Periodically, I spend time in New York meeting with investment managers, channel partners, and media outlets. While I enjoy Zoom meetings and telephone calls, conversations in person always prove far more robust and, sometimes, what happens “off camera” teaches me the most.

Furthermore, because so much market sentiment and psychology originate with analysts and pundits in New York, it’s important to stay close to the source. This week, I had the privilege of visiting with all-star reporters from Bloomberg, Investment News, Reuters, the Schwab Network and with Charles Payne on Making Money. The available clips from each are linked below. You will find lots of market commentary, musings on Trump, AI, and even thoughts on the booming economy in Tennessee.

Bloomberg Intelligence: Intel CEO Forced Out (scroll to 18:54)

Investment News: Here’s How AI Will Forever Change the Financial Services Industry

Schwab Network: Corporate Profits, Earnings Bullish for 2025

Fox Business: Making Money with Charles Payne

For those of you who prefer the written word, here are some clarifying thoughts on Trump’s tariff agenda and why it’s critical to his deficit reduction pledge that the currency markets cooperate.

Trump’s Tariffs

The US government runs a $7 trillion budget. Of that, only $1 trillion is truly discretionary. $2 trillion goes to defense and interest payments and the rest to services entitlement programs. Our current deficit is approximately $2 trillion. Trump has committed to cutting the deficit in half (from 6% of GDP to 3%), requiring a $1 trillion pickup in revenues and/or cost savings. Let’s consider the revenue opportunities first:

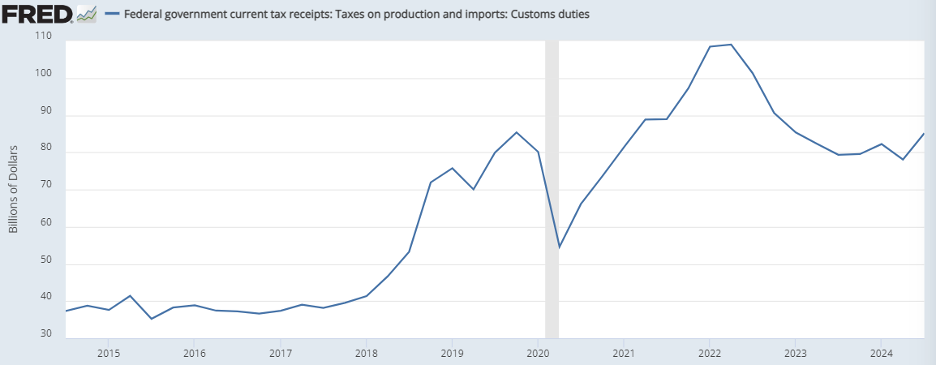

Higher growth historically leads to higher tax revenues. The Trump 1.0 (pre-COVID) economy grew at a 2.8% real GDP pace, well over our 2% potential. Total tax revenues rose from $1.9 trillion initially to $2.2 trillion, even with Trump’s historic tax cut passed in late 2017. Most of the incremental tax gains came from individuals as more income and more capital gains led to more taxes paid, offsetting less corporate tax (corporations are just pass-through entities). This policy strategy will likely surface again, considering corporate tax revenues have risen well above their pre-cut levels and Trump has signaled dropping them from 21% to 15%. Trump also doubled tariff tax revenue from $40 billion to $80 billion beginning in 2018 (note the continuation and expansion under Biden):

This time, Trump wants to impose 10-20% tariffs across the board (a dramatic increase from the 2-3% today). With imports of $4 trillion, this implies tax receipts of between $400 and $800 billion, diligently chipping away at the $1 trillion needed to halve the deficit. However, as we learned in our economics classes, tariffs axiomatically lead to offshore price hikes which ricochet back to the American consumer as inflation. But—this ignores currency effects. Note the US Dollar’s reaction to Trump 2.0:

Trump’s election initially led to a 7% rise in the value of the US dollar. This currency strength would have neutralized an equal amount of tariff. A 10% appreciation in the dollar would, therefore, offset the inflationary consequences of a 10% tariff. Obviously, there are unintended consequences to consider, and nothing is ever this simple, but this explains why Trump so strongly favors tariffs as the primary financing vehicle for deficit reduction.

Lastly, Elon, Vivek, and friends have their erasers out and their eyeshades on. I am still foggy on how much they can cut out of the Federal budget, but they will cut something. The combination of growth-stoked tax receipts, currency-neutralized tariffs and DOGE belt-tightening directives form the foundation of Trump’s austerity agenda. However, with entitlement spending growing faster than the economy, ignoring them makes long-term deficit containment impossible… But try getting elected on that!

Enjoy your week,

-David

Sources: FRED, YCharts, Federal Reserve Bank of Atlanta, U.S. Bureau of Labor Statistics, Institute of Supply Management

The above communications and contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on the publicly available sources listed below. These sources are believed to be reliable but are not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.