Thanksgiving week is upon us, and with it comes a uniquely American opportunity to pause, reflect, and appreciate all that we have. For many, Thanksgiving also brings traditions that go beyond the turkey and family gatherings. If you’re a football fan like me, Thanksgiving Day is forever synonymous with the NFL and the majestic voice of legendary John Madden. One of John’s best Thanksgiving Day traditions was handing out a turkey leg for a top player’s game performance. For investors in 2024, we have much to appreciate, so in the spirit of John Madden, we’re handing out our inaugural W&A Thanksgiving Turkey Leg award for 2024— market-style!

And the award goes to…

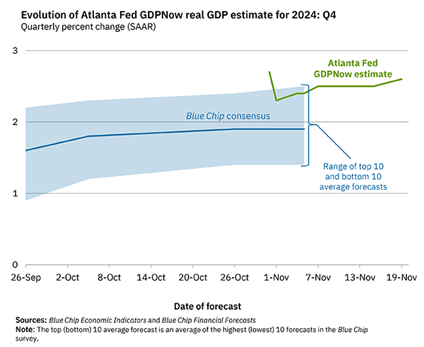

Madden’s tradition of giving out turkey legs began back in November 1989 when Eagles fans enjoyed a 27-0 win over the Cowboys. Then Eagles lineman Reggie White sacked Troy Aikman once and led the defense to earn the first-ever Madden turkey leg award. With it, a new tradition was born. This year, the inaugural W&A Thanksgiving Turkey Leg award winner is… the US economy! Let’s review the recent data and the stat lines, which suggest a healthier and more robust US economy than expected. Last Monday, Atlanta Fed estimates for Q4 GDP ticked up to an annualized 2.6%, following what has been a steady rise in the estimate throughout November:

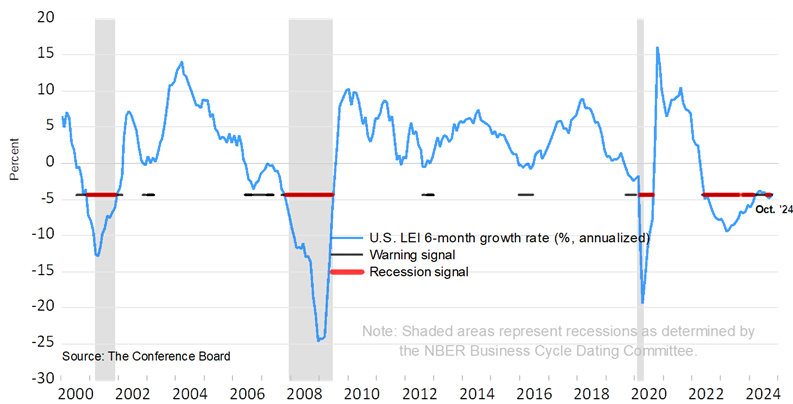

Further, the Conference Board Leading Economic Index® (LEI), which tracks a range of economic indicators to predict future economic activity, is no longer forecasting a recession for the first time since early 2022! No one indicator is perfect, but this shift reflects stronger-than-expected economic resilience, including robust consumer spending, steady labor market conditions, and a normalizing yield curve. While risks remain, the updated outlook suggests a more stable economic trajectory in the near term:

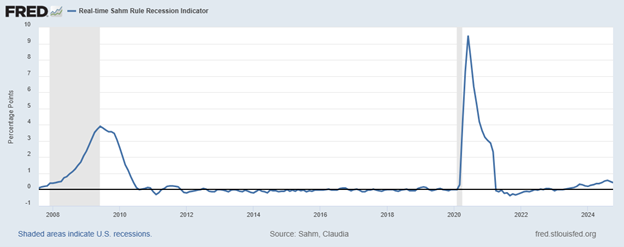

Next, you might remember reading about the ‘Sahm Rule’ back in July and August. Economist Claudia Sahm created the metric to help identify the onset of economic recessions in real-time by monitoring short-term trends in unemployment rates. Historically, a reading above 0.5 and rising has been a reliable indicator of ongoing recessions. The Sahm Rule was triggered in August when it reached a cycle high of 0.57. This sparked attention in the financial media, with many quickly pointing out its significance, and predicting a concurrent, ongoing recession. However, since most financial media won’t revisit previous play calls that went sideways, investors should know the two Sahm Rule readings since August have dropped to 0.5 in September and now 0.43 in October!

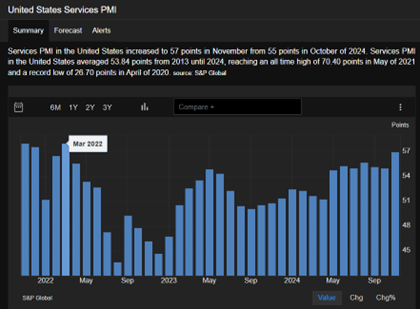

Additionally, Friday morning saw a big upside win in the US Services PMI, reading a 57 handle versus 55 in October, the prior month. As a refresher on PMIs, a level of 50 indicates no change over the prior reading, while readings above and below 50 indicate an acceleration or deceleration, respectively. As you can see in the chart below, this month’s reading represents the largest number since March 2022.

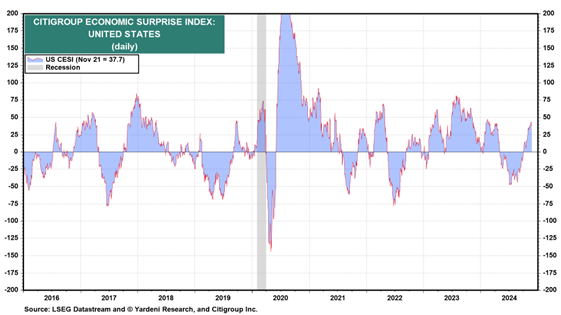

Lastly, a quick peek at the Citigroup Economic Surprise Index reflects the current assessment that the recent US economic data has been improving and surprising to the upside. All told, the US economy continues to recover, evolve, grow, and most importantly, has not yet descended into a recession even with restrictive fed monetary policy.

Congrats, US economy!

Have a great week!

-Matt

Sources: Yardeni, FRED, S&P Global, Federal Reserve, The Conference Board

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.