W&A clients will soon see confirmations of two rotational trades within our equity portfolios that better align portfolios with our 2026 Outlook (register for our live webinar here). While the SEC will not let us discuss specific trade details within this format, we can discuss general strategic decisions. For more insight and information on the specific transactions, feel free to call your W&A advisor.

Emerging Markets Rotation

We have always approached the emerging markets with a value bias, seeing exposure to the segment as growthy enough. Small cap emerging market names can provide additional downside insurance as they trade far less frequently than their larger cap peers, leading to less performance volatility driven by low conviction capital volatility. In uncertain periods we will hold small cap exposure to avoid capital whipsaws. Unfortunately, just as the low trading volumes limit selling pressure, low trading volumes also limit buying pressure. With conviction growing in the durability of emerging market outperformance, after twenty years of underperformance, we have chosen to swap our emerging markets small cap passive position for a larger cap active position that will benefit more from incoming capital flows. Our selected manager prioritizes dividend paying companies, maintaining our quality bias, while also aligning with our “prove it” financial bias at this point in the cycle. Consider the following factors supporting our Emerging Market exposure:

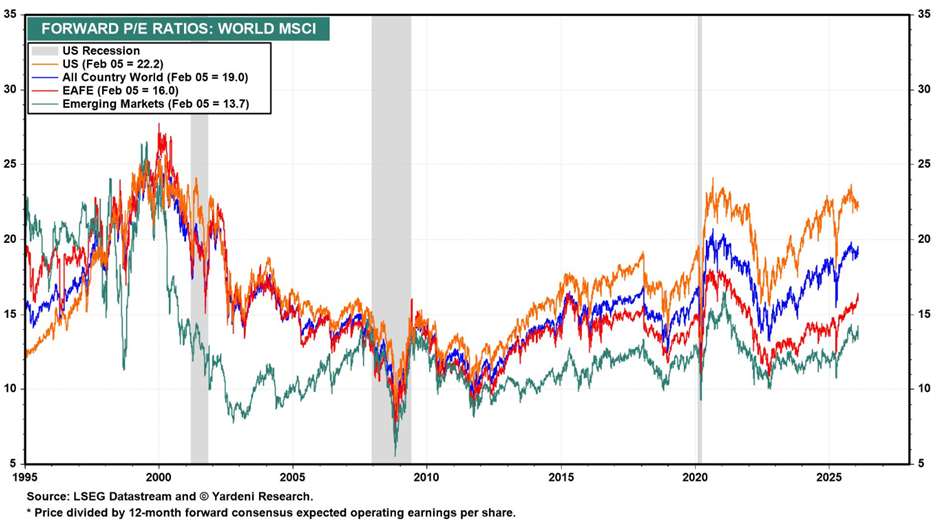

- Note the valuation differential when comparing the Emerging Market stock market index with other world indices:

The emerging market complex trades at 13.7x forward earnings within the midpoint of its historical range, while the US trades at 22x, near the top of its historical range.

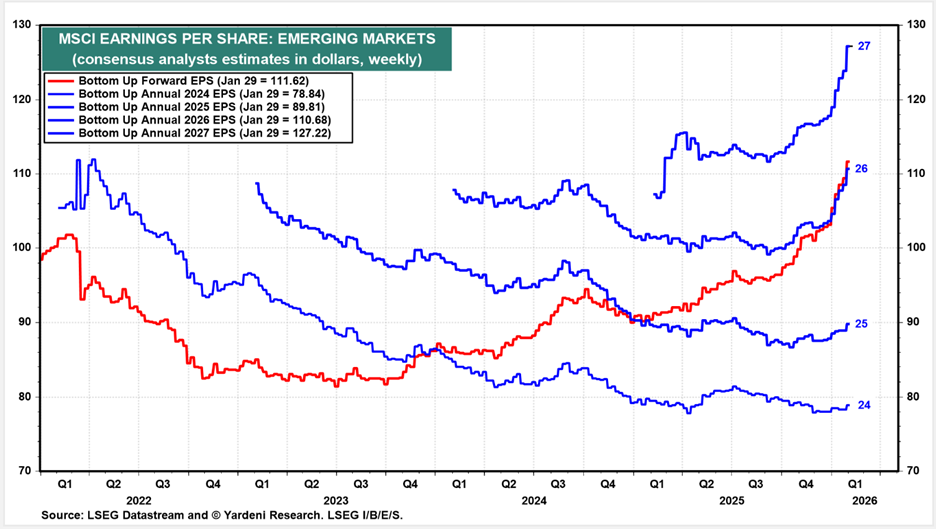

2. Consider the earnings momentum that “Re-globalization”, technological adoption, and voracious demand for materials and components have unlocked:

While analysts expect US earnings to grow 15% and 16% in 2026 and 2027 respectively, they forecast 23% and 15% earnings growth within Emerging Markets.

