Congratulations to the US Women’s Hockey team for their stunning defeat of Team Canada in Thursday afternoon’s gold medal game. Electric!

Throughout the Olympic Games this year, every American hockey goal was followed by Lynyrd Skynyrd’s “Free Bird”, the official Team USA hockey goal song at the 2026 Winter Olympics in Milan-Cortina. A fitting choice, symbolic of our beloved bald eagle. The beauty of the ‘free bird’ is its ability to go where it wants, when it wants, unrestricted in choice. For the last several years, America’s largest technology companies have operated with similar freedom in the form of free cash flow; but that bird might be soon landing. Let’s explore.

Cash is King

Over the last several years, big tech has generated extraordinary amounts of free cash flow. What is that? In simple terms, it is the cash a company generates after operating expenses and capital expenditures. In plain English, its money left over that companies can re-deploy towards shareholder dividends, new capital ventures, share buybacks, and more. Free cash flow is what gives companies strategic flexibility on their financial futures. For big technology companies like Microsoft, Alphabet, Amazon, META, and Oracle, that flexibility has historically been enormous with trailing twelve-month free cash flow totaling a combined $200 billion. But that freedom is now being tested.

The AI Investment Surge

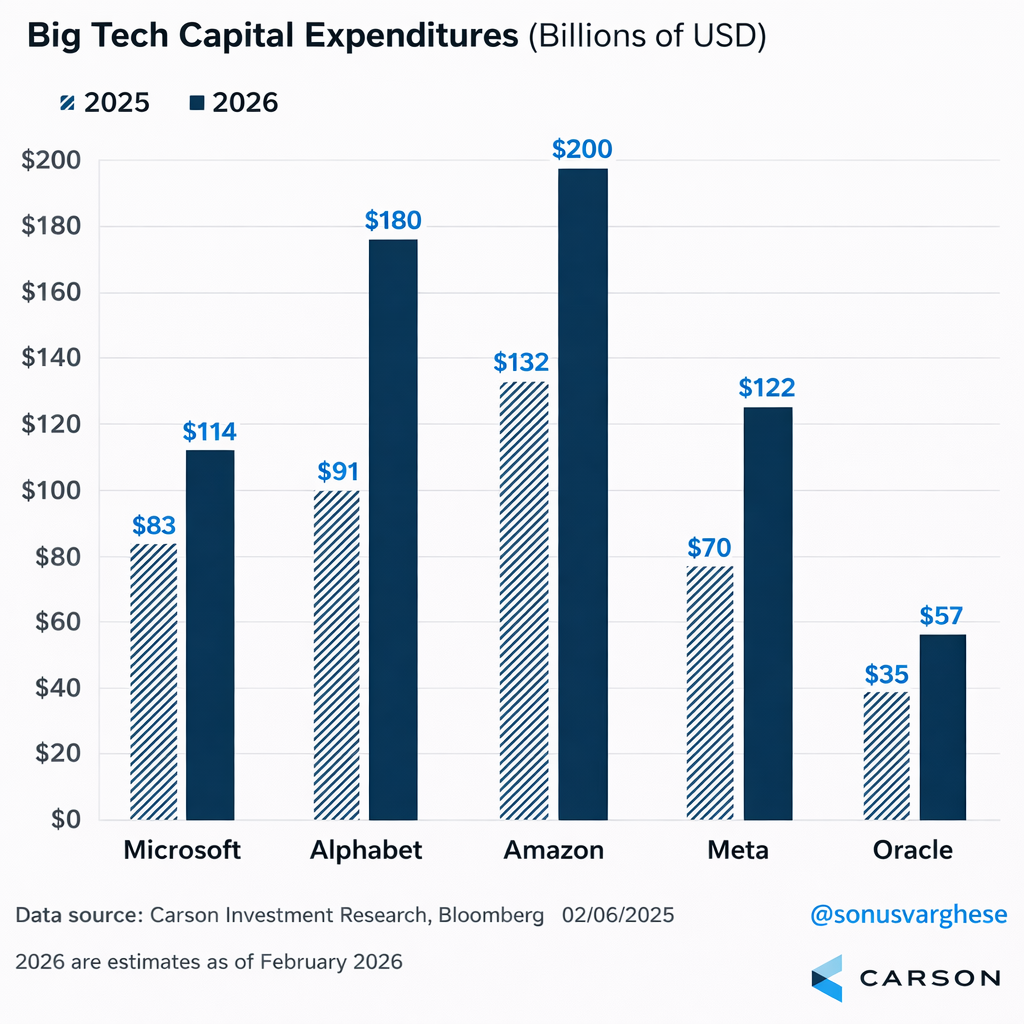

These same companies are committing that free cash flow towards capital expenditures to build out their artificial intelligence advantages, including data centers, semiconductors, infrastructure, model training, and more. The scale and projected spending increase over last year is significant:

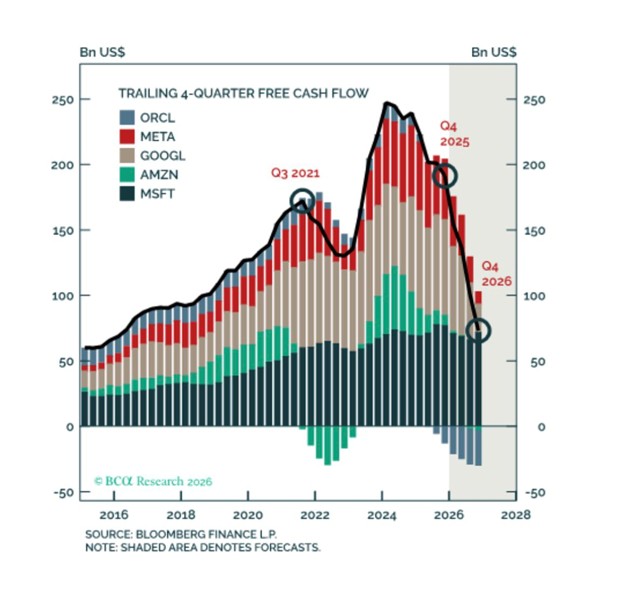

We don’t know what rate of return these investments will ultimately earn. We do know the surge in spending is projected to eat away at what made these companies so valuable over the last several years: near term free cash flow. The chart below depicts the impact of expected capital expenditure amounts on trailing free cash flow of these same companies:

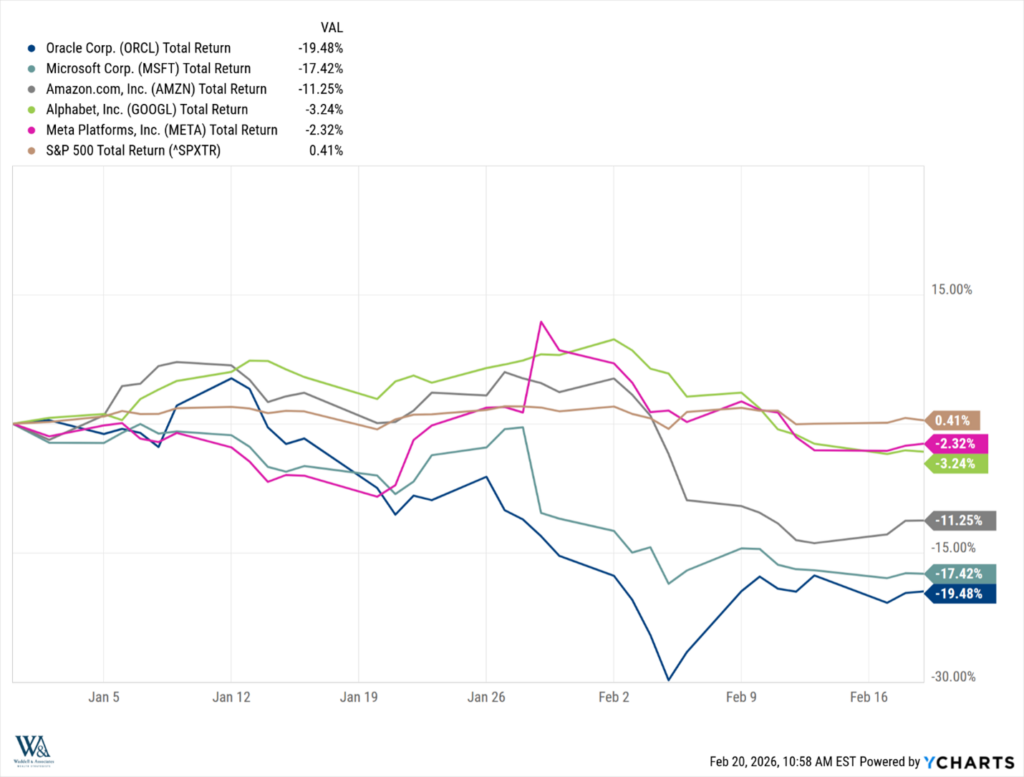

These forward estimates suggest net free cash flow declining 50% in just over a year. Meaningful. For years, ample free cash flow fueled aggressive share repurchase programs that offset dilution and improved shareholder value. But now, that free cash flow is being redirected and the market is taking notice. Below are the year-to-date returns of the same constituents reflecting investor recalibration as capital allocation priorities evolve amongst big tech.

A small sample size, yes. Earnings are still projected to grow significantly. It doesn’t represent a downshift in profitability, but it does represent a strategic decision which ultimately will improve, or erode, future shareholder value.

Apple, By Contrast

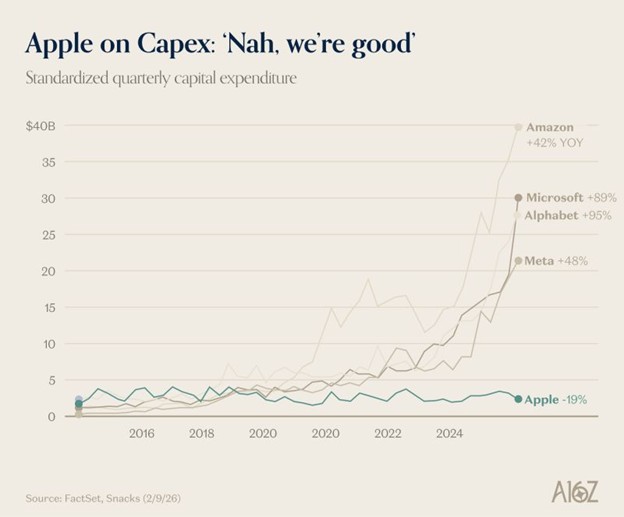

But not everyone is partaking in the spending spree. Apple has lagged its peers considerably in their growth (or lack thereof) in Capex spending, noted below.

This raises an important strategic question. Is Apple demonstrating discipline or risking a “Kodak Moment”? For context, Eastman Kodak famously chose not to adopt new digital photo technology, opting to stay in its profitable film photography lane. Digital photography ultimately won the technological cycle, and Kodak lost their competitive moat in film photography.

This technological inflection point will reward decisive and disciplined capital allocation, and we’ll look back on this someday with clear hindsight as to the winners and losers. Big tech has operated like a financial free bird generating excess cash far beyond their recent reinvestment needs. That era of surplus is transitioning into intentional investment in the artificial intelligence buildout. The question is no longer how much free cash flow these companies generate, but how effectively they allocate it, and what return that capital ultimately generates for investors!

Have a great week!

-Matt

Sources: Ycharts, BCA Research, Carson Investment Research, Factset, Andreessen Horowitz

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.