Fourth Quarter, 2024

This time of year, we are inundated with Wall Street’s market predictions about AA—Asset Allocation. “Treat it as entertainment much like you would a sports match,” reports Bloomberg in a December 21, 2024 article.

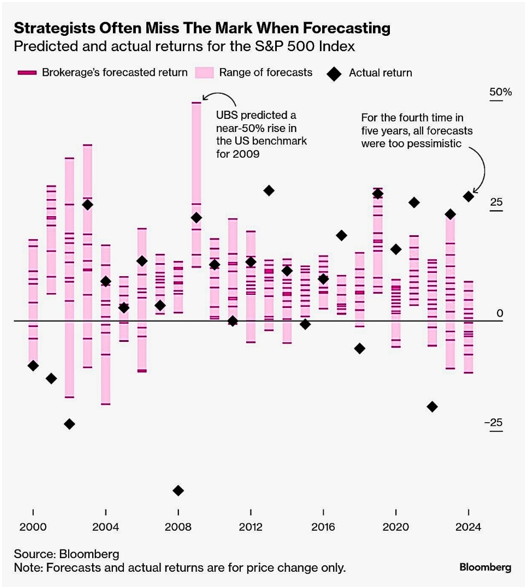

Traditionally, on average, more than half of the market soothsayers predict a 0% to 10% gain for the stock market. As you can see from the chart above, annual returns are far more volatile. Since 2000, strategists, on average, missed the mark by more than 15 percentage points. Longer term, the pattern is the same. Over the last century, large gains and losses were more frequent than single-digit gains, which only occurred fourteen times in 97 years.

Sound like a bad bet?

Don’t be a speculator with your investment assets. The roles of asset allocation to bonds and cash in your investment portfolios should be that of shock absorbers to the short-term annual volatility of the stock market, especially as we age. As this chart reflects, short-term stock market returns vary between (25%) to +50%. I tell my clients that the older we get, the less time we have to make up for large losses. So, allocating more to the shock absorbers of fixed income and cash as we age becomes more valuable to our portfolios and net worth than betting your hard-earned money on Wall Street prognosticators.

-Phyllis

Sources include: Bloomberg

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable. However, Waddell & Associates cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Waddell & Associates does not provide tax or legal advice, and nothing contained in these materials should be taken as such. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. As always, please remember investing involves risk and possible loss of principal capital and past performance does not guarantee future results.