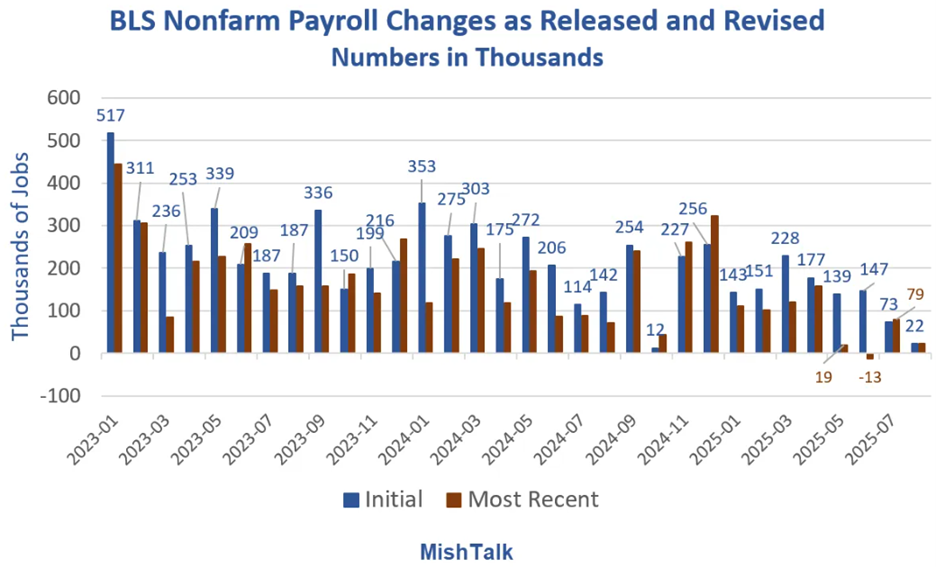

Recent reports on the state of the US labor market have been dispiriting to say the least. Last Friday, the Bureau of Labor Statistics (BLS) released its monthly employment report showing 22,000 jobs were created in August versus 77,000 expected. Each monthly release also provides revisions to past month’s figures—these figures come from survey data. The initial release, like the one last Friday, only includes about 60% of the survey respondents. Revisions occur as more data arrives. For instance, the BLS estimated that the US created 147,000 jobs in June only to revise this number to 13,000 jobs lost. That’s the first month since December of 2020 that the US shed workers with more negative revisions likely to come. In fact, most revisions tend to reduce initial estimates. Consider the differences between the first and final reads on monthly job creation below:

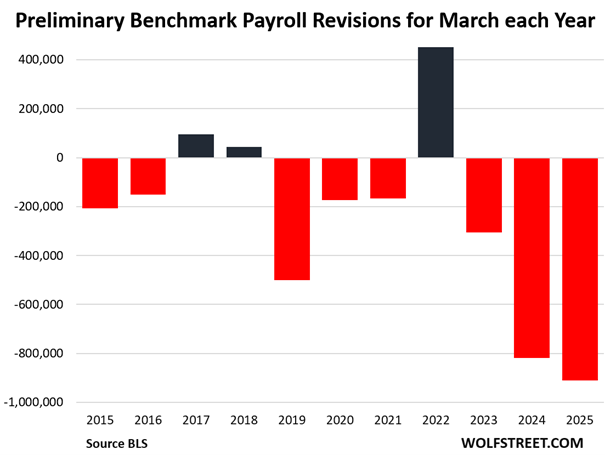

Once a year, the BLS reconciles its data with data from a slower, but more extensive, government survey (The Quarterly Census of Employment and Wages). Over the past few years, these surveys have strongly diverged. Many reasons account for the discrepancy, but most notably, undocumented workers that show up in the BLS survey do not appear in the QCEW report. As illegal immigration increased, so has the size of the downward revisions. For the year ending in March, the government revised payroll gains down by 911,000. That takes away roughly HALF of the job gains previously reported. Furthermore, this marks a record for an annual revision as seen in the chart below:

