In what can feel like an early kickoff to summer, the first Saturday in May draws millions to the heart of Kentucky for the annual running of the Kentucky Derby. Otherwise known as the “The Most Exciting Two Minutes in Sports”, it’s become much more than a horse race. I’ve often felt that sports are the fabric of many of our lives, and annual events like the Derby allow us to add new stitching each year. Throughout the seasons of the teams we follow, the fabric reminds us of the past, lives through the present, and shapes our dreams of the future. It’s been a bumpy market ride through the quarter pole of 2025, but let’s review as we head towards the backstretch.

Exacta, Trifecta, Place Your Bet!

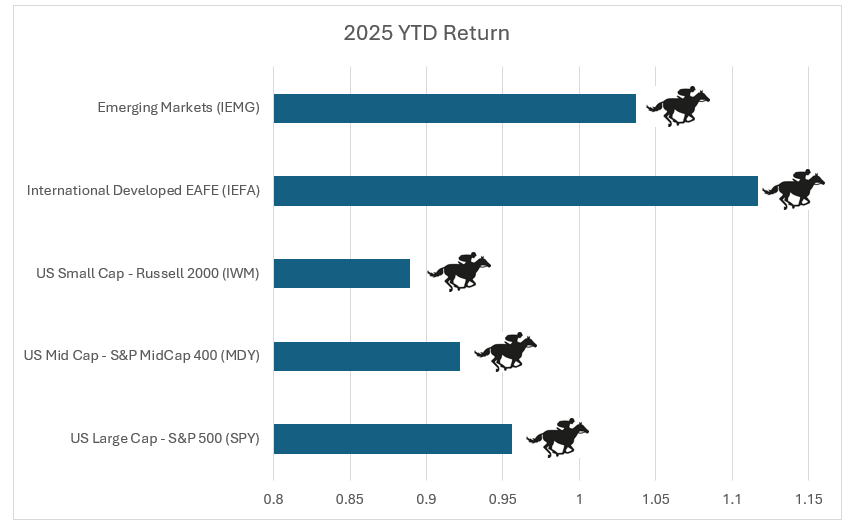

Below is a chart of year-to-date returns of most world markets as a factor of one. So far, developed international markets lead the pack by a substantial margin. Now, international markets were not a horse that would have won you a lot of bets over the last several years. However, they’ve caught a tailwind in parts due to the European Central Bank cutting interest rates at a faster pace than the US Federal Reserve, President Trump’s tariff tirades, and a devaluation of the USD relative to foreign currencies. As such, US markets have lagged the rest of the world quite substantially so far this year.

If you’ve ever had the pleasure of attending a horse race, you might have ventured to the window to place a friendly wager on a thoroughbred. After all, not only does the winning Derby horse receive a vast bouquet of roses, but they also take home $3.1 million in winnings. Common bets to place include win, place, show, exacta, or even a trifecta. My favorite, the “trifecta box” allows you to pick three horses to finish first, second or third, in any order, increasing your chances of a win. Though the payout may be lower than a single, longshot bet to win, the odds of success rise significantly.

This is diversification in action. Betting your entire portfolio on a single stock, country, or even asset class can be exhilarating, but it also carries excess risk. A diversified portfolio spreads risk across many opportunities, increasing the odds that something will perform well, even when others falter. Like the trifecta box, diversification in asset allocation doesn’t guarantee a win, but does improve the odds of success in any given environment.

Odds, Expectations, and Outcomes

On race day, odds are posted for every horse. These odds aren’t a prophecy—they’re a reflection of how the betting public perceives each horse’s chance of winning. High odds can signal low expectations, and vice versa. But everyone knows surprises happen. Markets work the same way. Prices reflect consensus expectations. When those expectations are too optimistic, even solid earnings can disappoint. Conversely, low expectations can lead to upside surprises.

Let’s look at the odds markets posted as of Friday morning. After the positive jobs report on Friday, the odds of a recession in 2025 still sit at 61%:

Similarly, after the jobs report Friday, the odds of a rate cut in June are now simply a coin flip:

And there’s only a 23% chance of a trade deal with China by June:

Even further, though Q1 S&P 500 earnings have been solid, they have come with forward concerns. With the ongoing tariff talks, Q2 S&P500 earnings growth rates have been cut nearly in half from 10.2% to 6.4%.

Remember, markets trade on news and expectations. Forward expectations for a recession, rate cuts, trade deals, and earnings are all tilted toward the side of pessimism. This paints a clear path to positive upside surprise for investors: No recession, earlier than expected Fed interest rate cuts, and completed trade deals, which would bring better than expected corporate earnings along with them. So, stick with the process and place your bets accordingly, because when you consider the current odds, upside surprise is the dark horse for the remainder of 2025’s race!

Enjoy your weekend!

-Matt

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.

Sources: YCharts, Returns as of 5/1/2025, Polymarket, Kalshi, CME Group, Factset,