After an Oval Office impasse Tuesday evening leaving the continuing resolution bill unsigned, the US government began furloughing non-essential services and employees. At stake? The Mid-Terms. Democrats want the continuing resolution (CR) bill to continue COVID era subsidies for Obamacare which the Republicans voted to discontinue at year’s end in the OBBB. The 60 votes required in the Senate to pass the CR enable this re-trade as there are only 53 Republican Senators leaving them 7 short. Democrats failed to use this same leverage when passing the March CR, fearing that Trump would use the financial shortfall to permanently gut sacrosanct programs like National Public Radio. Today, the Democrats have the OBBB in hand to cherry pick “heartless” measures like ending healthcare subsidies for the “needy”. Republicans initially seemed resolute, but less so recently, with Trump and JD Vance expressing willingness to negotiate (either before or after passage of the CR). How will this end? Who knows, and from the market’s perspective… Who Cares?

Higher Highs

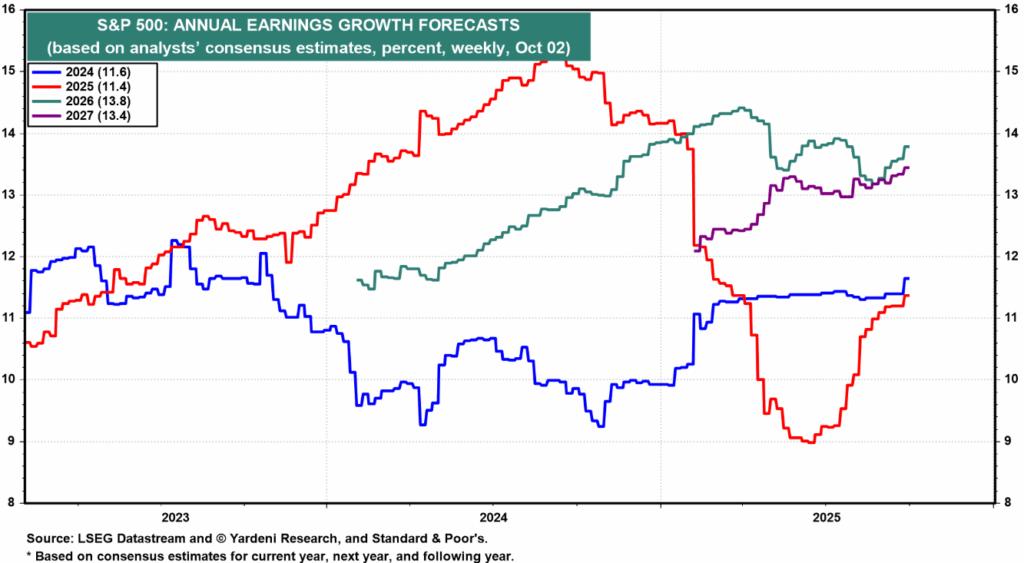

The S&P 500 has hit new closing highs 30 times this year, including every day this week. Beneath the relentless move higher in stock prices lies the relentless move higher in earnings expectations:

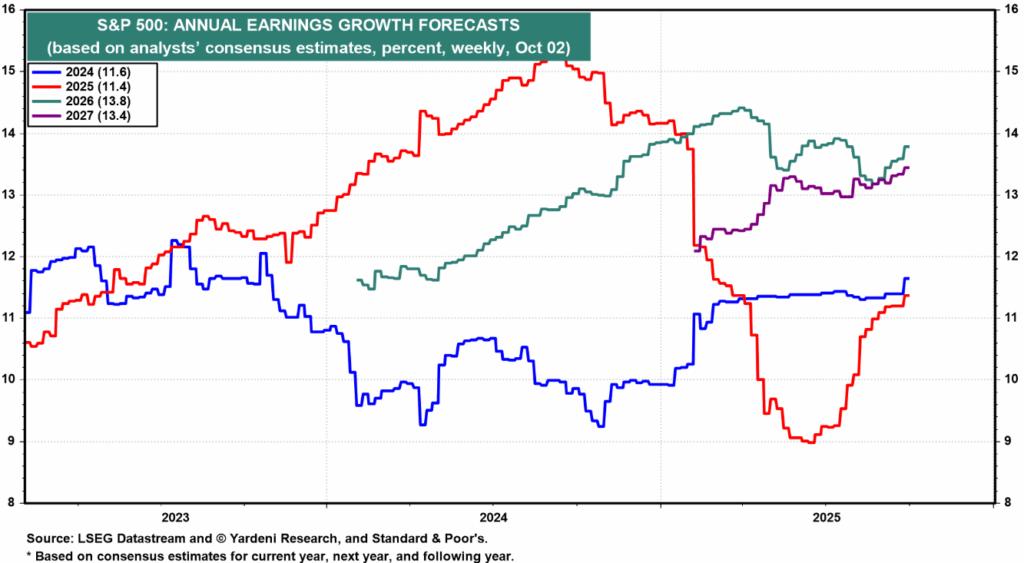

I know it’s a busy chart but let’s digest. The lines move left to right and chronicle analyst earnings projections as time advances. Note the harmonic surge higher in 2025 earnings expectations (red), 2026 earnings expectations (green) and 2027 earnings expectations (purple) over the past few months. This accompanies increases in revenue expectations:

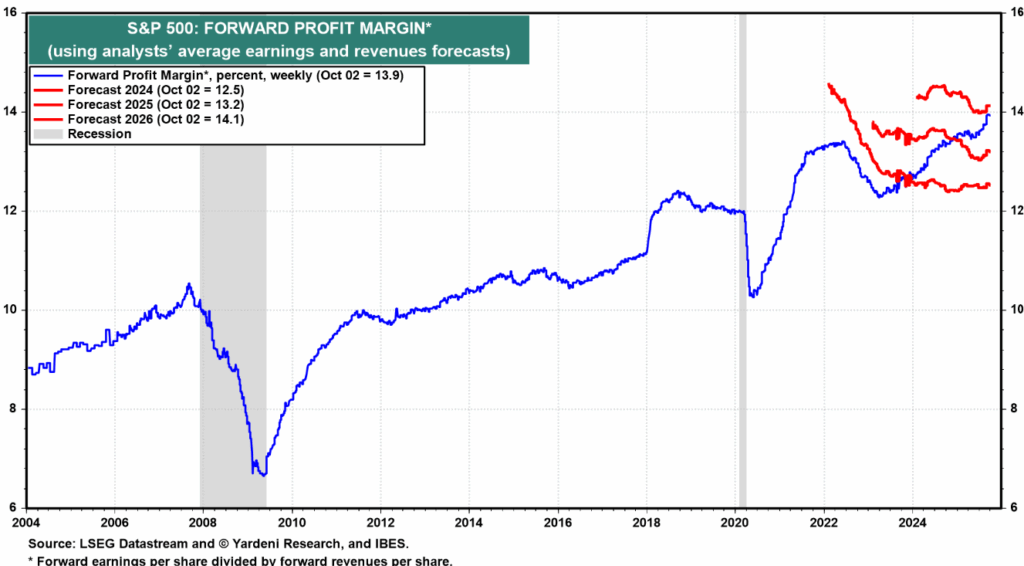

And increases in profit margin expectations:

Rising revenues + Rising Profit Margins = Exponential Earnings! As we have noted, the combination of monetary stimulus from rate cuts, fiscal stimulus from tax cuts, currency stimulus from dollar depreciation, and CAPEX stimulus from the AI arms race all combine to boost economic and revenue growth while technology adoptions boost profit margins. While tariffs and shutdowns apply levitation counterweights, they merely amount to strings on the ballon.

