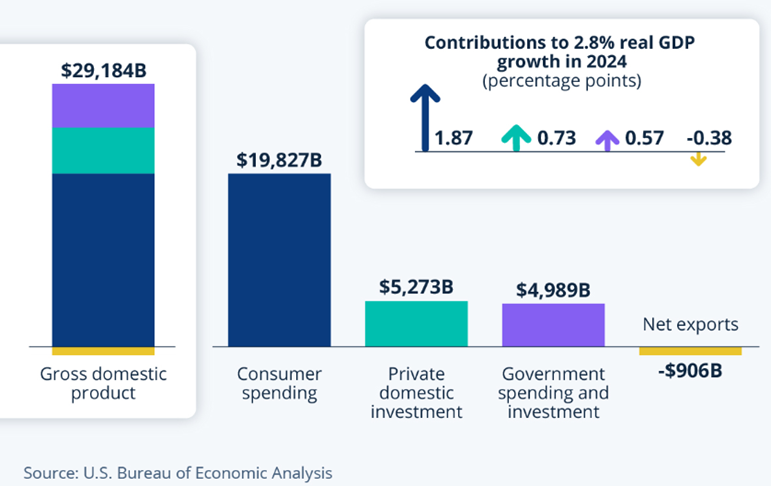

As goes the US consumer, so goes the American economy. Many economic and investment maxims fail to stand the test of time. This one does. The most powerful economic engine on the planet remains an American with a credit card. Consider this data from the full year of 2024:

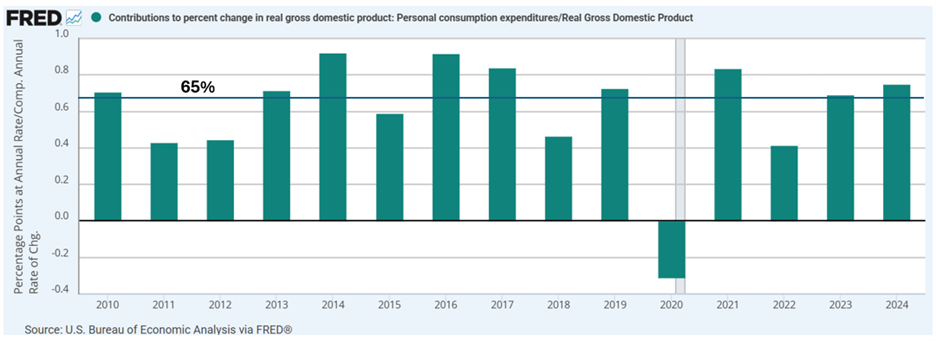

US nominal GDP for the calendar year ending 12/31/24 totaled $29 trillion. Consumer spending accounted for $19.8 trillion of that figure. To put this in perspective, China’s entire economy generated $18.8 trillion of GDP in 2024. Not only does consumption comprise the lion’s share of US GDP, but also the lion’s share of US GDP growth. The chart below chronicles the percentage of total GDP growth contributed by consumer spending growth:

Over the last decade and a half, consumer spending growth has driven 65% of annual US GDP growth. The one year when consumption declined, the US economy fell into recession. As is said, “As goes the US consumer…”

This week, amid all the confusion, anxiety, misinformation, and marketplace turmoil that Trump’s “Liberation Day” and Israel’s attack on Iran have triggered, let’s check the U.S. consumer’s vitals to see if any apparent weakness there might be fermenting hidden weakness elsewhere.

