Happy March Madness!

Last week, 68 teams were selected to participate in the Men’s NCAA basketball tournament, and today marks the conclusion of the first and second round games. Both college basketball enthusiasts and casual fans know that even the most dominant teams can fall in a single-elimination tournament, leading to a few weeks filled with unexpected twists, turns, and excitement—often referred to as ‘madness.’

Like the March Madness on the court, U.S. equity markets have begun their own version of March Madness by dipping into a correction! This week, we’ll review the recent activity in the equity markets and help coach you through the game of long-term investing.

Corrective Behavior

Over the past two weeks, U.S. equities, as measured by the S&P 500, were down 10.4% at their lows since the index reached its all-time closing high of 6,144 on February 19th. This downturn is classified as a correction, which is defined as a decline in the index of between 10% and 20%. Corrections in equities are normal, and all markets experience them regardless of economic recessions. This marks the first technical correction in the S&P 500 since 2022. Psychologically, this amount of volatility is difficult to stomach because of how infrequently it happens. The behavioral temptation to adjust portfolios during these turbulent times is strong. Avoiding that temptation is a crucial aspect of managing long-term investment cycles.

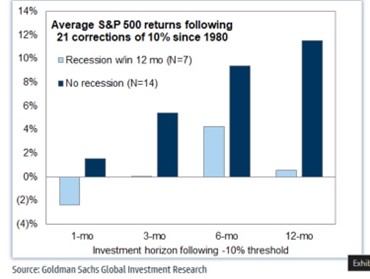

Whether we are in a recession or not, market corrections present a chance for investors to take advantage of fear and lower asset prices. Consider the following chart:

Since 1980, there have been 21 technical corrections in the S&P 500. Regardless of the current economic conditions, the average return of the S&P 500 is positive 12 months after a 10% correction. So, while it can be challenging to click the buy button during falling markets, this is exactly when investors should avoid panic and strategically invest their cash!

Prevailing Sentiment

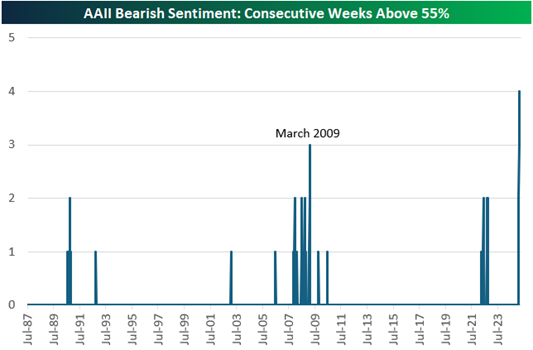

Teams that advance in the March Madness bracket tend to play their best basketball of the season just as the tournament tips off. In contrast, early upsets are typically those teams caught in a downward spiral. Similarly, we can classify today’s investors as being trapped in a negative sentiment spiral. As we noted last week, investor sentiment is at cycle lows, and this week, that trend continues. Notably, investors have never been this pessimistic about equities for so many consecutive weeks. The AAII Bearish Sentiment index has remained above 55% for the fourth straight week, surpassing the previous three-week record set in March 2009.

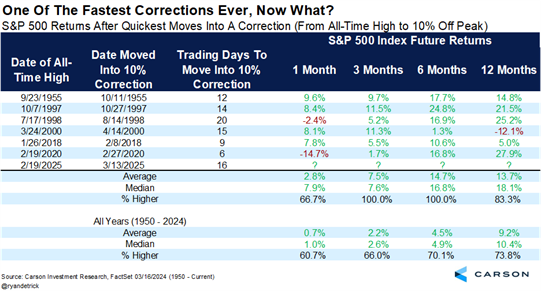

While it may appear that investors are heading for an early upset, they need not panic! The recent correction in the S&P 500 occurred at one of the fastest paces on record—a shoutout to fellow Xavier graduate Ryan Detrick and his team for the accompanying chart. Historically, there have been six other corrections that unfolded this quickly in terms of the number of trading days. In each case, the S&P 500 has shown gains three and six months later. Additionally, in all but one instance, the index was higher a year later. A strong win rate for long-term investors!

All told, with the verifiably depressed sentiment levels and now more reasonable market valuations, investors can keep calm, and strategic investors can take advantage. So, sit back, enjoy today’s games, and embrace the madness!

-Matt

Sources: Carson Investment Research, Goldman Sachs Investment Research, Bespoke Investment Group

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.