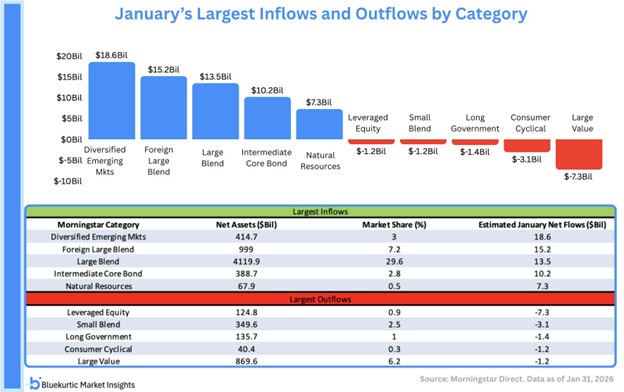

3. Consider money flows into Emerging Markets from January alone:

How long can these catalytic money flows persist? Lower valuations and improving earnings momentum paired with Mag-7 fatigue and institutional under allocation to the asset class could fuel relative outperformance for years.

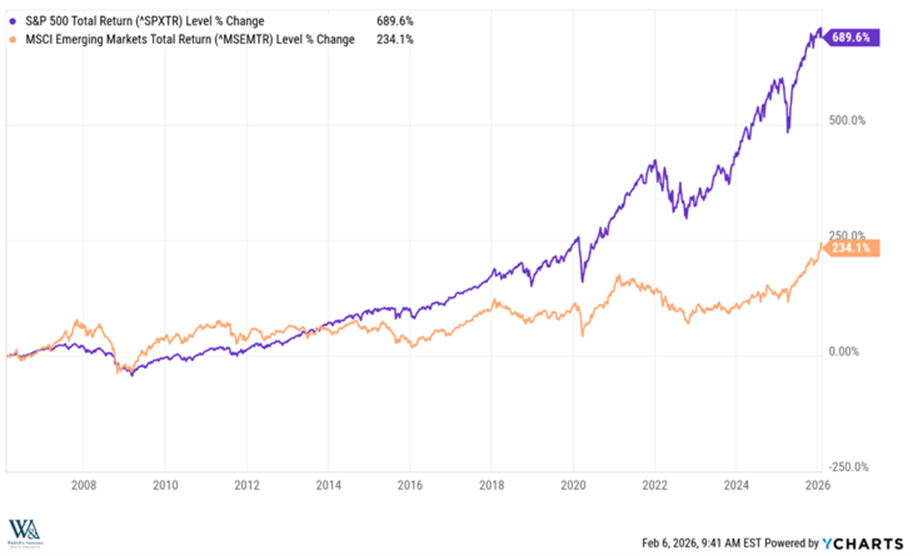

4. Consider the last twenty years of relative underperformance and the spread available for recapture:

In this year alone, the Emerging Markets index has advanced 7% while the S&P 500 has declined 1%. Last year, the Emerging Markets index outperformed the S&P 500 by 16.5%. Relative performance ebbs and flows, but after two decades of neglect, the revival of the Emerging Markets seems well overdue and fundamentally defensible.

