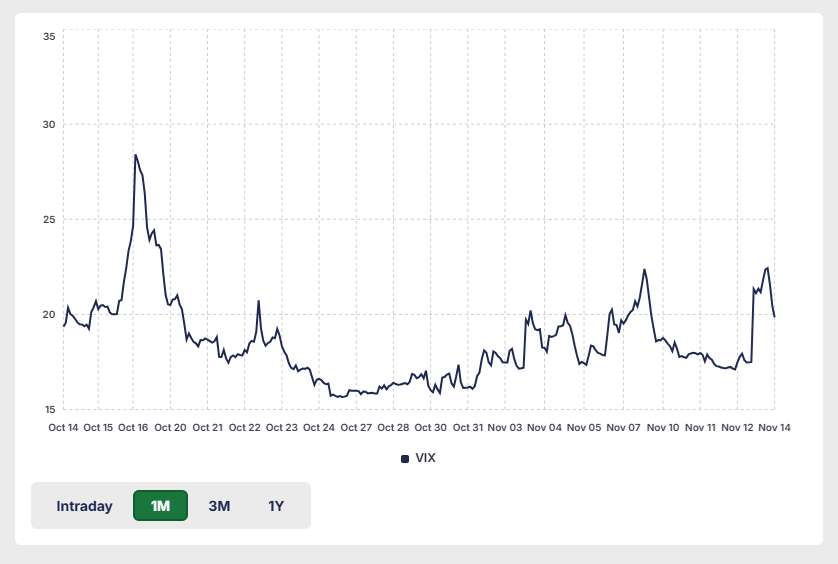

The CBOE Volatility Index (VIX), the market’s most common gauge of near-term S&P 500 volatility, has been steadily climbing since Halloween. We’ve seen two notable 1–2% pullbacks in recent weeks: Friday, Nov. 7 and again Friday morning, Nov. 14, both of which were quickly bought back. This pattern of sharp dips followed by equally sharp recoveries has contributed to a grind higher in equity volatility over the last two weeks.

In contrast to equities, Treasury volatility tells a much calmer story. The MOVE Index, the bond-market equivalent of the VIX, has ticked slightly higher but remains near year-to-date lows. When bond volatility stays anchored, it signals that investors are not concerned about recession risk, liquidity, or expect major shifts in Fed policy. Fixed income markets are behaving as if the current bout of equity volatility is noise, not signal.

High-yield spreads, another gauge of risk appetite, remain at cycle lows. Tight spreads indicate that credit investors, historically quicker to detect financial fragility, see little to no meaningful deterioration in corporate fundamentals. If there were real macro or earnings-driven stress brewing, spreads would be increasingly widening, but alas, they are not.

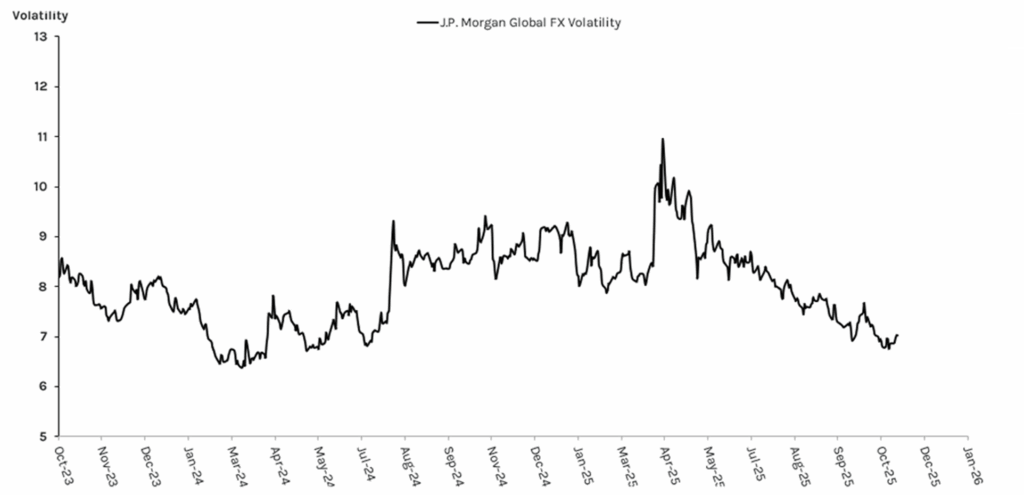

Lastly, global currency volatility remains at very depressed levels. FX or currency markets are the original 24-hour trading markets. They are usually the quickest to react to geopolitical events, liquidity stress, or growth fears. No currency volatility means a lack of financial distress.

In sum, though equity volatility has risen over the last few weeks, the bond, credit, and currency markets say the volatility is episodic, non-trending, and localized to equities rather than a broader risk-off signal.

Have a great week!

-Matt

Sources: YCharts, Hedgeye, Federal Reserve Bank of St. Louis, Barchart, CBOE

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.