As we pass the halfway mark of 2025, one of the important themes shaping the investment landscape is the performance of the U.S. dollar. As the world’s reserve currency, the dollar wields unique influence over international markets from equity and bond returns to commodity pricing and capital flows. And this year, its story is one of meaningful weakness.

As measured by the DXY (U.S. Dollar Index), the greenback is down roughly 10% year-to-date. The index, which tracks the dollar’s value relative to a basket of other currencies (The euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc), hasn’t experienced a double-digit annual drop since 2017—and before that, 2002. Moves of this magnitude have been rare in recent memory, and it materially impacts investor portfolios.

Why a Weaker Dollar Matters

For investors with international equity exposure, this year’s dollar decline has been a major tailwind. When the dollar weakens, gains in foreign markets, priced in local currency, translate into even stronger returns in dollar terms.

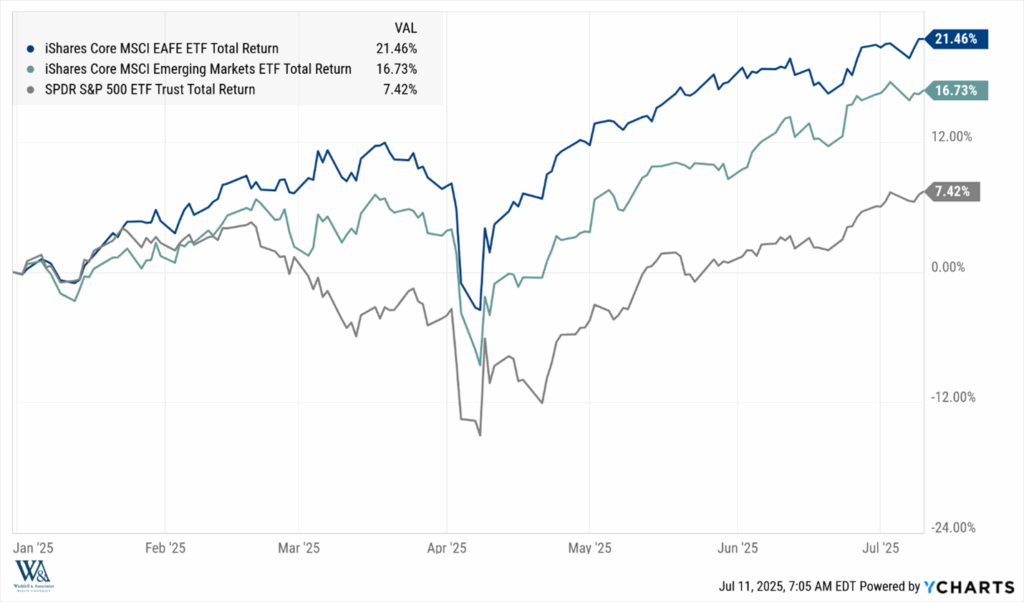

And the results have been impressive:

- Developed market equities, as represented by the iShares Core MSCI EAFE ETF (IEFA), are up 21% YTD in USD terms.

- Emerging market equities, via the iShares Core MSCI Emerging Markets ETF (IEMG), are up 16% YTD.

But if you remove the impact of the falling dollar, those returns fall to 11% and 6%, respectively. In other words, currency appreciation accounted for half the gains. That’s the power of foreign exchange working for, rather than against, global investors.

A Trend Reversal?

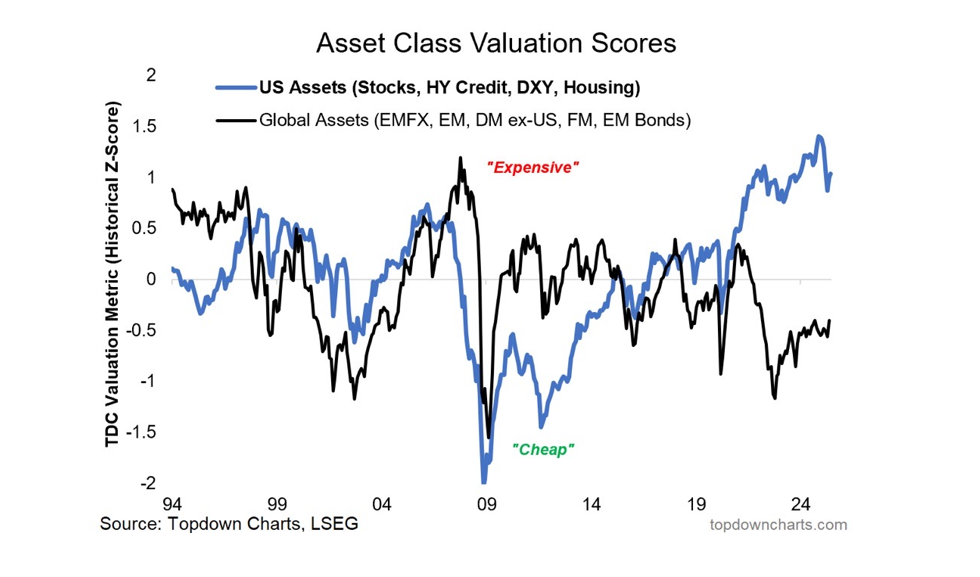

The shift represents a clear departure from recent history. For much of the past decade, a strong dollar suppressed foreign asset performance. When local currencies weakened against the dollar, U.S.-based investors often saw overseas gains erased in translation. The USD strength underpinned an era of U.S. asset outperformance and contributed to consistent home bias.

But 2025 is reminding investors that when the dollar falls, global diversification pays. And after 15 years of U.S. outperformance, the valuation gap between US and international assets has become increasingly difficult to ignore. U.S. assets are expensive relative to their global peers, and dollar weakness gives international markets both valuation appeal and performance momentum.

Reassessing Global Assumptions

It can be easy to fall victim to the narratives of recent market performance, but an environment with a weakening dollar necessitates a fresh look at portfolio factors, specifically:

- Currency exposure, historically viewed as a risk factor, is now a contributor to returns, particularly for investors in unhedged international allocations.

- Global diversification, often a defensive strategy, is now a source of alpha as foreign markets outperform and currency gains compound returns.

- While U.S. multinationals may benefit from currency translation, it’s international companies with revenues tied to strengthening local currencies that gain the most, both in earnings and relative valuation. The weaker dollar helps level the playing field, making non-U.S. equities more competitive on a global basis.

Enjoy the rest of your weekend!

-Matt

Sources: Ycharts, Topdown Charts, LSEG

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.