AI chip maker NVIDIA reported superlative quarterly results this week with sales leaping 260%, earnings leaping 460% and the stock leaping to a 100% gain on the year. I cannot recall a company dominating a megatrend as completely as NVIDIA. Analysts have drawn parallels to the rise of Cisco in the late 90s, but Cisco did not have nearly as firm fundamentals as NVIDIA, nearly as defensible technology, or nearly as durable a customer base. For those unfamiliar, NVIDIA makes the chips that power the data centers that power AI. Amazon, Meta, Microsoft, and Alphabet represent 40% of revenue, and each has copious cash flow and insatiable demand for NVIDIA’s GPU (Graphics Processing Unit) chips. Note the recent surge in demand from these providers as they incorporate AI, machine learning, and high-performance computing infrastructure within their data centers:

According to CEO Jensen Huang, the world currently has $1 trillion worth of installed data centers (that need GPU upgrading) and will need to add another $1 trillion over the next 4-5 years. In other words, the AI transformation and installation cycle has just begun. This project will require a lot of financing. That’s good for banks. These server farms will require a lot of real estate. That’s good for property owners. These data centers will require a lot of power. That’s good for utilities. NVIDIA isn’t the only beneficiary of this tech moon shot. Consider the performance of some other AI enablers:

Over the past year, the S&P 500 has advanced 28%. JP Morgan (a bank) has advanced 47%, Digital Realty Trust (a data center real estate developer) has advanced 63%, while Constellation Energy Corp (an electricity provider) has advanced 165%. Yes, NVIDIA has outperformed, rising 204% over the time frame, but my point is that they are just one vendor in this historic buildout.

Taking the theme a step further, if there is this much demand for suppliers of AI infrastructure, there must be widespread demand from AI consumers. In fact, according to AI overlord and NVIDIA CEO Jensen Huang, we will see four distinct progressions of AI adoption:

Wave One: Initial training and infrastructure build-out (where we are now).

Wave Two: Widespread enterprise adoption using AI agents (bots do the programming).

Wave Three: AI usage in heavy industries (manufacturing, energy, etc.).

Wave Four: Sovereign AI (every government relies on AI).

So first they build it, then EVERYONE uses it. But since we are all economic actors, we wouldn’t use AI unless we profited from AI. And according to analyst earnings forecasts, everyone will:

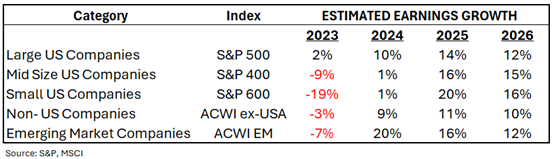

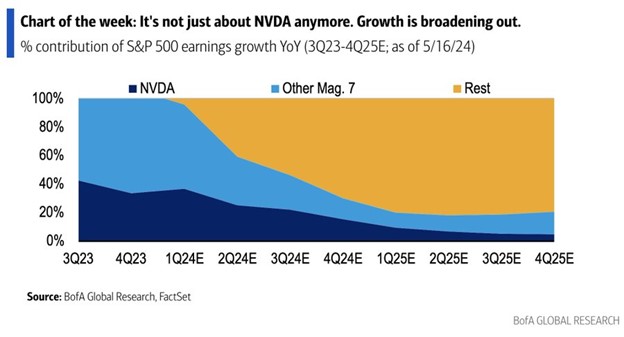

Note the double-digit earnings growth expectations moving forward from large, mid, and small sized US companies, but also companies located offshore and within the emerging markets. So, while NVIDIA’s economic performance has been breathtaking, it is just a preview of what is to come economy-wide and globally. Here is another chart that caught my eye this week, demonstrating the upcoming earnings proliferation beyond NVIDIA:

This is the story beneath the resilience of this market rally. NVIDIA’s awesome… but what it is previewing for everyone else is even awesome-ER.

Bonus Section: I need to do more work on this, and I will, but all this upcoming investment and economic activity requires lots of money. The Fed has been deliberately shrinking money supply to battle inflation. For this massive global buildout, too little money supply could limit its speed and breadth. With inflation whipped (core ex-housing CPI = 2.1%), shrinking the money supply further could prove economically limiting and destructive. Fortunately, money supply:

… and money velocity:

… have resumed their growth trajectories, providing more monetary supply for the project. Inflation hawks may find this alarming, but just as data centers need electricity… technological revolutions require cash!

Have a great holiday weekend!

-David

Sources: Seeking Alpha, https://seekingalpha.com/news/4109616-nvidia-in-charts-data-center-revenue-surges-427-from-last-year, FRED, YCharts, Waddell & Associates, S&P, MSCI, BofA Global Research, FactSet

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.