On Wednesday of this week, President Trump unveiled his tariff tonic for what ails the American economy. As we discussed last week, Trump has three main objectives for his historic tariff deployment. First, America needs to reshore its manufacturing output and employment. Second, America needs to raise tax revenues offshore to reduce fiscal deficits. Third, foreign nations need to lower trade restrictions on American exports. Let’s consider the case for each of these restructuring objectives and consider the strategy overall.

Make US Manufacture Again!

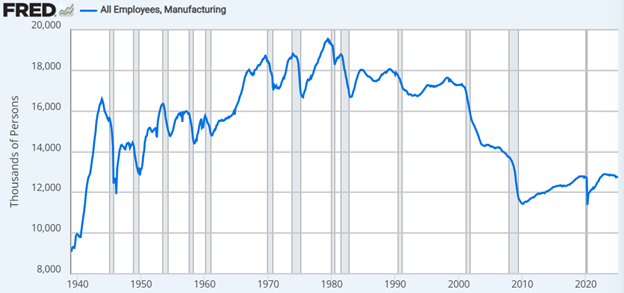

President Trump asserts that the US has been shipping manufacturing capacity and manufacturing jobs overseas. He’s correct that US manufacturing employment has declined significantly since peaking in 1979:

At its peak employment, the US manufacturing sector employed 19.5 million Americans. Today that number has fallen to 12.8 million Americans. However, the value of US manufacturing output hasn’t declined since 1979; it has increased substantially. In 1979, the US manufacturing sector contributed $500 billion to the US economy. Today, manufacturing contributes $3 trillion to the US economy. How do you get more output with fewer workers? By increasing worker productivity.

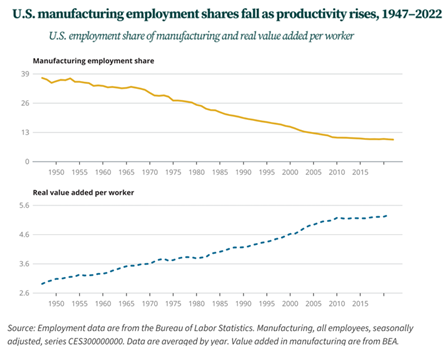

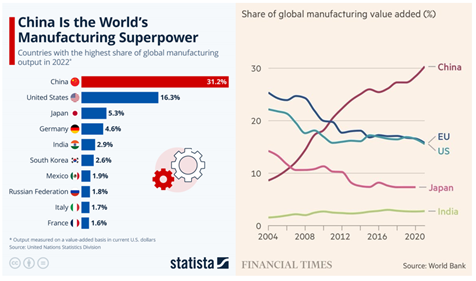

Developing worker productivity and increasing GDP per capita is the core objective of economic growth. As economies develop, they become more sophisticated and shift from mining and agriculture (Africa) to manufacturing (China) to services and consumption (USA). Since their inclusion into the WTO, the ascension of China’s manufacturing capacity has not only displaced US manufacturing share, but everyone else’s as well:

This is because it has been so cheap and effective to make things in China. American manufacturing workers cost five times as much as Chinese manufacturing workers. This explains why Trump reserved his highest tariff rate of 54% for China (and China proxies like Cambodia, Laos, and Vietnam). However, recognize that even with its manufacturing dominance, China’s GDP per capita is $13,000, compared to $70,000 for citizens of the United States. They make more stuff, but we make more money. Will all these tariffs lead to a renaissance in US manufacturing output? Perhaps, if they remain at high levels for an extended period and foreign direct investments pour into the USA, as advertised. Will the tariffs lead to a renaissance in US employment? Unlikely, as AI mixed with dexterous robotics creates virtual workers that “steal our jobs” right here at home.

Make Budgets Balance Again!

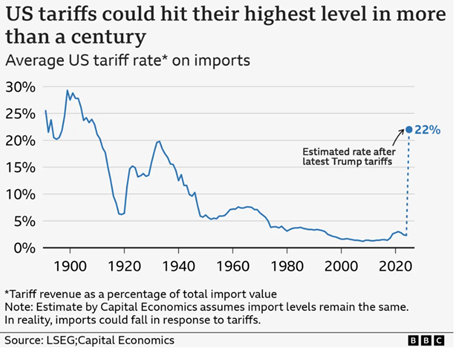

Trump suggested throughout his campaign that he could eliminate the $2 trillion annual fiscal deficit through tariffs and DOGE cost savings. We currently import roughly $3.5 trillion worth of goods. Therefore, math suggests a 28% tariff would produce $1 trillion in tax revenue. That assumes, of course, that counter-tariffs, retaliatory actions, and economic contractions don’t interfere with collections, but I digress. As of Wednesday’s announcement, Trump has lifted the effective import tariff rate to 22% with more in the pipeline (copper, lumber, semis, pharmaceuticals) to get us closer to 28%.

If tariffs can generate $1 trillion in revenue and DOGE can deliver on its claim, “Yeah, I mean, unless we’re stopped, we will get to a trillion dollars of savings,” the deficit gets eliminated. Although the $1 trillion in fiscal contraction would subtract 3.33% from our $30 trillion GDP overall, requiring growth offsets to maintain income and tax receipt levels.

