The Full Story:

Federal Reserve Chief Jerome Powell is not an economist. Jerome studied politics at Princeton and obtained a law degree from Georgetown. He worked as an investment banker for Dillon, Read & Co., in capital markets at the US Treasury, led corporate finance at Bankers Trust, and identified, developed, and divested industrial businesses within private equity mega-firm, The Carlyle Group. Of the 12 voting members of the FOMC, eight have a Ph.D in economics. Other than Jerome Powell, the three who do not hold a Ph.D. in economics include a regulator and community banker (Michelle Bowman), a public policy professor (Michael Barr), and a consultant (Thomas Barkin). Only Jay Powell has a background in operating within capital markets, making go/no-go investment decisions, and structuring finance packages based on projections.

We made note of Powell’s visible discomfort at the last FOMC press conference on June 12th. The Committee opted to leave rates unchanged and reduced their rate cut projections in their Summary of Economic Projections for the year from 2 to 1. Supporting their stance, inflation remains above the Fed’s 2% target; recession risks appear contained and fears of repeating the premature cuts of the 1970’s haunt. For students of history and masters of economic models informed by history, staying “data dependent” appears appropriate. However, Powell wasn’t trained by and paid for within the private sector to look backward. Powell was paid to look forward. Powell wasn’t paid to be “data dependent”, Powell was paid to be “outlook dependent”.

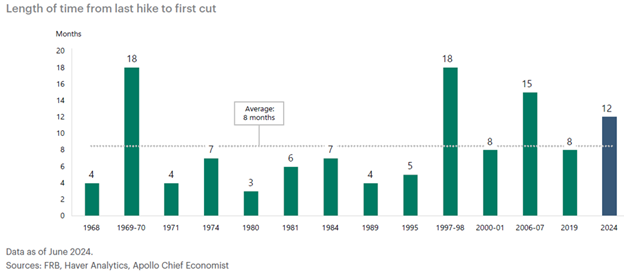

Right now, the Fed has left rates unchanged since the last hike in July of 2023. That’s a much longer pause than usual:

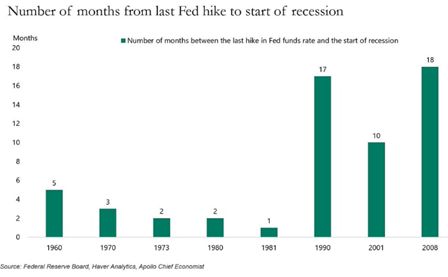

Because of the systematic dispersion of monetary policy, leaving rates “higher for longer” ferments unintended consequences and increases recession risks. For instance, tight Fed policy may not always cause a recession, but it often does. Consider the following time lapses between last hikes and recession onsets:

With 12 months having elapsed since his last hike, Jerome has to fear overstaying his tightness. Investors, like Powell, rely heavily on mean reversion and probability theory to make forward-looking judgments. Knowing the information above, Powell should rightly be getting nervous by now. That’s what surfaced at his press conference last month, and that’s what lurked within his testimony on Capitol Hill this week. Powell WANTS to cut rates, but he needed a defining data point to break the backward-looking gridlock on the FOMC. He received that data point on Thursday.

Powell’s Proof

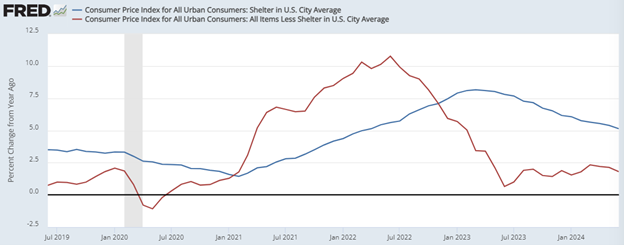

Following Powell’s dovish testimony before Congress on Tuesday and Wednesday, the Bureau of Labor Statistics released its June Consumer Price Index (CPI) inflation report. Overall, inflation fell by .1% in June. Over the past year, CPI has disinflated to 3%, the lowest overall inflation level since March of 2021. For those backward-looking, 3% is obviously 50% above the Fed’s 2% target. Those looking forward recognize that the badly lagging shelter component distorts the true underlying inflation rate. Subtracting shelter inflation (36% weight within CPI) produces an overall inflation rate of 1.8%, well below the Fed’s target. With sticky shelter inflation in steady decline, future inflation reports will fall further. Note the lag between shelter inflation in blue and non-shelter inflation in red:

Source: https://fred.stlouisfed.org/graph/?g=1q6h4

This report provided the proof and relief that Jerome Powell needed. Future traders have now priced in a 90% chance that the Fed will cut rates by .25% in September, and a 6% chance they will cut them by .5%. Markets reacted pleasantly and violently.

The Rate Cut Playbook

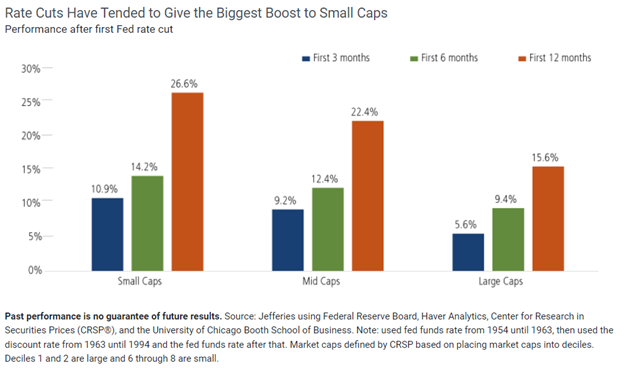

Smaller companies tend to borrow more money as a percentage of assets than larger cap companies. They also tend to get acquired more when rates are lower. For these reasons and others, small cap stocks have historically benefited far more during Fed rate cut cycles than large cap stocks. Note the performance differentials below:

As such, Thursday’s CPI release immediately activated a historic rotation out of large cap stocks and into small cap stocks. Note the performance differentials on the day:

The largest capitalization companies within the Russell 1000 fell .21%, while the smallest capitalization companies rose 3.51%. The much-vaunted Magnificent 7 cohort fell 4.5% on the day, led lower by AI star Nvidia’s 6% decline—a clear source of funding for the rate cut rotation. By the end of trading Thursday, the S&P 500 fell nearly 1% while the Russell 2000 small cap index rose 3.5%. This was the fourth largest underperformance by the S&P 500 to the Russell 2000 since 1979.

Just as the backward-looking FOMC members favor higher rates, backward-looking investors favor large cap US stocks. Forward-looking cohorts must now consider rate cuts… and investments beyond the Magnificent 7.

Have a great weekend!

-David

Sources: FRB, Haver Analytics, Apollo Chief Economist, Federal Reserve Board, FRED, Bespoke

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.