Before I get to the main course of this holiday blog, let’s briefly review the week that saw US equities have a healthy market correction.

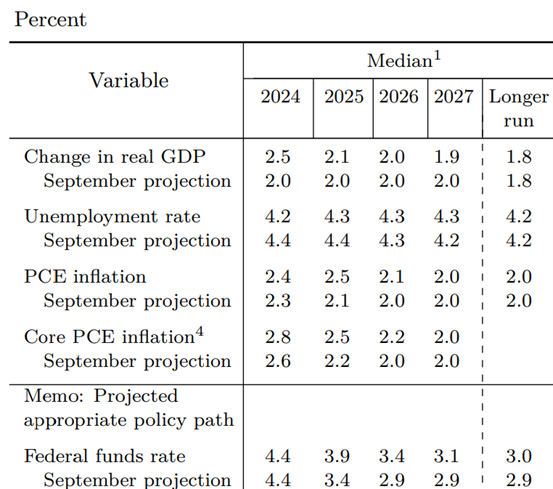

On Wednesday, Jerome Powell and his fellow committee members cut short-term interest rates by 0.25%, but saw their summary of economic projections increase their 2025 expectations for inflation, GDP, and the Fed funds rate. This induced a correction in US equities and a small rise in the 10-year treasury, but it’s important to understand the correction in the context of other asset classes, specifically treasury bond volatility, oil prices, and credit spreads, all of which barely moved alongside their US equity counterparts!

First, the MOVE index, which measures US Treasury volatility, did not have much to say about the equity sell-off and is near the low on the year:

Source: https://www.google.com/finance/quote/MOVE:INDEXNYSEGIS?sa=X&ved=2ahUKEwiGt6HKoLeKAxUoOTQIHSeiBVcQ3ecFegQIJRAf&window=YTD

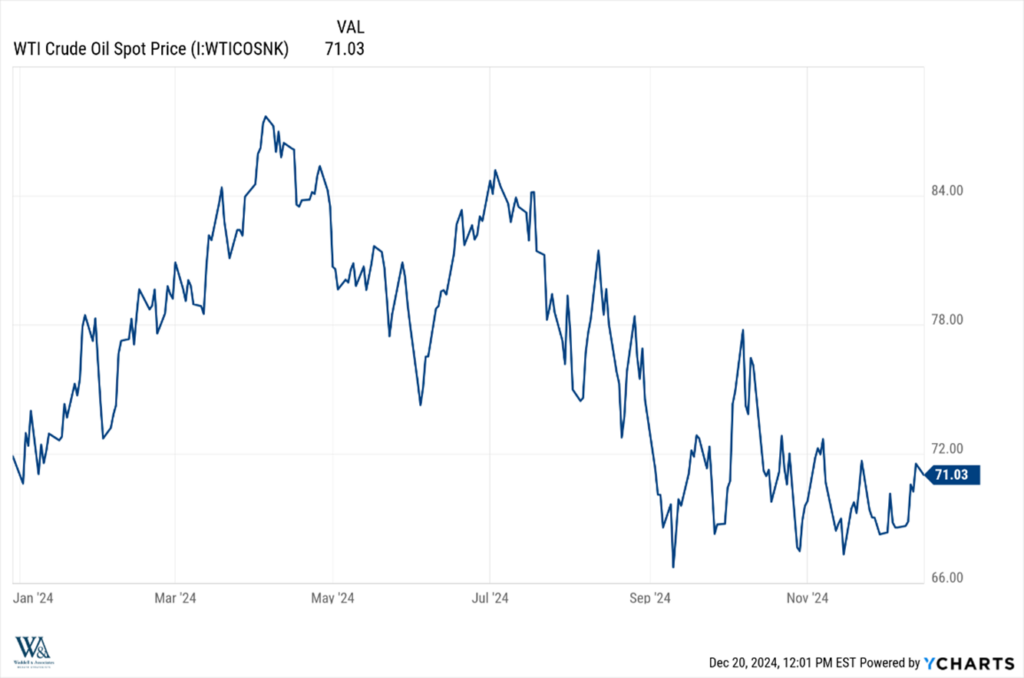

Second, oil prices are relatively unchanged. If markets were expecting an economic downturn and/or recession, oil prices would be collapsing:

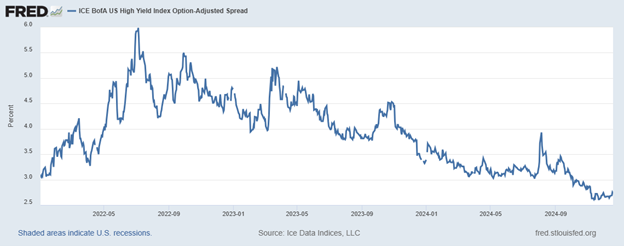

And lastly, credit spreads remain at cycle lows, indicating the equity sell-off wasn’t attributable to increasing systemic credit risk:

Source: https://fred.stlouisfed.org/graph/fredgraph.png?g=1CmaT

While US equity markets were falling, credit spreads didn’t budge, oil and other commodity prices were flat, and treasury bond volatility was non-existent. If Santa were delivering an economic downturn, it wouldn’t be exclusive to a US equity market correction!

On a more fun note, a timeless tradition in our house is the annual reading of “‘Twas the Night Before Christmas.” So, in keeping with the holiday spirit, I wrote a few words to reminisce on the year we’ve shared. I hope you enjoy it and maybe you’ll share it!

‘Twas the night before Christmas, and all through the Street,

The terminals were stirring; the year’s been a treat.

The strategists were nestled, their screens shut down,

While visions of gains danced all around.

The Fed had been slow, with cuts here and there,

To ease the worry of economic despair.

Inflation ticked lower, labor was tight,

Yet uncertainty lingered—an ongoing plight.

The S&P rallied, the Nasdaq soared,

With tech leading gains like many times before.

AI and data centers filled our minds,

While no drones were found, as if by design.

Bonds were resilient, while yields stayed alight,

Gold shined as a hedge all throughout the night.

Crypto found bulls to put on their team,

And Bitcoin hit levels thought only in a dream.

“On Powell! On Yellen! On GDP, hooray!”

Japan and Ukraine kept volatility in play.

With Yen-carry-trades painting the tapes,

Investors stayed cautious, unaware of their fates.

With portfolios balanced and earnings now clear,

Strategists worked calmly to keep clients near.

For long-term investors weathering the storm,

We built firm foundations, beyond the norm.

So, here’s to the markets and what they may bring,

To growth and to value, and everything in between.

As the New Year descends, let’s welcome with pride,

For patience and planning will be our guide.

Happy holidays to all, and to all a good night,

May your future portfolio be prosperous and bright!

– Matt

Sources: FRED, ICE Data Indices LLC, Y Charts, Google.com, FederalReserve.gov

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.