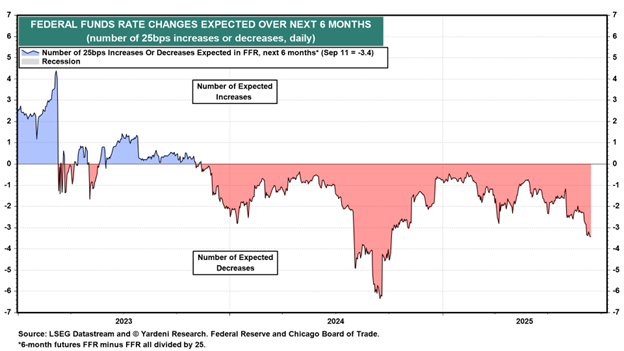

This week we also received higher than expected unemployment claims over the past week. This caught the market’s attention, but the continuing unemployment claims didn’t point to major deterioration. Nonetheless, it’s another negative data point. In sum, the BLS has overstated the strength of the US labor market for some time and recent reports show that softness driven by tariff, DOGE and immigration policy changes could reinforce the tepid trends. This will certainly shift the Fed’s narrative away from inflation concerns toward employment concerns, leading traders to price in three rate cuts before year end:

Given that the stock market uses earnings data and prevailing interest rates to calculate value, weak job growth does not imply weak stock market performance. In fact, stocks usually rally on layoff announcements as lower labor costs imply higher profits. Additionally, lower employment growth implies lower interest rates which support higher valuation multiples. As evidence, despite the gloomy labor data, the NASDAQ and S&P 500 hit record highs on Wednesday.

Get Real

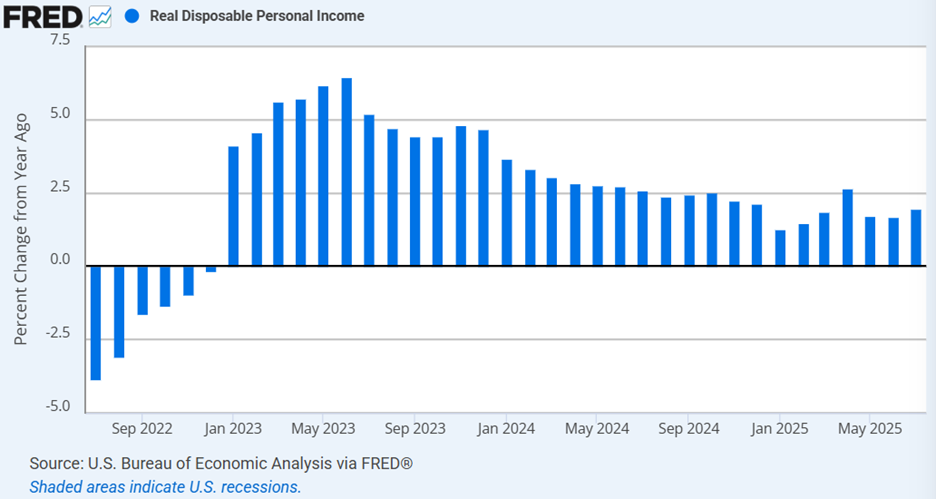

Remember, jobs themselves do not power the economy. Spending does. With all of the goofiness associated with labor market calculations, we prefer to track real disposable income as a more accurate read on the consumer:

As you can see, real disposable income has downshifted slightly over the past year but remains healthy overall. The 2022 and 2023 highs and lows reflect inflationary distortions. Removing those leaves real disposable income performing right around long-term trends associated with healthy economic growth.

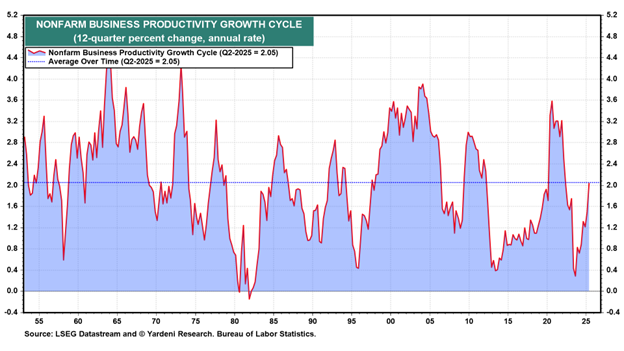

Lastly, if labor force growth isn’t driving economic growth, productivity growth must be. Enhancements in technology should be driving more output per unit of labor. Should the promise of AI and robotics prove true, we should see accelerating productivity trends. We have:

While the current level reflects long-term averages, productivity clearly has upside momentum. Should this persist, the economy can afford both higher wages for workers and higher profits for investors. The first will power consumption, the latter will power even more productivity enhancing investments. Virtuous!

Enjoy the rest of your Sunday!

-David

Sources: MishTalk, Yardeni Research, Federal Reserve Bank of St. Louis, Wolfstreet, Bureau of Labor Statistics

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.