Markets sold off this week in reaction to a marginally hotter-than-expected CPI report that marked down the odds of a Fed rate cut in June, marked up the US Dollar, and marked up longer-term US interest rates. Geopolitical tensions in the Middle East also weighed heavily on Friday as traders zeroed out positions ahead of a potentially newsworthy weekend. While these fear factors may have driven the selloff, healthy markets climb a wall of worry, and recent investment sentiment measures read far too worry-free. When assessing sentiment, we refer primarily to the sentiment of professional investors using the Investors Intelligence Survey, and retail investors using the American Association of Individual Investors Survey data. Let’s review each to psychoanalyze the current investor psyche.

INVESTORS INTELLIGENCE

The Investors Intelligence Sentiment Index traces its origins back to the 1960s when Investors Intelligence began surveying investment advisors and newsletter writers. The survey provides insight into the prevailing bullishness or bearishness among investment professionals. The difference between the two percentages forms the basis of the index. Based upon the most recent survey data, investment advisors are four times more bullish than bearish:

Note that advisor bullishness has rarely exceeded these levels. The typical bull/bear survey ratio ranges between 1-3; we sit at 4 today. Investors should read excessive advisor bullishness as a contrarian indicator, as investable cash has likely already been deployed. Further gains need further fuel, and bullish investors hold less cash. Fortunately, while high bullish levels may restrict further gains, they don’t indicate imminent declines. Note that between 2013 and 2015, the ratio bounced between 3.5 and 4 while the market rose 32%, 13%, and 1%, respectively. So, while the current reading bears considering, it shouldn’t, alone, cause a bear.

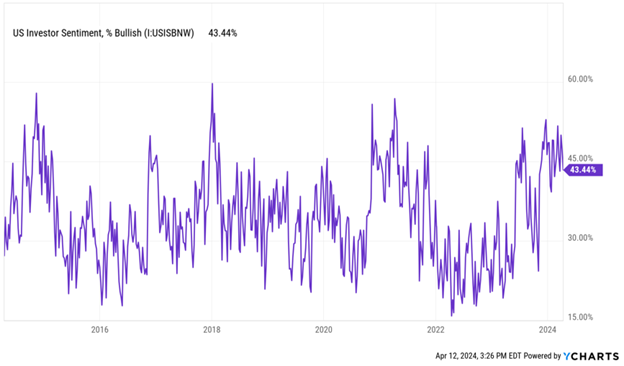

AAII BULLS

I find this sentiment measure the most useful for forecasting short-term market movements. Each week since 1987, the American Association of Individual Investors has polled its members to ask whether they are bullish, bearish, or neutral looking six months ahead. Bullish levels above 50% suggest irrational exuberance, while bullish levels below 20% suggest irrational pessimism. Currently, 43% of investors surveyed count themselves as bullish:

While this seems elevated, retail investor bullishness averages 37.6% over the long run. So, while professional investors seem overly optimistic now, individual investors seem generally optimistic. Nonetheless, returns from this level looking forward historically lag returns at lower levels:

According to the chart above, bullishness between 40-50% correlates with average forward returns of 7%. That’s less than long-term average equity returns of 10%, but still highly profitable. As with the Investors Intelligence index, I don’t find high levels of bullishness a particularly good timing tool. Conversely, I do find low levels of bullishness highly useful. When bullishness sinks below 20%… buy, buy, buy! For now, at 43%, bullish retail investor sentiment isn’t ideal but also not a major rally threat.

VIX

Lastly, the options markets dynamically price volatility assessments within a measure called the VIX index. I haven’t found the VIX particularly useful in predicting forward returns (unless it falls below 10%), but it does provide investors with a useful perspective on anxiety levels.

On Friday, The VIX shot up nearly 30% at the high. A move like that doesn’t occur because of a warmer CPI number. This volatility stems from geopolitical tensions between Iran and Israel, creating a demand spike for short-term options strategies. A spike in the VIX can also reflexively fuel broader market sell-offs as options activity aggravates equity activity. Absent a firefight between Israel and Iran over the weekend, I would expect this EKG to descend as next week’s earnings releases return investor attention to more investable considerations.

THE GOOD NEWS ABOUT THE BAD NEWS

Reversals in investor sentiment driven by a slightly hotter inflation report and hotter than usual rhetoric between Israel and Iran will benefit this market. A reversal in sentiment driven by deteriorating economics or earnings decay would prove far more concerning and problematic for investors. Lower sentiment levels without lower economic and earnings levels will only reload the rally for further gains. For those dismayed by this week’s sell-off, remember two things. First, if every quarter this year performed as the first quarter performed, we would end the year up 40%+. Unlikely. Furthermore, even after this week’s downside detour, we remain within 3% of all-time highs. Recognize that pullbacks build bull market character, and expect earnings momentum to rebuild market momentum beginning next week.

Have a great week!

-David

Sources: AAII, Waddell & Associates, YCharts, LSEG Datastream, Yardeni Research

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.