Four times a year, companies report their prior quarter’s financial results. Analysts refer to this as earnings season. Remember that stock prices (P) represent earnings results (E) times a valuation multiple (P/E). We spend a great deal of our strategic efforts trying to divine the forward environment for earnings growth as well as the forward sentiment and interest rate combinations that ultimately drive valuations. These activities essentially require us to predict the future… a very hazardous career choice, I might add. Four times a year, we get to benchmark our predictions as companies reveal their actual earnings results (E). For much of the last two quarters, our faith in corporate management and their policy adaptability has outpaced our peers who feared that rising tariffs and falling consumer sentiment would limit, if not eliminate, corporate earnings. We wagered otherwise. Now that we have received roughly a third of Q2’s earnings results, let’s assess the merit of our optimism.

The Envelope Please

Of the 165 companies within the S&P 500 that have reported their second quarter results, 84% have beaten analyst expectations. Given that management tends to under-promise and over-deliver, beating expectations isn’t unusual, but the 84% beat rate outpaces the 75% average beat rate over the last decade.

For those concerned that companies have simply “managed” earnings, revenue growth rates have also beaten analyst expectations, but by a far wider margin. Eighty-three percent of reporting companies grew revenue more than expected compared with the 10-year average of 64%.

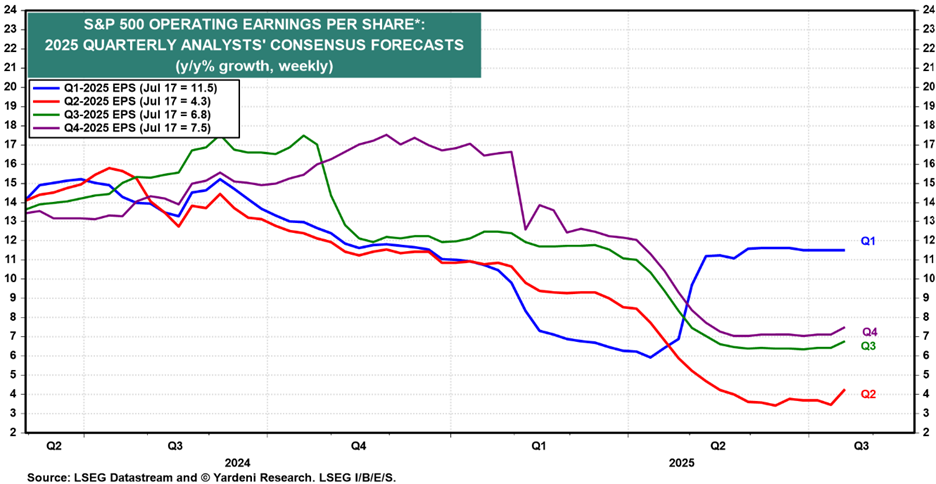

Investors have applauded these results with record highs for the S&P 500 and raised their expectations of future earnings growth rates:

Each of these lines represents consensus analyst forecasts for earnings growth in each quarter of the year. Analysts typically initiate earnings forecasts with an optimistic bias only to become more insecure as the actual quarters end. Consider the blue line, which represents the expectations path for Q1 2025 earnings. A year ago, analysts expected a 14% growth rate for Q1, which they reduced to 6% prior to the reporting of actual results. Trump tariff policy fears drove much of the decline, only to be dispelled by registered growth of 11.5%. The same concerns have plagued expectations for Q2, Q3 and Q4 results as shown above. The anticipated double digit growth rates collapsed under the psychological weight of tariff impositions. However, while the surprising uptick in Q1 results visually stemmed further expectation declines, the surprising uptick so far in Q2 results has begun driving expectations higher for Q3 and Q4 earnings. Positively surprising results and rising future earnings expectations fully explain the speed of the stock market recovery off the April 8th lows and the persistent clip of new all-time highs.

Enjoy the rest of your weekend!

-David

Sources: Yardeni Research, Econovis

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. References to political figures or policies are for informational purposes only and do not represent an endorsement by Waddell & Associates. Any forward-looking statements reflect current opinions and assumptions and are subject to change without notice; actual results may differ materially. Past performance does not guarantee future results. Waddell & Associates may use artificial intelligence tools to help generate or summarize content; all outputs are reviewed by our team for accuracy and relevance.