September and October have always carried weight in markets. They’re months when volatility tends to pick up, mutual fund fiscal years come to an end, and the year’s outlook can shift quickly. As we kick off this fall, three forces are now front and center: Powell, Trump, and the data!

Powell: A Near Certain Cut

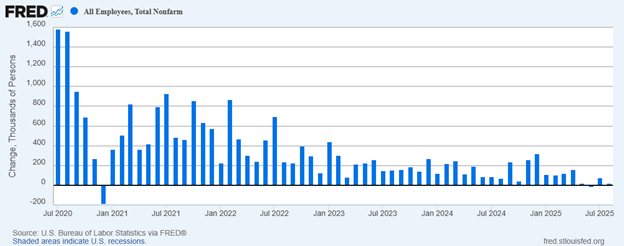

The next Federal Reserve meeting on monetary policy is scheduled for September 16th and 17th, meaning we are less than two weeks away. After Friday’s job numbers, fed-funds futures imply over a 99% chance of at least a 25bp cut this month. Some traders are even pricing in the chance of a 50bps cut. The fed’s dual mandate of maximum employment and 2% inflation has become harder to balance, but the backdrop certainly justifies a cut, and perhaps more going forward. Job growth and inflation momentum have slowed. Since January’s Fed pause, monthly payroll gains have been positive, but meaningfully lower, and the trend lower in payroll growth is clear:

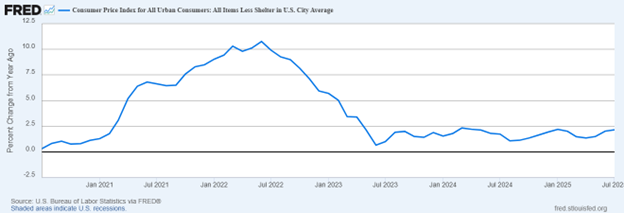

Then consider inflation. The largest component of the consumer price index measurement of inflation is housing and shelter. It makes up about 1/3 of CPI. Without it, CPI has been relatively unchanged since mid-2023:

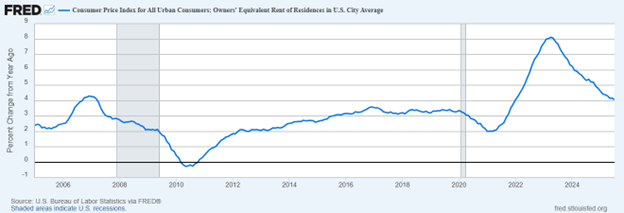

With it, housing costs continue to moderate back to pre-pandemic levels. The owners-equivalent rent component inside of CPI continues to drag lower, with it’s month over month impact continuing to slide south:

Unlocking the housing market is an important relief valve for the Fed, releasing more inventory and taking pressure from affordability issues. With only one inflation report left before the Fed meeting, the focus of the Fed mandate has shifted toward employment. But the real driver won’t be the cut itself, it will be Powell’s messaging thereafter. If he cuts and signals patience, markets may retrace their October and December rate expectations. If he cuts and focuses on the weakening labor market, future rate cut expectations will accelerate.

Trump: Tariffs in Legal Limbo

Was Powell too late? Trump may be right, but he has his own fiscal issues to deal with. The one big, beautiful bill was passed on the backs of tariff revenue that is now hanging in the balance of the courts. Tariffs have long been one of Trump’s hallmark economic weapons. They’ve reshaped supply chains, boosted certain domestic industries, and become a central talking point around American competitiveness. But now the legal ground has slightly shifted. On August 29th, (yes, the Friday before a long holiday weekend!), a Federal Court of Appeals ruled that the President’s use of the International Emergency Economic Powers Act (IEEPA) to impose reciprocal tariffs exceeded his authority. The court concluded IEEPA does not provide a blanket authority to the executive branch to levy sweeping tariff programs.

Importantly, the court withheld its mandate until October 14th, keeping tariffs in place while the administration seeks an emergency appeal in the Supreme Court. The government has already petitioned the justices for expedited review, arguing the tariffs are essential.

The near-term fork in the road is two-fold:

- If the Supreme Court grants a stay, the tariffs keep running during the appeal process.

- If the stay is denied, collection halts and importers could begin seeking refunds.

Either outcome carries some market consequence. For investors, this is not just about a legal circus; it’s about whether Q4 starts with tariff revenues or refunds and how they shift the dynamics. Historically, September and October are already prone to market weakness and volatility, and this ruling simply reinforces that historical pattern.

The Data

Payrolls are still growing but at a slower pace. Inflation ex-shelter has been relatively flat since mid-2023, and housing costs, the largest component of CPI, are trending lower.

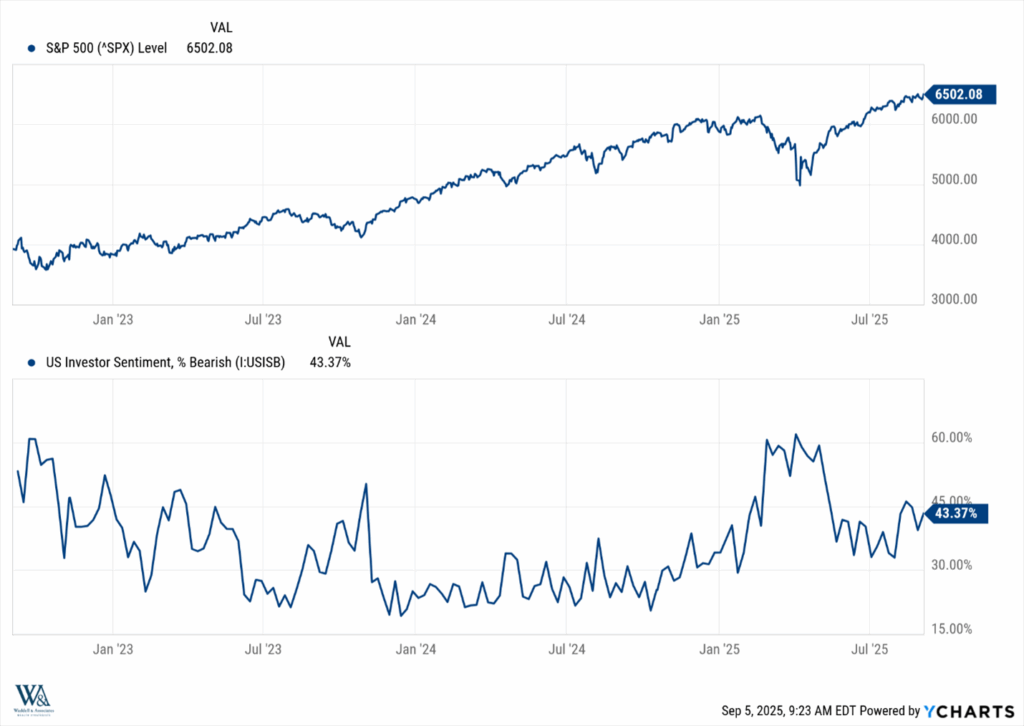

Despite these crosscurrents, equities remain near all-time highs. What makes this interesting is the contrast: markets keep grinding higher as sentiment surveys show more pessimism. The chart below illustrates the S&P 500 and bearish investor sentiment levels. As markets have rebounded off the April lows, bearishness, though lower, has remained elevated. So long as the pessimism persists, it will continue to create opportunity for long-term investors as the skepticism of future market returns helps propel them higher!

That’s all for this week!

-Matt

Sources: YCharts, Federal Reserve Bank of St. Louis, CME Group FedWatch

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.