In the Absence of Data

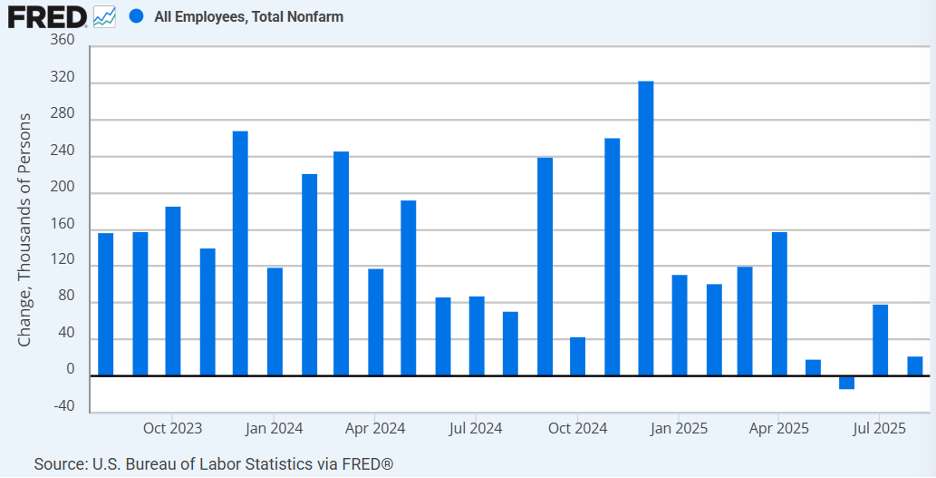

Apparently, the Government deems economic data unessential. This hurts our feelings and requires us to construct our own labor market assessments. The Trump labor market differs greatly from the Biden labor market given the immigration halt. Under Biden, the surge of immigrants into the workforce required an addition of 150,000 jobs a month to keep the unemployment rate level. Under Trump, this number has fallen to approximately 40,000 a month in job creation needed to keep the unemployment rate level.

The optics of this chart invite concern as the surge in hiring evident in late 2024 has apparently collapsed into 2025. This has not been lost on the Fed who have noted deteriorating strength in the labor market as evidenced by their .25% rate cut in September and another .25% cut likely on October 28th. A prolonged shutdown only increases odds of further rate reductions with odds of a December reduction of .25% currently at 85%. This aligns with the Feds projections released in September. Only a significantly stronger employment report would derail their intentions, which seems unlikely as the steady state number has fallen and the number of virtual hirings has risen.

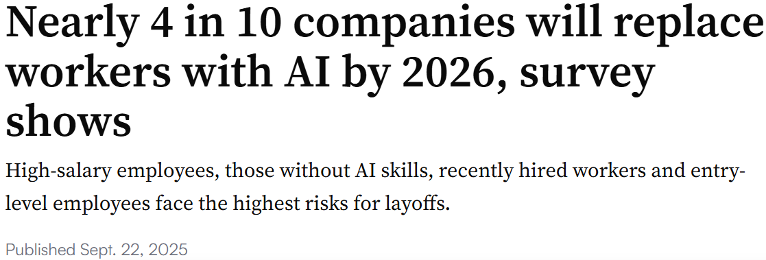

Companies today seem to be competing now on how many real people they can replace with AI agents as seen in the following headlines:

I could go on and on. Also, note the industry diversity represented above. What started out as a tech trend has now metastasized across other industries as well. In traditional economics, a slowdown in hiring accompanies a slowdown in GDP, requiring rate cuts from the Fed. Within this cycle, despite the slowdown in job creation, the US economy grew 3.8% in the 2nd quarter and the Fed’s GDPNow predicts another 3.8% growth in the 3rd quarter.

Welcome to the brave new world. Will Fed rate cuts offset AI driven employment cuts? Unlikely. With less influence over the labor market, perhaps the Fed’s dual mandate becomes a more singular focus on inflation. However, not only does AI suppress hiring, it’s productivity enhancements also suppress inflation. Companies that can do more with less, can afford to charge less. We see this in today’s record profit margins, poised to climb higher. In sum, a slowdown in hiring this time may not accompany a slowdown in growth. The axiomatic Fed rate cuts to support the labor market only reduce the expense of AI investments, further encouraging the labor substitution impacts. This higher growth/lower employment/lower inflation AI paradigm remains theoretical, but evidence is amassing. And if true… it’s not good news for laborers… but it is great news for investors!

Enjoy the rest of your week!

-David

Sources: Yardeni Research, Federal Reserve Bank of St. Louis, Federal Reserve Bank of Atlanta

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.