As markets climb to new all-time highs, it’s natural to feel a bit uneasy. After all, buying stocks when they’re most expensive feels counterintuitive. Many investors ponder, “Should I wait for a pullback before putting more cash to work?”

It’s a reasonable question—one that surfaces nearly every time the market reaches a new peak. But history tells us a reassuring story: investing at all-time highs is not as scary as it seems. In fact, the data says that investing through new highs has often led to stronger results. Let’s explore!

Time In the Market

Markets never move in a straight line. In the short-term, news and headlines drive price swings. Over the long haul, earnings growth, productivity, and innovation determine direction.

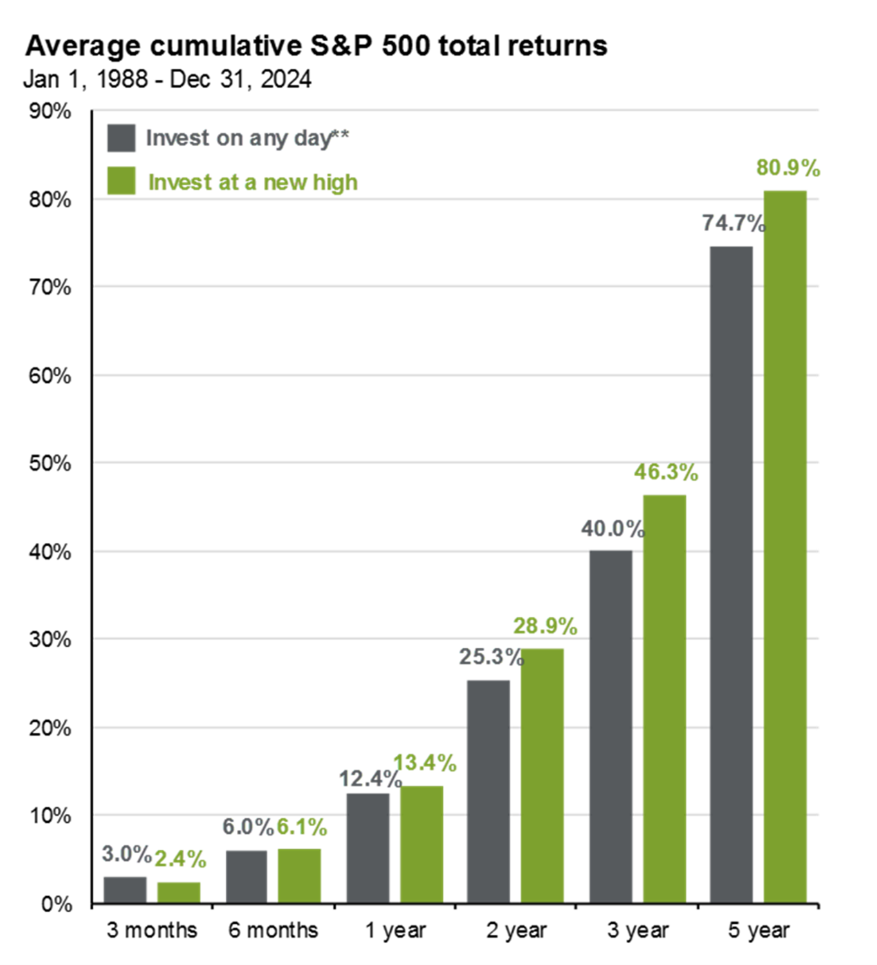

When markets make new highs, new investors often fear buying the peak, and existing investors wrestle with loss aversion, or our tendency to feel the pain of losses more intensely than the joy of like size gains. But time in the market has consistently proven more valuable than trying to time the market. Furthermore, take the chart below. Since 1988, investing on a day when the S&P500 hits a new all-time high has historically produced better cumulative returns than investing on any other day.

There are a few different factors for this, but the long and short is that new highs tend to perpetuate more, new all-time highs. Growth begets growth. The key takeaway is that new highs typically don’t signal the end of opportunity, but the continuation of it!

What to Do When Markets Feel Expensive

Investing at all-time highs doesn’t mean ignoring the risk but managing it thoughtfully. If investors do feel uneasy with markets at new highs, here are three things to focus on to stay disciplined and strategic:

- Revisit your allocation. After a strong market rally, portfolios may have drifted from a target mix of stocks, bonds, and alternatives. Rebalancing, or selling a bit of what’s grown and adding to what’s lagged, can help maintain discipline and manage risk.

