Each day investors receive stock market valuation inputs: Fed decisions, economic data releases, fiscal policy changes, sentiment squiggles, weather reports, Superbowl winners, etc. Yet only four times a year do investors receive the meaningful output from all these disparate inputs: corporate earnings data. With first-quarter earnings season nearly over, let’s review the numbers to assess the current health of this market, and the outlook for its longevity.

Know the Grow

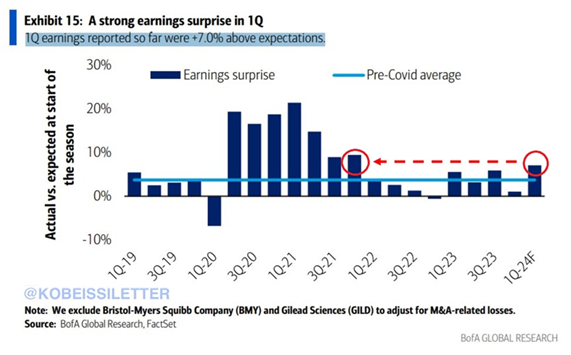

460 of the 500 companies within the S&P 500 have now reported their first-quarter earnings. Overall, for the reporting companies, earnings grew 5.4% last quarter. That’s the highest quarterly earnings growth rate since Q2 of 2022. Revenue grew less at 4.1%, but that means profit margins expanded, a healthy harbinger of earnings persistence. Not only were these numbers solid, but analysts were also solidly surprised:

On average, companies reported earnings 7%+ higher than analysts expected entering the quarter. This is the highest “positive surprise” level since the 4th quarter of 2021 and well above the pre-COVID average of 5%. And while averages can be misleading, each of the 11 sectors within the index reported surprisingly better than expected results:

Better than expected trailing earnings results, at high margins of surprise, should increase confidence in, and degree of, future earnings growth. To wit, full-year earnings estimates for 2024, 2025, and 2026 have all risen throughout this earnings season:

This chart requires orientation. Focus on the Blue line. This line represents consensus earnings estimates for 2023. Analysts began contemplating 2023 earnings back in 2021 at which point they projected earnings would grow by 10%. Unfortunately, as time progressed and the Fed hiked rates aggressively, 2023 earnings estimates collapsed into June of 2022. Earnings estimates recovered from there, but full-year earnings ended 2023 merely 2.3% higher, far short of the 10% initially projected.

Now look at the purple line. Analysts began contemplating 2024 earnings early in 2022, again projecting 10% growth. As time progressed, analysts raised their estimates to compensate for the large drawdown in 2023 earnings expectations. As 2023’s prospects improved, analysts trimmed their 2024 estimates back towards their initial 10%, which is where they sit today.

Now look at the green line which represents analysts’ earnings growth estimates for 2025. Note that this line has risen consistently since its inception. While analysts initially projected 11% growth, expectations now register at 14% growth.

Lastly, look at the red line. This represents analysts’ earnings growth projections for 2026. Note that this line has drifted slightly higher since inception, with growth expectations now nearing 12%.

In sum, analysts have held firm on their expectations that 2024 will deliver 10%+ growth in corporate earnings, they have grown significantly more confident that earnings will grow more quickly next year at 14%, and they have grown slightly more confident that earnings will grow another 11% in 2026. Add it all up, according to analysts, earnings for companies within the S&P 500 will grow 40% by year end 2026. Maybe they will grow less, maybe they will grow more, but that is A LOT of earnings growth for this market to consider as it inches ever closer to all-time highs.

Happy Mother’s Day!

-David

Sources: BofA Global Research, FactSet, LSEG Datastream, Yardeni Research

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.