Trump has discussed additional tax cuts, in addition to extending his expiring tax cuts and deregulation, as a stimulus offset. Unfortunately, growth-stoking stimulus is deficit-stoking as well. Trump’s efforts to balance the budget through higher tariffs and fiscal contraction increase recession odds, which increases deficit odds. To reduce deficits effectively and consistently, Washington must have the courage to restructure and reduce Medicaid, Medicare, and Social Security. Tariffs and DOGE work to eliminate the deficit with simple math, but the unintended consequences of these major policies will not be simple.

Make America Export Again!

Just to level set, the US is the world’s largest goods importer at $3 trillion and the second largest goods exporter at $2 trillion. This leaves us with a $1 trillion trade deficit, largely a function of two things primarily. First, we are the wealthiest nation on the planet by far, with a $30 trillion GDP, 50% higher than second-place China, providing us with massive purchasing demand to be satiated. Second, we have the most overvalued currency in the world thanks to US exceptionalism and our currency reserve status. Nonetheless, Trump has simply stylized our overall trade deficit as cheating. He quantified the amount we are being “ripped off” by each trading partner by dividing our trade deficit with each country by our imports from them. For example, we run a $123 billion trade deficit with Vietnam. We import $136 billion in goods from them. Dividing $123 billion into $136 billion derives a 90% “rip off” rate. To be “nice”, Trump only applied half of this rate as the reciprocal tariff. Therefore, to motivate Vietnam to eliminate its trade imbalance with the US, Trump placed a 46% tariff on all imports from Vietnam. Vietnam’s actual tariff rate on US imports is 5.1%. Therefore, true reciprocity would require that the US charge 5.1% on imports from Vietnam. Instead, we will be charging 46% to recoup half of the “rip off”. Unfortunately, seeking to eliminate trade imbalances with each trading partner isn’t feasible. Vietnam imports about $350 billion overall. That number includes $150 billion in computers, electronics, cell phones, and components from China. Commodities account for most of the remainder of the value. The $13 billion in Vietnam imports from the United States includes $4 billion in advanced manufacturing components, $1 billion in aircraft, spacecraft, and specialty equipment, and $500 million in pharmaceuticals—cotton, plastics, animal feed, chemicals, and petroleum account for the rest. To nullify the trade imbalance, Vietnam needs to spend ten times the amount on US exports as it does today, moving our import share from 3.7% to 37%. Simple enough, we just need to quickly start producing the lowest cost consumer electronics in the world. Take that, China!

Best Guess

So, what is really going on here? It’s highly unlikely that the US will challenge China as the world’s manufacturer. Even at China’s breakneck pace, it took decades for them to build up the capacity they have today. Furthermore, the US cannot compete with developing nations as the world’s lowest cost manufacturer. Additionally, modern manufacturing uses more robots than people, making the jobs argument dubious. Lastly, no one will make a long-duration, large-scale investment decision based upon an executive order from a President with a plummeting approval rating.

The re-industrialization of America argument and the deficit elimination arguments feel contrived. However, the deficit reduction argument has potential, but not at 28% tariff levels. These levels likely trigger a recession, and recessions expand deficits. The world can likely absorb the 10% statutory rate, and that would contribute significantly to deficit reduction. However, to extend Trump’s tax cuts and eliminate even more, he needs to show more revenue than that. (Those deep into the mechanics will note that since Trump used executive orders to impose the tariffs rather than the legislative process, they don’t apply to the reconciliation. To that I say, majorities have their privileges).

Trump needs roughly $5 trillion in deficit reduction strategies to pass his tax cut agenda. If he can demonstrate the ability to harvest that amount from tariffs, he might get the tax cuts through. Once that happens, he could begin reducing and eliminating the reciprocal tariffs, relying on newly stimulated GDP growth for deficit reduction. Not saying that’s his plan, but it is a plan, and one that could have the economy kicking entering the mid-terms. My only other explanation is that he plans to have a “Mar-A-Lago Accord” resembling the “Plaza Accord” in 1985, which devalued the US dollar by 50% against the Yen and the Mark. I’ll introduce that concept here, but I am not there yet.

In conclusion, I feel like this chaos is a classic Trump setup – either for budget negotiations, currency devaluation, or something, I am just not seeing yet.

What Investors Should Do

Selling into this environment may feel correct, but history demonstrates it’s usually incorrect. For long-term investors, selling out today requires buying back in on another day when things feel safer. But remember that buying at peak pessimism levels proves most profitable. Good feelings lead to lower returns, the thesis of our 2025 Outlook. At this point, the decision to de-risk needs to have already been made. From here, it’s possible to harvest tax losses, redeploy the cash, and put fresh cash to work, patiently, at pessimistic extremes. This is a tradeable market, but trying to time Trump isn’t a viable strategy.

Have a great weekend!

-David

Sources: FRED, Financial Times, LSEG, Capital Economics, World Bank, Statista

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.