- Have a plan. For new investors, structure matters. Whether one decides to invest in a lump sum or dollar-cost-average investment over a set timeframe, having a defined strategy can reduce the emotional burden of ‘buying the top’.

- Keep perspective. Market pullbacks are normal, even healthy at times. Historically, the S&P500 has averaged an intra-year decline of around 10%, while oftentimes finishing positive despite the decline. Volatility and dips are part of the journey, not the destination!

Further Running of the Bull?

With markets hitting record highs, the question becomes: What could keep this bull market charging further? Two forces stand out today: earnings and pessimism.

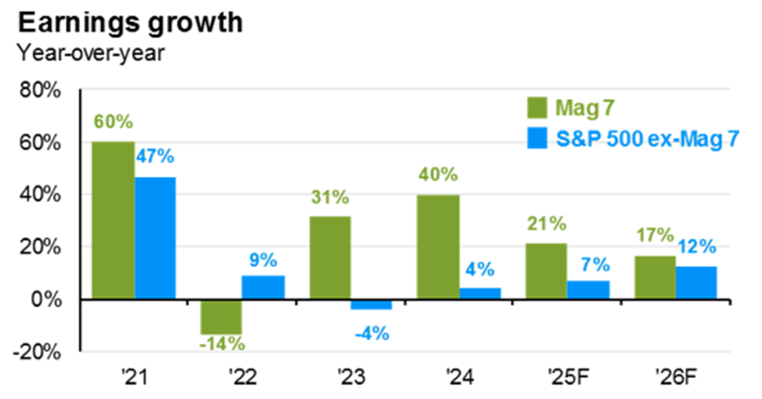

Third quarter earnings season kicked off earlier this month and early results have been encouraging. As valuations have increased, earnings must deliver to sustain upward momentum. Of the companies that have reported thus far, 86% have reported a positive earnings surprise. Blended year-over-year earnings growth sits at 8.5%. Looking further ahead, analysts expect earnings growth to broaden beyond the Magnificent 7. Forecasts for 2026 expect Mag 7 earnings to grow but decelerate, while the remaining 493 firms pick up the slack:

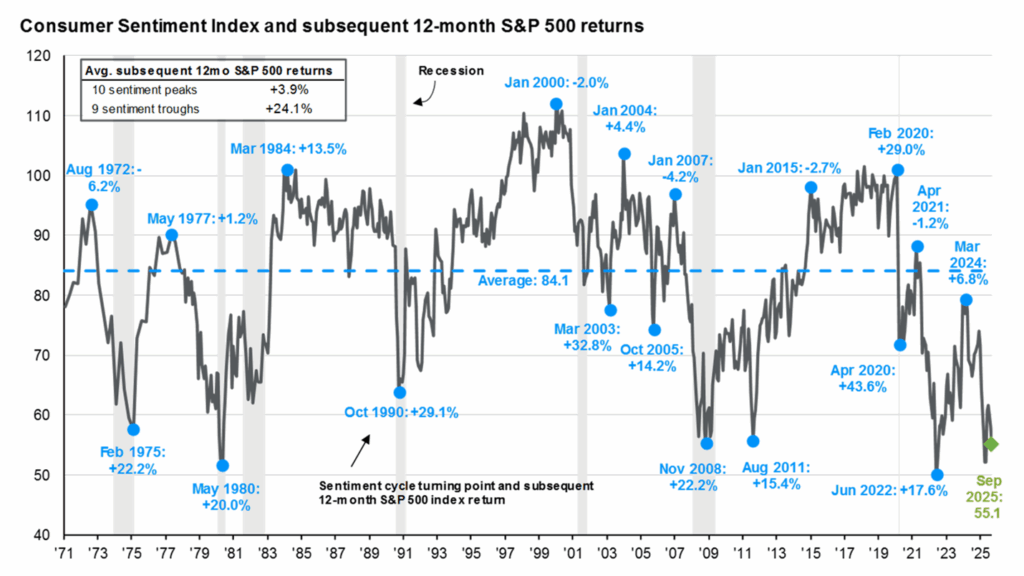

At the same time, consumer and investor sentiment remains remarkably subdued. Surveys of both investors and consumers show confidence at low levels, even as portfolios and household net worths climb higher. The irony is that the pessimism often serves as fuel for future gains. Historically, periods of low sentiment have preceded above average forward returns, as negative expectations leave room for upside surprises!

Enjoy the rest of your weekend!

-Matt

Source: JP Morgan Asset Management, Guide to the Markets

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.