Fifteen months of speculation have now ended. Donald Trump has nominated Kevin Warsh as the 17th Chairman of the Federal Reserve. Warsh has pedigree credentials with degrees from Stanford, Harvard, and MIT. He began his career as a Wall Street investment banker before transferring to K Street as an economic policy advisor under President Bush. In 2006, he became the youngest person ever appointed to the Federal Reserve Board of Governors at age 35 and played an active role during the Great Financial Crisis as an emissary between policy makers and market participants.

Following his tenure at the Fed, he lectured at Stanford’s business school, invested alongside Stan Druckenmiller within his family office, and maintained policy influence within the Congressional Budget Office. He also managed to marry Jane Lauder, the heiress to the Estée Lauder fortune. Kevin has built an impressive career with exceptional accomplishments within both the public and private domains.

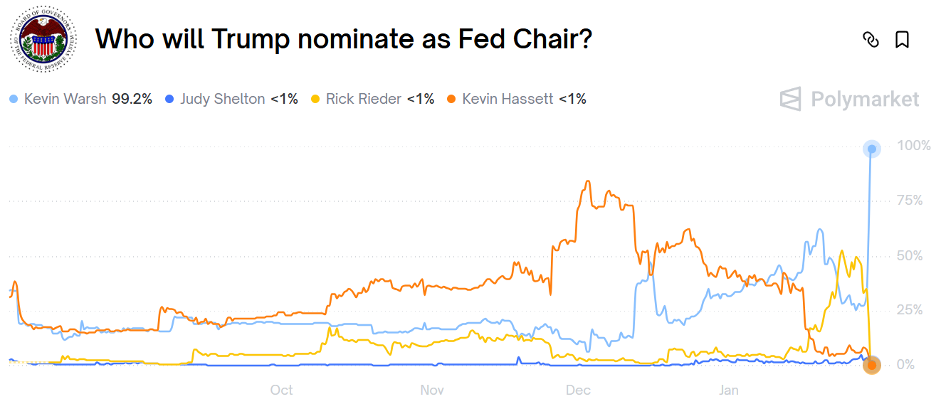

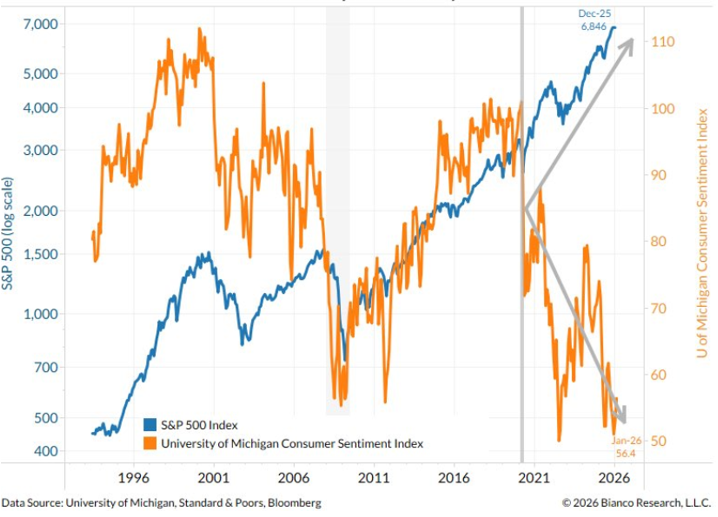

Interestingly, Kevin trailed in the prediction markets for most of the campaign cycle, largely because he seemed the least sycophantic and least dovish of the potential nominees. Why would Trump choose a more hawkish candidate? That’s the right question to ask and only Donald knows why Donald does, but I will offer my best guess: Trump’s biggest issue is not economic growth. The economy has grown substantially since Trump took office—and markets trade near all-time highs—yet consumer sentiment languishes near record lows as seen in the chart below:

Although Trump’s policies have boosted economic and wealth creation, they have not relieved inflation agitations. Consumer prices stand 27% higher today than pre-COVID levels. Inflation rates have drifted lower, but remain well above the Fed’s 2% target.

While Chairman-to-Be Warsh appears to favor lower interest rates, he also favors shrinking the Fed’s balance sheet, philosophically blaming quantitative easing policies for the post-Covid inflation, not lower rate policies. Therefore, Warsh believes that the Fed can lower interest rates without raising inflation. If he is right, his policy combo of lowering rates while tightening money supply could provide lower rates, lower inflation, and perhaps—most importantly to Trump—happier voters!

Trump’s nomination still requires Senate confirmation. Warsh will not simply replace Powell, as Powell has three years remaining on the board post-Chairmanship and has not yet indicated whether he intends to step down or not. Therefore, to attain a seat on the board, Warsh must apply for Stephen Miran’s seat as well as the Chairman’s role. This makes the process a little clumsier, but we expect Powell will retire and Warsh will attain Senate confirmation.

Overall, we view this as a solid choice that de-risks the politicization of the Fed and increases the odds of supportive rate cuts while also lowering the threat of re-inflation. Markets clearly agree, as the US Dollar rallied nearly 1% following the announcement, and safe-haven metals tarnished substantially.

Markets will test Kevin in the months to come, as they always do, but he’s battle-hardened and resilient. While Trump’s tactics often destabilize, his appointment of Kevin Warsh should provide bankable stability at the Fed.

Enjoy your week!

-David

Sources: Bianco Research, Polymarket

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.