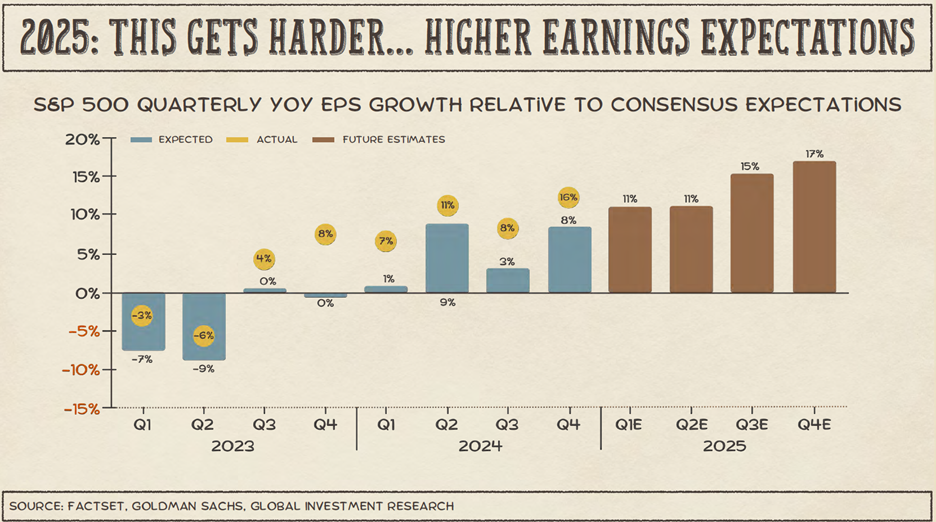

Long-time MLB catcher Yogi Berra is famously attributed with the quote, “When you come to a fork in the road, take it.” Sure, Yogi, got it! As markets drown in the noise of the last several weeks reverberating from Washington D.C., companies in the US mostly finished reporting earnings for the fourth quarter of 2024. As we discussed during our 2025 Outlook presentation in the chart below, analyst estimates for 2025 company earnings are higher now due to recent outperformance at the end of 2023 and throughout 2024. This can be problematic for markets if companies do not deliver on earnings expectations. Think of it like Steph Curry taking a three-pointer: you absolutely expect it to go in, but only this time, it doesn’t!

Looking Back, Q4 2024

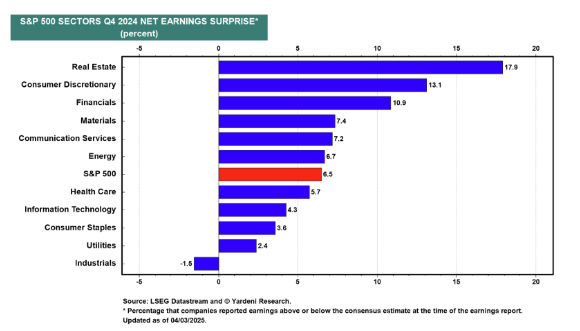

As of the writing of this blog, over 97% of companies in the S&P500 have reported fourth-quarter earnings. So far, the blended fourth-quarter earnings growth rate sits at 18.2%, which would mark the highest quarterly growth rate since Q4 2021. Good news! However, only 75% of companies have reported a positive net earnings surprise, led higher by ten of eleven sectors with an average upside surprise of 6.5%. This puts Q4 2024 earnings surprises lower than the 10-year average upside surprise of 6.7%, meaning companies are growing earnings but not at levels relatively higher than their expectations.

