Central banks worldwide spent much of 2022–2023 draining the liquidity they had pumped into markets after COVID to combat accelerating inflation. Since then, inflationary pressures have cooled, and asset prices have rewarded investors with strong gains. But beneath the surface, a global easing cycle, rising liquidity, and loosening financial conditions have been a key support, and they remain firmly in place. Let’s review.

The Global Easing Cycle

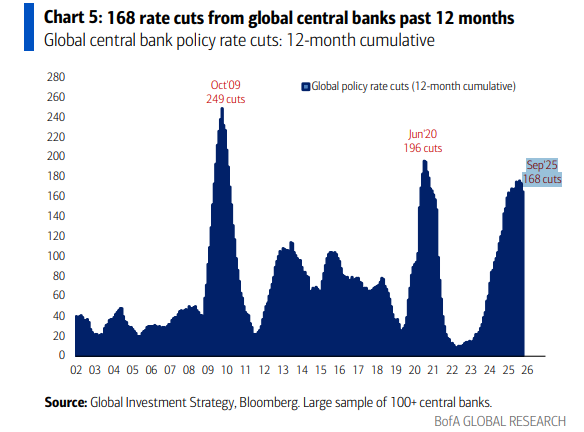

Last week we highlighted Jerome Powell’s 25-basis point “risk management” rate cut. But zoom out, and it’s only one piece of a much larger puzzle. Across the globe, central banks are cutting in unison to the tune of 168 rate cuts since mid-2023. When central banks ease in lockstep, liquidity rises system wide. Stress across funding markets is relieved, capital becomes cheaper, and risk appetite improves.

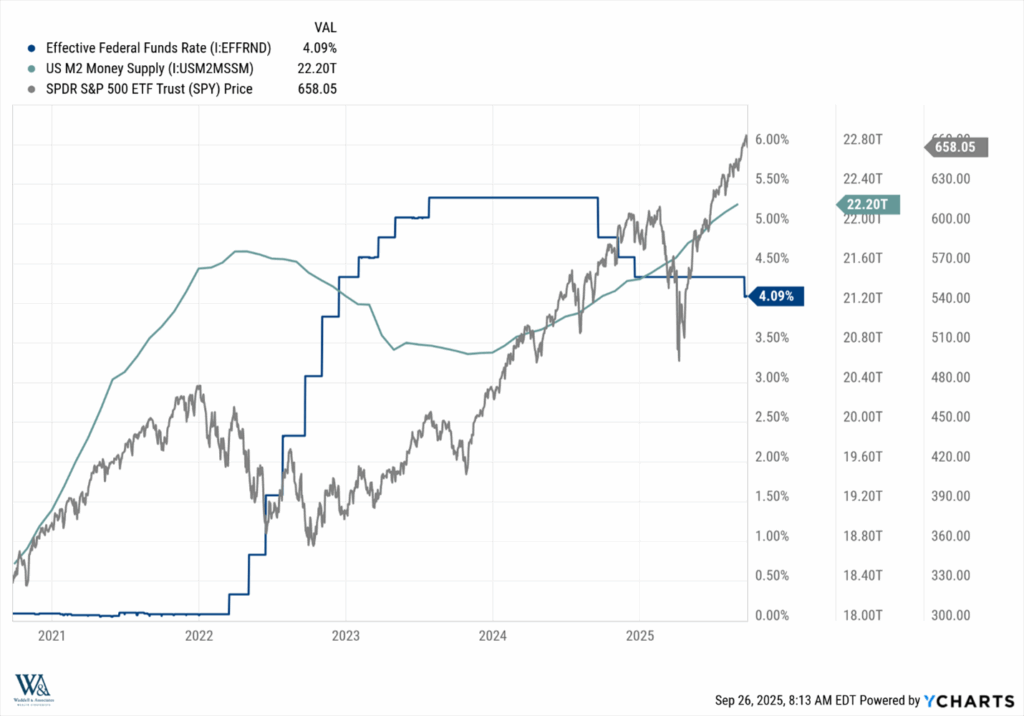

The chart below tells the story. The overlay in the chart is the US federal funds rate, the M2 money supply index, and the S&P500 index (Ticker $SPY). As the Fed raised rates through 2022–2023, money supply contracted, draining liquidity, and pushing stocks lower. But once money supply leveled off and began to rise again, equities moved higher in lockstep. This is no coincidence. Increasing money supply is naturally supportive of capital markets and public equity flows.

