The Full Story:

This week contained a cornucopia of market-moving morsels. Fed action, earnings action, tariff action, and year-end positioning pressed all three major stock market indices to fresh new highs. However, beneath the surface, individual stock performance showed far less conviction. With ten months of the year and 15%+ returns now behind us, will this rally rest…for the rest of 2025?

Powell Says What?

Jerome Powell provided monetary easing by cutting the Federal Funds rate .25%, but also conversational tightening by saying further cuts in December are “not a forgone conclusion” and, in fact, “far from it”. Odds of a December rate cut fell from 95% before the meeting to 60% after. This added some uplift to longer-term yields across the Treasury curve and downforce on more interest-rate sensitive areas of the market like the Ex-Mags and smaller cap stocks. Powell apparently sees more strength in the labor markets and risk of reinflation than markets anticipated. The lack of economic data releases due to the shutdown only exacerbated communication confusion as perhaps Powell knows something we don’t know. Ironically, the impact of the government shutdown should be less growth, less labor strength and lower inflation. Go figure. Stocks struggled with the interpretation, ending Wednesday essentially unchanged due to the dovish cut and hawkish chat. Whether the Fed cuts rates in December or not, they will be cutting rates further in 2026 as each of Trump’s candidates to replace Powell on May 15th have assured.

Friends Again

Donald Trump stylized his meeting with Xi Jinping of China a 12 on a 10-point scale. As a result of the pleasantries and gift exchange, the US agreed to cut tariffs on Chinese goods from 57% to 47% while China agreed they will sell us more rare earth materials, less fentanyl, and will buy more soybeans. This amounts to a tactical trade truce with China for now, removing a key risk factor for the markets. None of this has been papered of course but concerns over a reescalation of trade tensions with China have abated.

How Magnificent!

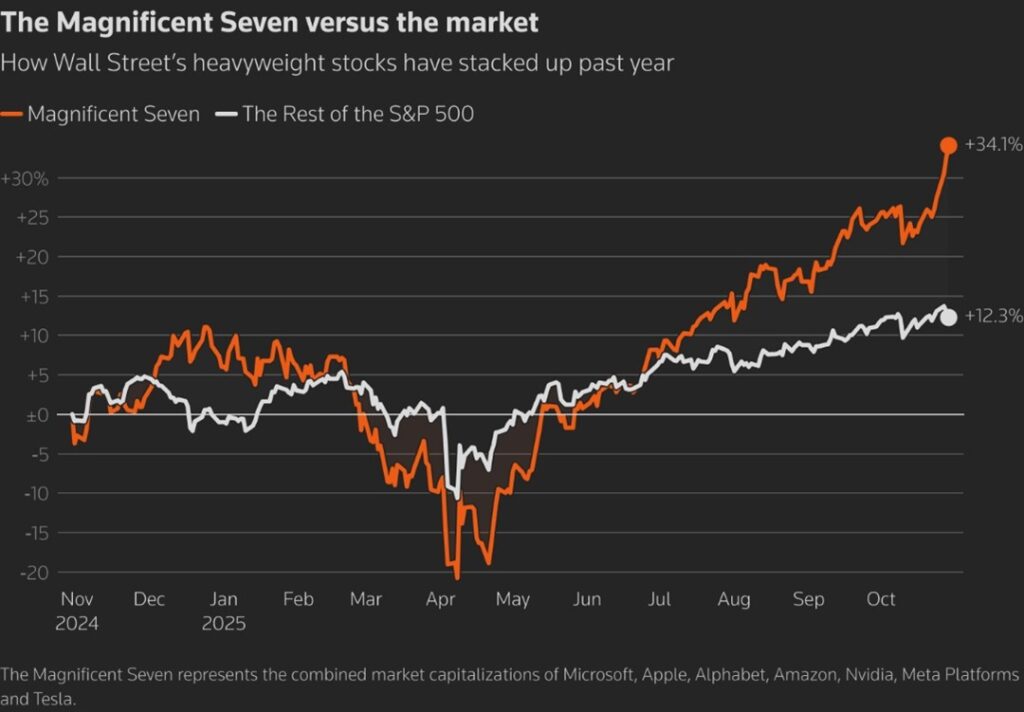

Six of the Mag 7 stocks have now reported their 3rd quarter earnings. Investors praised and rewarded results for Apple, Amazon, and Google, while punishing Tesla, Microsoft, and META. Nvidia matters most but will not report until November 19th. Investments into AI continue to outpace returns on AI for these companies, but their legacy business units continue to perform well and provide cash flow to underwrite the hyper scaling. However, the ratio of cash flow to capex ratio has been declining given the ever-higher level of AI investment. This bears watching as rising financing requirements on unknown outcomes increases risk, but this hasn’t interrupted return trends to date. Overall, the market passed this quarter’s Mag 7 earnings moment (pending Nvidia), and their atmospheric trends as a cohort continue:

Is That You, Santa Claus?

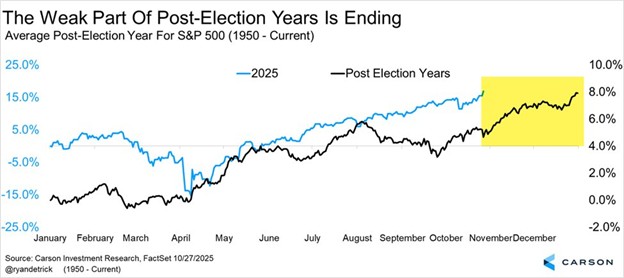

Welcome to November and the potential for a year-end Santa Claus rally. By this point in the year most problematic unknowns have become pacifying knowns. The trade war has effectively ended. The OBBB has passed. The Fed has started its rate reduction campaign. Gaza has a peace plan on paper. Russia’s theatre seems contained (even more so since we re-friended China), and the US border has been sealed without economic distress. The indices have priced this reality in as evidenced by the continuous claims of all-time highs. Traditionally, late October marks the beginning of a year-end rally, but also the completion of a seasonal pullback period:

That didn’t happen this year as both September and October provided above average returns. Did Santa come early? Maybe, but historically a strong first 10 months presages a strong last two months as well:

Over the last 75 years, when the S&P 500 has gained more than 15% in the first ten months, it rose another 4.7% on average over the last two. Furthermore, the two-month period over these occurrences delivered positive returns 95% of the time. Markets have a way of embarrassing forecasters, but with strong results for this earnings season, and positive guidance for many earnings seasons to come, Santa may just yet deliver S&P 7,000 by year end, unless interrupted by some unforeseen Grinch. Rally Ho!

Have a great weekend!

-David

Sources: Bloomberg, Carson Investment Research

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.