Happy New Year from all of us at Waddell & Associates. For readers affected by the tragic events that occurred last week across the US, we offer our sympathies.

Before we look ahead to the remainder of 2025, let’s look back at the year that was in 2024. As the saying goes, hindsight is 20/20; just when you think an asset should zig, it often zags!

The Trend Is Your Friend—Until It Isn’t!

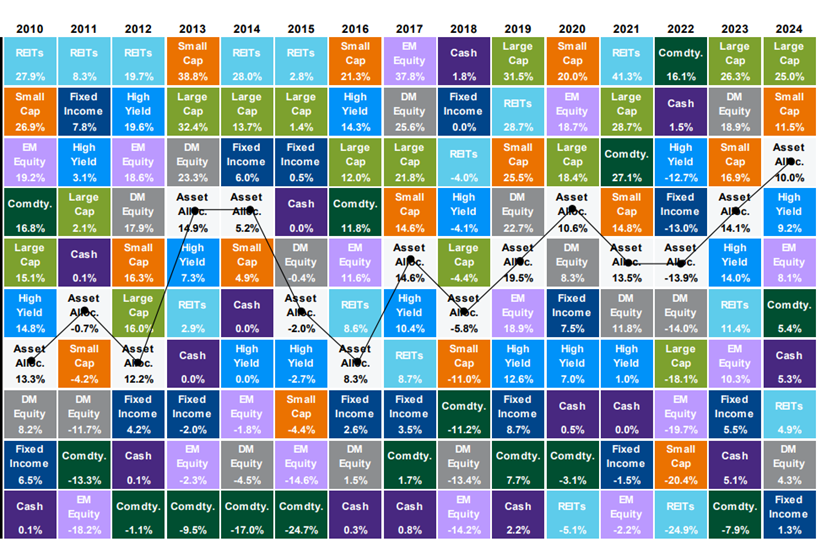

I’m a big visual learner. One of my favorite ways to digest asset class returns is through a quilt chart like the one below. Of course, this does not represent the entire investing universe, but it does provide helpful context through color:

Much like in 2023, large-cap US equities led the way again in 2024, producing a 25% return—over double the closest competitor. Similarly, cash assumed invested at the fed funds rate earned a 5.3% return, beating traditional fixed income and even international, developed equities at 1.3% and 4.3%, respectively. However, the “quilt” nature of the chart shows why we diversify portfolios across different asset classes, and it provides a valuable lesson as we kick off 2025.

Both Winners and Losers

If you look at the top left of the quilt, you’ll see that, coming out of the Great Financial Crisis in 2009, REITs led the way in returns for three straight years and for five of the first six years that kicked off the 2010s decade. For those who recall the sentiment at the time, an allocation to REITs was necessary and borderline foolish to underweight inside of portfolios.

On the bottom of the quilt, you’ll see just the opposite. Commodities ranked near the bottom for almost the entire decade. They were the laughingstock of asset allocators, bringing forward the question of why anyone would ever invest in commodities. Amazingly, they awoke from their performance slumber and had fantastic performances in 2021 and 2022.

Looking back at various outlooks for 2022, likely very few, if any, had commodities at the top of the buy list. So, reallocating your hard-earned capital into REITs after their strong run or dumping commodities after their difficult decade would have proven costly thereafter. But that’s what makes the ”quilt” essence of the chart so informative. It is a humbling reminder that being in the prediction business of calendar-year returns is a difficult endeavor.

Looking Ahead

Fast forward to the present, and we find ourselves in the middle of another leadership streak after US large-cap equities continued to flex their return muscle in 2024. Of course, owning US large-cap stocks has been a lot like picking the Chiefs to win the Super Bowl in recent years. When the trend is your friend, it’s silly to pick the time when that trend will end. However, we do know from history that it will likely end at some point.

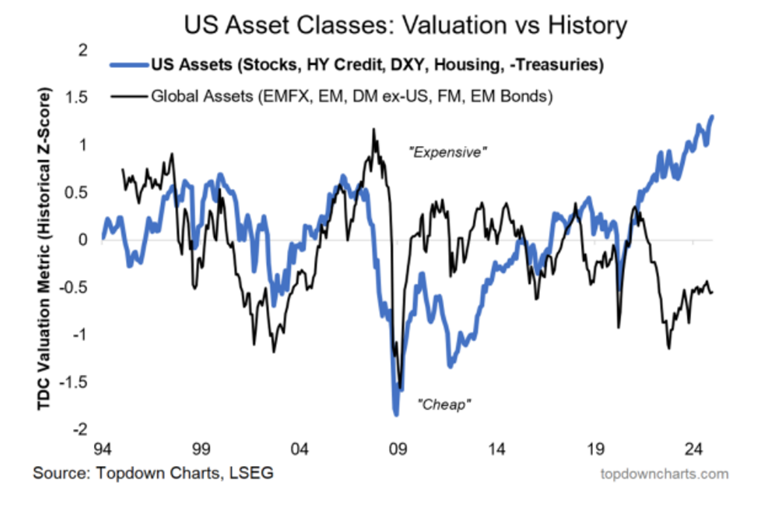

Peering through the hourglass of 2025, will US large-cap stocks lead the way? Maybe, but maybe not. Consider the below chart of historical US asset class valuations against the rest of the world:

Going back thirty years, US assets are expensive compared to the rest of the world. Past performance is no guarantee of future results, and as we can see in the quilt chart, a trend might continue, but it also might not. There is no necessary reason that US vs. Global valuations should mean revert, but we know from history that they often do at some point in time.

So, before ditching the underperforming asset classes in your portfolio, it’s important to remember why we own a collection of assets instead of one or two. The collective pool of diversified, un-correlated asset classes helps generate portfolio returns with lower levels of volatility or, in essence, smoothing out the ride in the growth of the portfolio over time.

Have a great weekend!

-Matt

Sources: JP Morgan Asset Management, Topdown Charts, LSEG

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.