Those of you who viewed our 2024 Halftime Report will recall that we designated the conflict between the backward-looking FOMC and the forward-looking Jerome Powell as the biggest risk to the economy and the markets. The Fed has two mandates: maintain stable prices and support full employment. Currently, headline inflation measures have downward momentum, while unemployment measures have upward momentum. Based upon the mandate, the Fed should be considering a policy tilt towards accommodation, and yet, at 5.5%, policy sits at highly restrictive levels.

The Fed has identified 3% as the neutral policy rate, implying 2.5% of policy restriction just to return to even. While many on the committee prefer a “safer,” more incremental wait-and-see approach to cutting rates, the numbers and the logic argue for a bolder response. It is time for Powell to shed the committee, assert his leadership, and produce. On Wednesday he did just that, inciting the first committee member dissenting vote since 2005.

The Fed cut the overnight interest rate from 5.5% to 5%. A 0.5% cut to begin the cycle amidst committee incrementalism and political scrutiny declares that Powell has the power. Investors initially cheered the move, then reconsidered as a close study of the committee’s projections show a projected three-year timeframe to reach neutral. We agree. But with Powell now leading, rather than following the committee, we suspect a steeper downslope than that.

Why risk recession with inflation whipped?

Powell’s term ends on February 5th, 2026. Few Fed Chairs have achieved a “soft landing” after running a restrictive policy regime. If Powell can forestall recession for the next 17 months, he will secure his legacy as one of them. Powell’s legacy pursuit and leadership assertion provide investors with powerful support. FOMC member Michelle Bowman voted against the 0.50% cut. Powell reacted by stating in the press conference, “There’s nothing wrong with dissents, and if it happens, it happens.” Cue Thursday’s all-time highs.

While we welcome Powell’s rally support, we should not overlook the threat of his opponent. The Fed has now recalibrated efforts from fighting inflation to fighting recession. As investors, we prefer an inflation fight to a recession fight. Historically, stocks perform well in inflationary times. Stocks do not perform well in recessionary times.

Markets may have cheered weak economic data releases during the inflation fight, but they will not cheer weak economic data releases during the recession fight. This invites more anxiety and downward volatility. And while Powell cut the overnight rate 0.5% on Wednesday, the market drove the 10 Year Treasury yield up 0.15%, partially offsetting the stimulus. Recession odds remain low at this point, but risks have risen. A Powell-led soft landing remains our base case, and we have calibrated our investments toward higher earnings and lower rates. For now, markets agree:

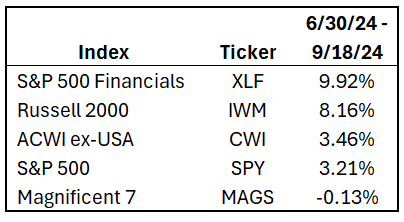

Economic growth and lower rates should benefit interest rate-sensitive groups like financials and small caps the most. Economic growth and lower rates should also lower the US dollar and boost international stocks. As seen above, small caps, financials, and internationals have all outperformed the S&P 500 since June 30th. To fund these advances, investors have added cash and proceeds from the previously undefeated Magnificent 7 stocks.

As we watch the macroeconomic data trends vigilantly, we must also scour the macromarket trends for confirmation. As of this writing, the economic and market data agree. Inflation is falling, rates are falling, the economy is growing, and Powell’s legacy pursuit provides powerful recession insurance.

Have a great week!

– David

Sources: Y Charts, https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.