Looking Ahead, Q1 2025

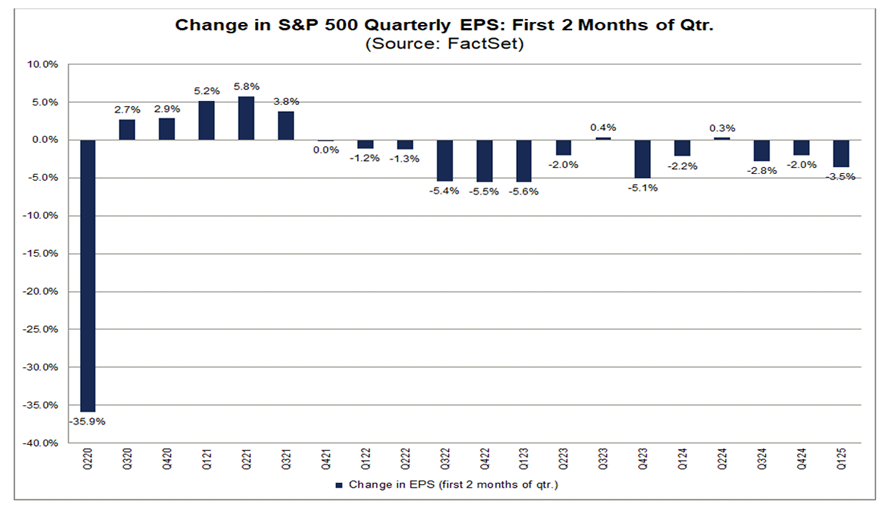

But what about expectations for 2025? Are company management teams and analysts reacting to policy uncertainties that we’ve heard so much about? The short answer so far is yes. Even though typically the first two months of any given quarter have larger revisions to earnings growth rates, since the beginning of this year, analysts have decreased Q1 2025 EPS estimates by 3.5%, which is above the long-term 20-year average of 3.1%. So, not only are earnings estimates being reduced, but they are also falling faster than the historical average.

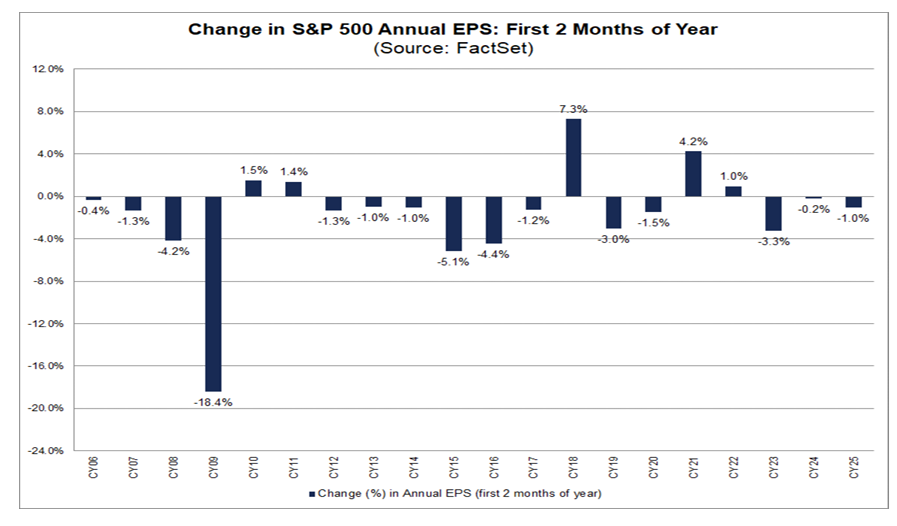

This, of course, is just one quarter, but what about the rest of this year? A similar story. Typically, January and February see the largest haircuts in annualized forward earnings expectations. In 2025, analysts have reduced 2025 annual earnings by 1%, which is a bigger cut than recent years but smaller than the 20-year average cut of 1.5%. Likely, analysts have reduced Q1 2025 earnings expectations given the policy uncertainty but haven’t passed those earnings haircuts through to Q2 2025 and beyond. The policy uncertainty remains, and if it bleeds further into the year, earnings estimates could potentially fall further. In other words, that 6-1 NFL team to start the year finds themselves at 7-6 and battling for a playoff spot!

Bull Cycle Checkpoint

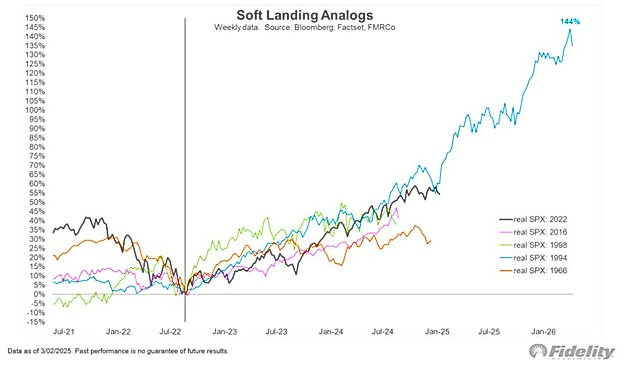

With Q4 2024 earnings now in the rearview and 2025 earnings taking form amid the noise, we’ve reached a fork in the road for this iteration of a soft-landing bull market. We shared a different version of this chart below in our 2025 Outlook; a historical analog of real S&P 500 returns during similar soft-landing markets. The average duration of these analog bull markets is 30 months, and we just wrapped month number 28 from the October 2022 lows. It’s hard to predict the future, but as I’ve written a few times on this blog, the mid-1990s economic and market analog is still a possibility as we progress forward. More specifically, if job gains deteriorate further because of more government layoffs, overall labor productivity would hold the key. On cue, last week’s 4Q labor productivity data came in at 1.5%, above estimates of 1.2%. A more productive workforce could keep this bull running quite a bit further!

Enjoy the rest of your weekend!

-Matt

Sources: Factset, Jurrien Timmer, Fidelity, Yardeni Research

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.