The Full Story:

You might have missed it, and I wouldn’t blame you. Amid the daily whirlwind of political drama, from a federal takeover of Washington DC to a public spat with the Intel CEO, an important economic metric quietly beat expectations: US Labor Productivity rose 2.4% in the second quarter of 2025, continuing an upward trend that is worth paying attention to.

What is it?

At its core, labor productivity measures how much economic output (GDP) is generated per hour of work. It answers a fundamental question: How efficiently are workers turning time and effort into goods and services? GDP, remember, is just a comprehensive measure of the total value of all final goods and services produced, and there are two ways to grow it:

- Employ more workers.

- Make each worker more productive.

With aging populations and decreasing labor force participation rates, the productivity of each unit of labor is increasingly critical to GDP growth.

Why It Matters

Over the long-run, productivity growth is a key driver of economic prosperity. When a worker can produce more goods and services in an hour, businesses can afford to pay higher wages without raising their prices, improving the standard of living. This was a key principle of your painfully boring microeconomics class: Productivity growth drives wage gains, expands profit margins, and feeds a cycle of income growth and consumption.

The Long-Term Trends

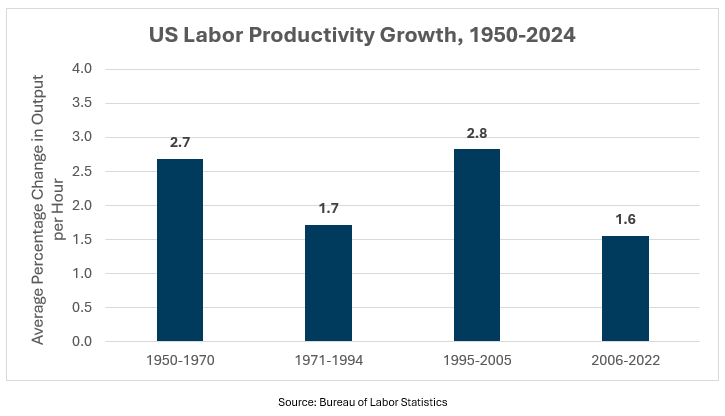

Since WWII, US labor force productivity has shown strength over the long run, averaging over 2% per year, but the pace of growth has been cyclical. We can divide the post-WWII era into four distinct cycles of labor productivity growth:

- 1950-1970: +2.7% per year

- 1971-1994: +1.7% per year

- 1995-2005: +2.8% per year

- 2006-2022: +1.6% per year

In 2023 and 2024, labor productivity grew at 1.9% and 2.7%, respectively, more in line with a long-term upswing in productivity. If we are entering a new cycle of stronger productivity growth, there are a few combining forces driving the acceleration:

- Artificial intelligence: Businesses are investing aggressively in AI technologies that reduce routine tasks and enhance efficiencies.

- Entrepreneurial boom: The U.S. has seen record new business formations, signaling an uptick in creative innovation.

- Reshoring and manufacturing: Strategic efforts to bring back production capacity, particularly in semiconductors and advanced manufacturing.

- Hybrid work models: More flexible work arrangements have in many cases increased output.

Taken together, these dynamics I think suggest more than just a post-pandemic bounce. They are structural shifts in how, when, and where work gets done.

Impact for Investors

Productivity is an important engine in long-term economic progress but also financial markets. When companies can produce more with the same labor force, margins expand and returns on capital improve, creating a powerful feedback loop:

Higher productivity → higher corporate earnings → higher wages →

higher consumption → stronger GDP → higher asset prices

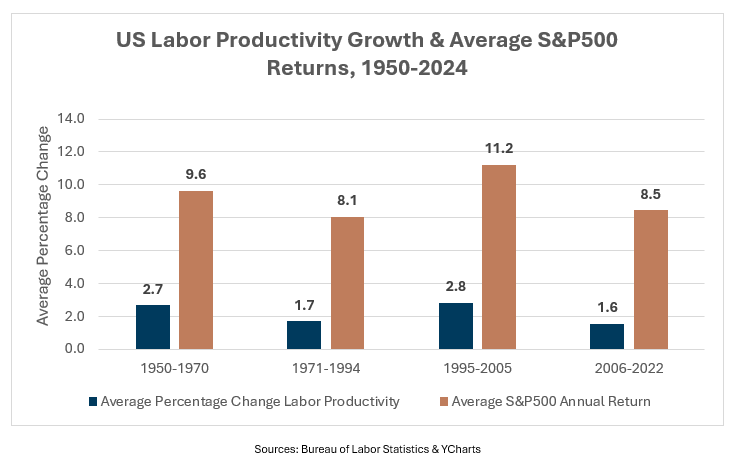

But have investors been rewarded during cycles of increased productivity? Yes. Here’s the same chart with the average S&P annual return during the same periods:

Of course, many factors influence equity returns, and past performance is not a guarantee of future results, but the recent uptick in productivity is a positive signal as we move ahead!

Enjoy the rest of your weekend!

-Matt

Sources: Bureau of Labor Statistics; YCharts

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.