I spent this week in New York City visiting with the media and debating current events with a variety of experts. The volatility in markets mirrors the volatility in their conclusions. Trump’s decision to stage an economic time-out with China has everyone scenario scatter planning. On Tuesday night, the “maximum” tariffs kicked in. On Wednesday afternoon, the “minimum” tariffs replaced them. On Tuesday, it appeared the Trump agenda was national re-industrialization. On Wednesday, it appeared the Trump agenda was international trade negotiation. Without clarity on the agenda, investors cannot have clarity on positioning. This explains the historic volatility levels across the markets. Two of the media spots were filmed on either side of Trump’s tariff two-step. The first—at the NYSE with the Schwab Network—runs about seven minutes. The second, a CNBC segment, clocks in at an hour. I’ve included a short clip here; the full episode will be available in the coming days. Given the depth of content in both, I’ll keep the written portion brief—but to provide some terra firma, I have three thoughts to share:

- The 10-year Treasury Yield Disciplinarian

In 2022, Liz Truss became Prime Minister of the United Kingdom. Truss soon after introduced a “mini-budget” that included unfunded tax cuts and unrealistic borrowing plans. This profligacy triggered financial market chaos. The pound plummeted and Gilt interest rates surged. The Bank of England had to intervene to stabilize the market. Truss resigned 44 days later. While Trump appears willing to endure recession and a stock market rout, he does not appear willing to endure higher Treasury yields, the fulcrum for his Wednesday tariff retreat. Companies use the stock market to fund operations. The US Government uses the Treasury market. Higher yields become highly problematic for funding the Trump agenda and represent a low confidence vote in his policies and American fiscal stability. Trump simply cannot afford, and Bessent cannot survive, runaway Treasury yields. For heads of state, higher yields lead to higher concessions. - Stick to the Plan

As outlined in this year’s Outlook, we expected Trump’s tariff campaign would generate volatility and limit upside a la 2018. We positioned our portfolios accordingly. Unfortunately, the scale of his actions to date swamped everyone’s forecasts, including ours. However, our playbook hasn’t changed. First, solid financial planning produces dependable asset allocations. Our clients’ long-term asset allocations contemplate short-term bouts of volatility. Asset allocations should only change if you experience a major personal change (job loss, health events, financial windfalls etc.) that would materially impact your long-run planning. Additionally, while your equities may be down, your cash, bonds, real estate, etc. are not. Your net worth may shift with the market, but the impact is often smaller than the swings themselves. Stay committed to your asset allocations. Second, use market volatility to generate tax losses. Earlier this week we sold a position and reinvested the proceeds in a similar position to book tax losses. We will continue doing this as opportunity arises, making lemonade out of lemons. Lastly, in a sentiment driven market we encourage adding cash at pessimistic extremes. We reached one such extreme earlier this week, and despite the start of a historic global trade war, the S&P 500 closed the week higher. Remember that investment returns equal reality minus expectations. It doesn’t matter if reality is horrendous, as long as it’s better than expected!

- Volatility is Opportunity

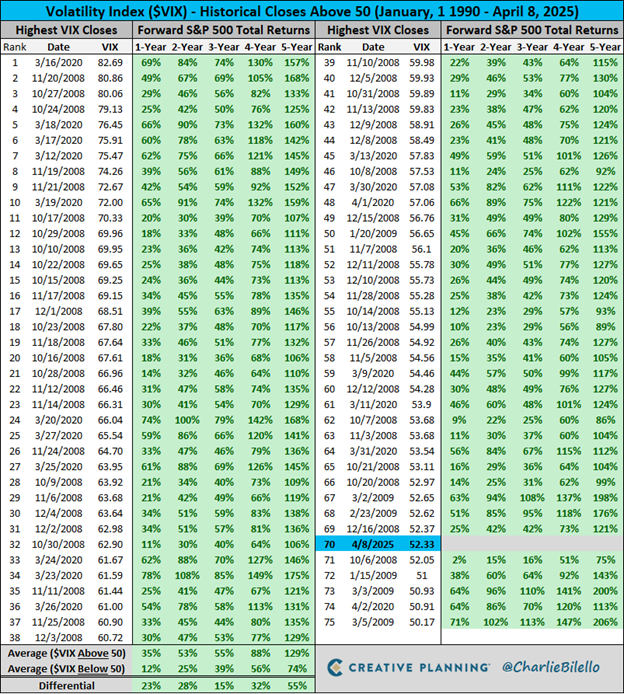

The following chart chronicles stock market returns following similar moments of extreme volatility since 1990:

Note that investing in high volatility markets proves far more profitable over time than investing in low volatility markets. High volatility markets force short-term traders to sell indiscriminately to cover margin calls or unwind impaired strategies. Long-term investors have a time arbitrage opportunity to take advantage of forced mis-pricings. Historically, when traders are sellers, investors should be buyers.

Have a great weekend!

-David

Sources: Creative Planning, @CharlieBilello

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.