Large Value Rotation

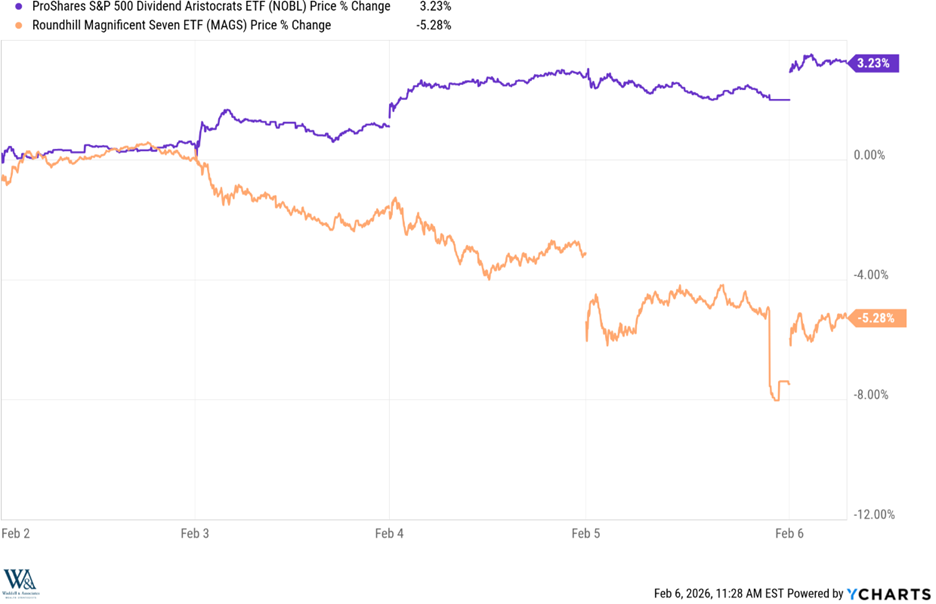

Over the past week, panic attacks incited by fears of AI capex overallocation, infighting among the Mag 7, and the threat of AI agents cannibalizing the software sector created dramatic deleveraging and a flight to quality within the markets. Consider the performance divergence between the Mag-7 complex and the S&P 500 Dividend Aristocrats index over the past week alone:

It’s highly unusual to see an 8% performance spread between such large weightings over a short amount of time, but it validates our thinking. While AI deployment will benefit some technology providers, it will benefit all who utilize it. Therefore, while the tech sector becomes more capital intensive to produce AI, traditionally capital-intensive businesses will become less capital intensive through utilizing AI. Additionally, the historic capex cycle we find ourselves in building out virtual AI, and ultimately physical AI, will require all forms of financing, including massive debt issuance. Much of this bloat can hide in circular financing structures and private debt markets, making investors unsure of true creditworthiness within the marketplace. This reveals the Achilles’ heel for this fast-paced economic cycle. While we are not concerned about an imminent credit event, we are attuned to rising investor skittishness as displayed last week. This drives part of our decision to rotate out of an agnostic deep value manager into another more dividend focused manager, finding comfort in the “prove it” attributes of tangible cash distributions. We expect to see more dividend payer appetite as the debt cycle enlarges, which means more demand, and higher prices for dividend centric strategies.

When Trump won the election in November, the US dollar strengthened. In theory, the orderly deployment of a tariff agenda should increase exports (purchases of dollars) and decrease imports (sales of dollars), supporting currency strength. In recognition, we repatriated a portion of our international exposure to avoid potential currency drag.

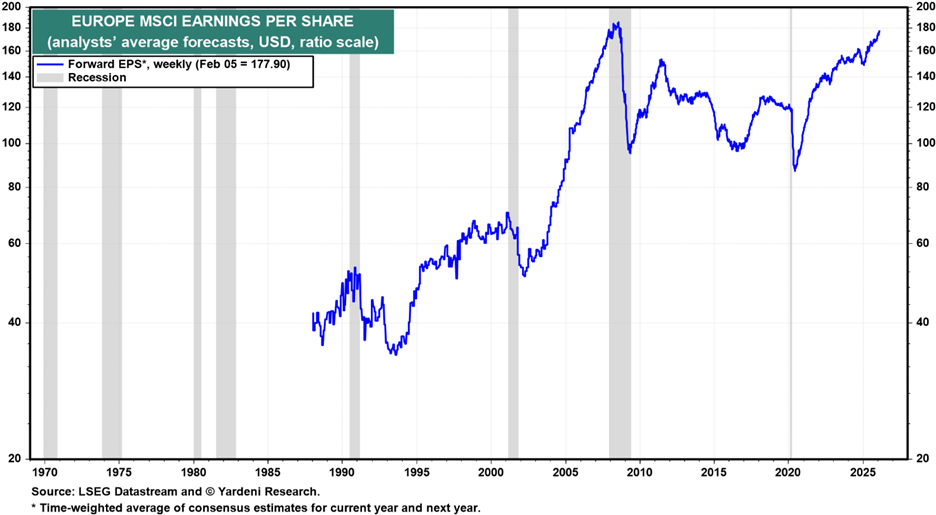

Trump’s tariff agenda was anything but orderly, overriding the economics and inciting dollar debasement benefiting Gold, Silver, etc. With Kevin Warsh’s appointment, we have less clarity on the dollar’s direction, but we do see Europe starting to consider economic growth as national security in a disorderly political environment. Increased military spending, fiscal deficit expansion, resumption of energy production, and whispers of deregulation should lift profit margins and earnings. We already see this in rising earnings expectations across Europe:

The combination of “prove it” cash flows and additional developed world international exposure informed our search and selection of a new value focused large cap manager screening for high free cash flows and juicy dividends, worldwide.

Fortunately, the remainder of our holdings properly calibrate with our worldview, which we will reveal next Thursday. Position changes from here will likely be situational (tax trades) rather than strategic, unless our worldview changes significantly. Remember, history shows a clear inverse relationship between frequent trading and investment returns!

Have a great week!

-David

Sources: Yardeni Research

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.