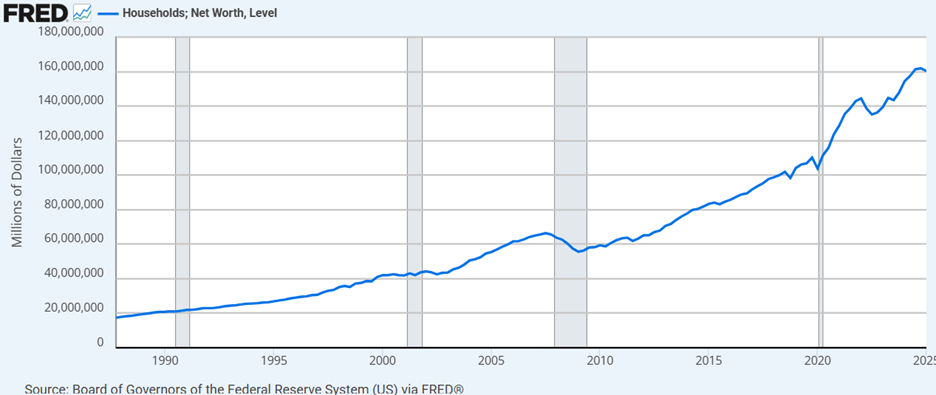

Net Worth

The US consumer net worth dipped slightly from record levels in the first quarter due to a pullback in equity prices. Equity prices have since recovered, reclaiming lost ground. With one-fifth of the US population now over the age of 65, net worth levels must remain healthy to support consumer confidence and retiree spending levels. For now, healthy net worth should sustain healthy spending.

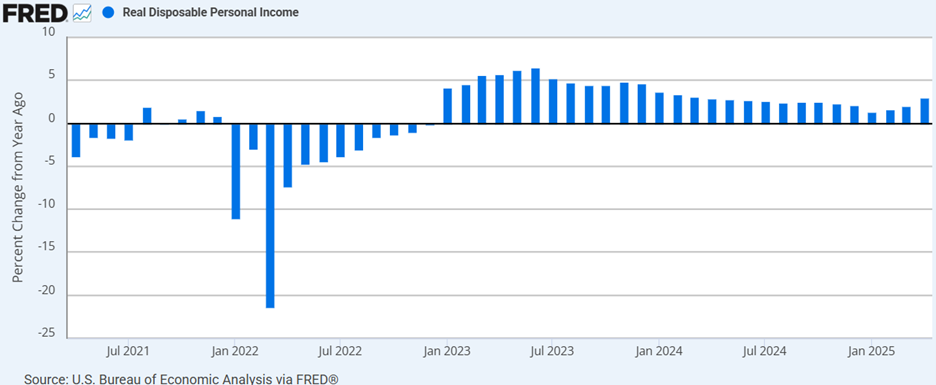

Real Disposable Income

While net worth supports spending capacity, real disposable income powers it daily. This calculation measures after-tax income adjusted for inflation. While many analysts focus on the employment data to determine consumer viability, jobs serve as a means to an end, and wages are the end. This number also includes government support inflows and investment income. The monthly employment reports do not capture these meaningful contributors. In the most recent data, real disposable income spending capacity rose 3% year-over-year, reflecting wage growth, social security inflation, and lower overall inflation levels. The US consumer exited April with substantial income-supported purchasing power.

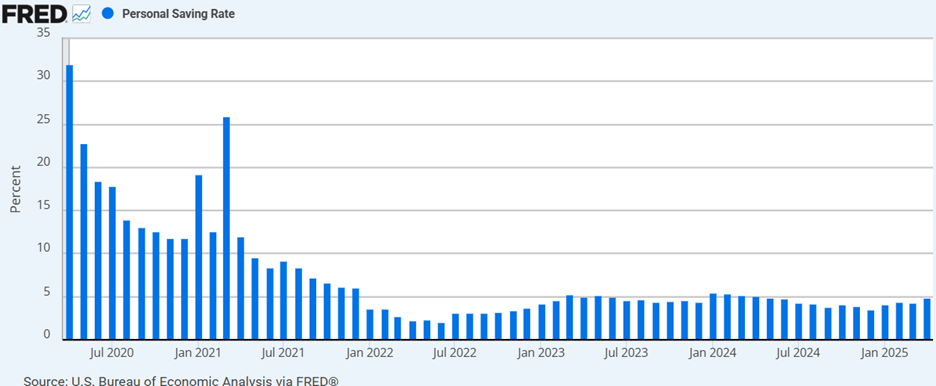

Net Savings

The chart above captures consumer saving patterns, including the COVID stimulus anomaly. Note that consumers saved a significant portion of their stimulus payments, greatly enhancing household net worth during the period. The rapid drawdown into mid-2022 reflects the impact of record inflation, which rapidly depleted spending capacity. Since then, consumer savings have returned to more normal levels around 5%. Changes in savings activity serve as a psychological barometer for economists. For example, while consumers received healthy income gains in April, they spent less of it than in previous months, boosting savings levels. This likely correlates with the slight downtick in net worth and the large uptick in uncertainty caused by “Liberation Day”. This could indicate more cautious consumer behavior ahead, even with resilient income flows, but not enough to drive the economy into recession.