Loosening Conditions

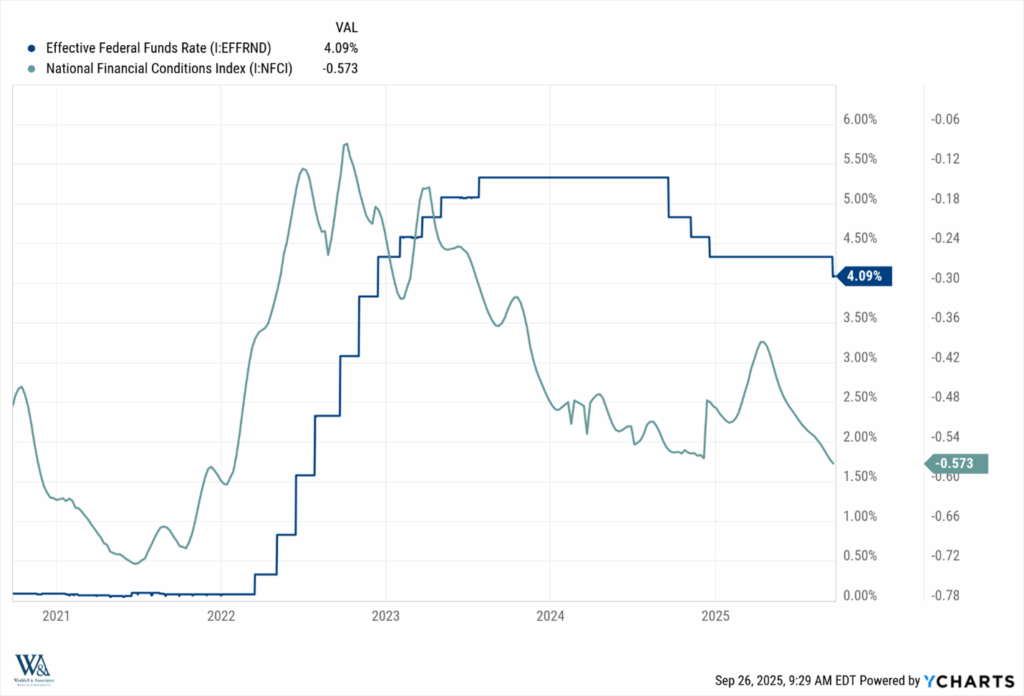

Financial conditions confirm the same trend. Once the Fed stopped hiking rates in 2023, financial conditions loosened and continue their same trajectory today. After the Fed rate cut earlier this month, financial conditions now sit at their easiest since late 2021. This translates to cheaper financing, stronger issuance, and again, healthy capital markets.

Credit spreads!

The market’s vote of confidence shows up in corporate credit spreads, and they too confirm the same trend. As rates rose and liquidity dropped throughout 2022, spreads widened out, reflecting the increase in credit and default risk across the system. But since then, it’s been trending back lower as rates dropped, liquidity rose, and conditions loosened.

Tight spreads do more than send a signal—they actively reinforce easier conditions. Narrower spreads lower the cost of capital for companies, making refinancing and new issuance more attractive. They reduce the odds of a credit crunch, encourage investment, and extend the cycle.

In the end, markets are being carried by a powerful current: a synchronized global easing cycle, abundant liquidity, loosening financial conditions, and tight credit spreads that signal confidence rather than stress. These forces don’t remove risk, but they do create an environment where capital is plentiful and the path of least resistance for asset prices remains higher. For investors, the message is simple: liquidity drives markets, and right now, the money is still flowing.

That’s all for this week!

-Matt

Sources: Bank of America Global Research, YCharts, Federal Reserve Bank of St. Louis

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.