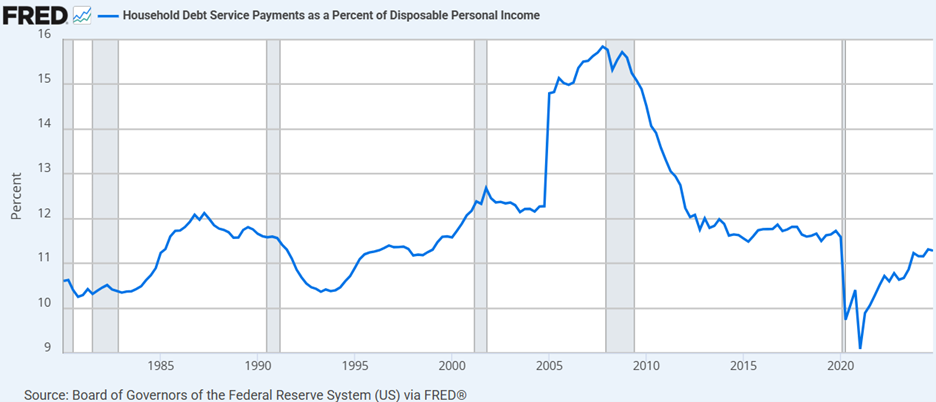

Debt Service Capacity

Consumers have multiple sources to fund their spending. As discussed, net worth levels remain healthy, disposable income levels remain healthy, and savings levels fall well within the historic norms that support spending. If needed, consumers can also draw on mortgages, credit cards, and credit lines to fund their consumption. During the current cycle, elevated interest rate levels make this somewhat problematic with 7% mortgage rates and 25% credit card rates. Fortunately, because the government overfilled our net worth reservoirs, consumers have relied less on credit during this cycle than in previous cycles. Media commentary on credit card debt levels and defaults rings false alarms. As my father taught me, it’s not the size of the note that matters – it’s your ability to tote the note that matters. Currently, US consumers spend less on debt service today than they did pre-COVID, even with far higher interest rates. These levels reflect early economic cycle behavior rather than late economic cycle behavior.

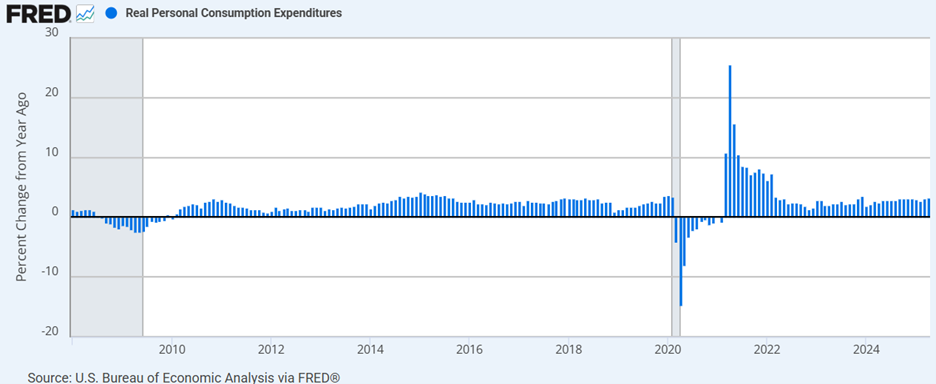

Real Consumer Spending

Consumers spent 3% more in May of 2025 than they did in May of 2024. This pace continues the robust spending levels that powered the 2024 economy to a nearly 3% growth rate overall. I have added the long lookback on the chart above to highlight just how impressive post-COVID consumption trends have been. Despite the pandemic, massive supply chain disruptions, historic inflation, the most aggressive interest rate hikes in history, the war in Europe, the global tariff shock and now elevated conflict in the Middle East, the US consumer has continued spending with historic vigor, without depleting savings and without overusing. Should some exogenous shock trigger recession, the health of the US consumer would likely restrict its depth. Absent an exogenous shock, the health of the US consumer foretells continued health for the US economy.

Have a great weekend!

-David

Sources: US Bureau of Economic Analysis, Federal Reserve Bank of St. Louis

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. Waddell & Associates does not provide personalized investment advice through this communication. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.