The Full Story

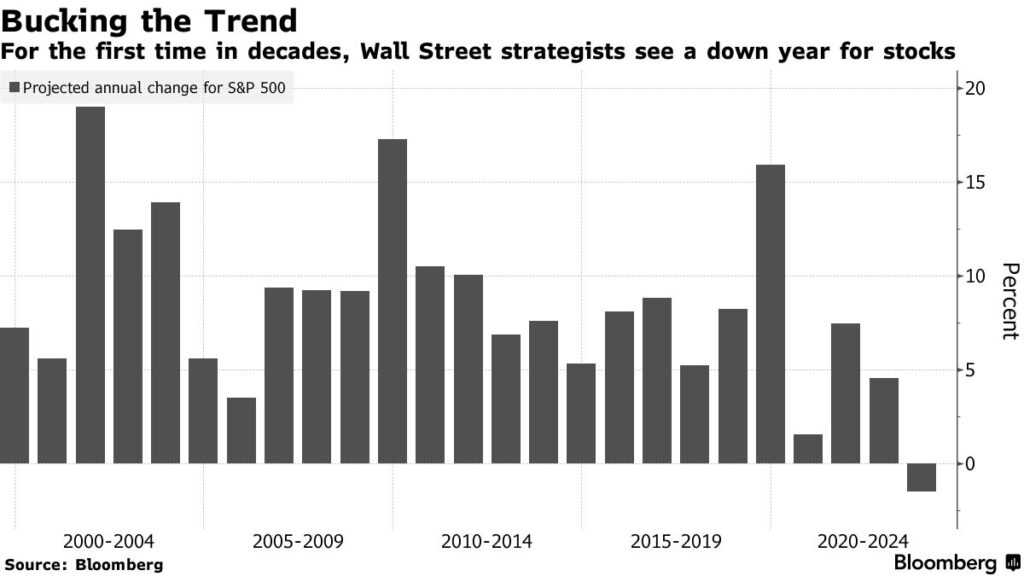

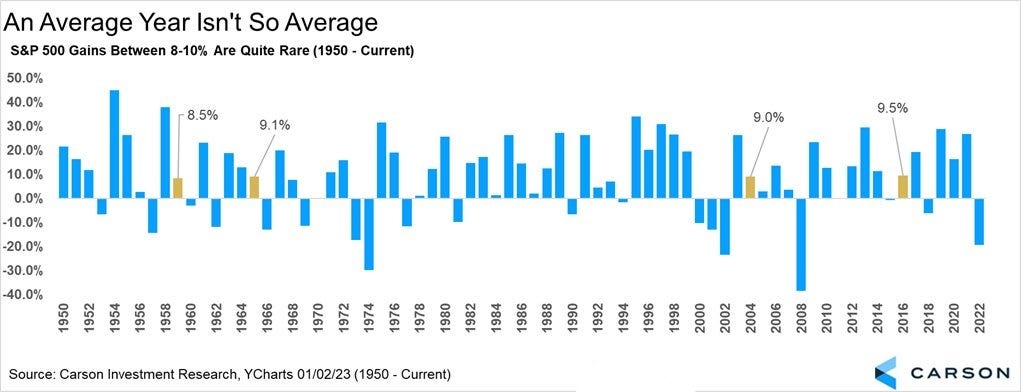

This time last year, pessimism reigned. Wall Street strategists were nearly unanimous in their prediction that 2023 would provide businesses with a recession and investors with losses. As we noted this time last year, sour sentiment cleared the way for gains, as the market prefers to behave as least expected. In fact, the S&P 500 did not end 2023 with losses, but rather with 20%+ gains. Not only did this wildly surprise the Negative Neds and Nancys last year, also note that in the chart above that Wall Street analysts haven’t projected a year of 20%+ gains in any of the last 25. In fact, most of the yearly go-forward projections resided between 5-10%, an increment rarely reached:

Between 1950 and 2023, the S&P 500 delivered “average” gains about 5% of the time, even though the “smart money” projects “average” gains around 75% of the time. As strategists ourselves, we can sympathize. If economic actors would simply act rationally, per the economic textbooks, volatility would subside and math would prevail. After all, forecasting year-end targets for the S&P 500 only requires projecting market-wide P/E ratios and aggregate earnings numbers.

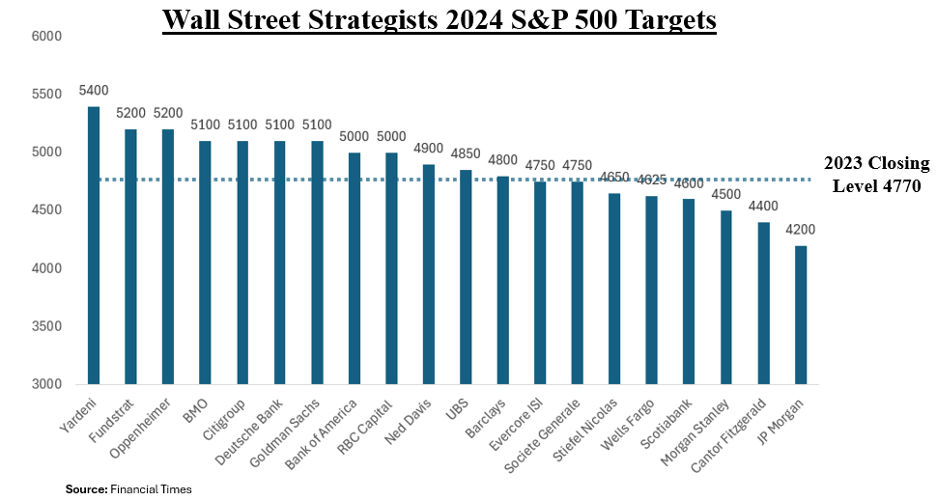

In an environment of 5% corporate bond yields, the stock market P/E should approximate 20x. In a 2% GDP environment with 2.5% Inflation, earnings growth should fall somewhere between 4% and 10%, depending upon profit margin variance. Given that the S&P 500 finished 2023 with a P/E approximating 20, we have reached that target and only have to solve for earnings. Strategists currently project full-year S&P 500 earnings roughly 5% above last year’s total, translating into a 5% gain for 2024. Strategists then add premium and discounting factors to derive ultimate targets. Here are Wall Street’s predictions for 2024:

On average, the Wall Street strategists above expect the S&P 500 to end 2024 at 4,861 for a gain of only 2%. Removing the influence of outliers, the median gain projected is still only 2.2%. By interpretation, the Wall Street consensus expects the economy to flatline in 2024, profit margins to stagnate, and corporate earnings to languish. Those are very low expectations, and that’s very good news!

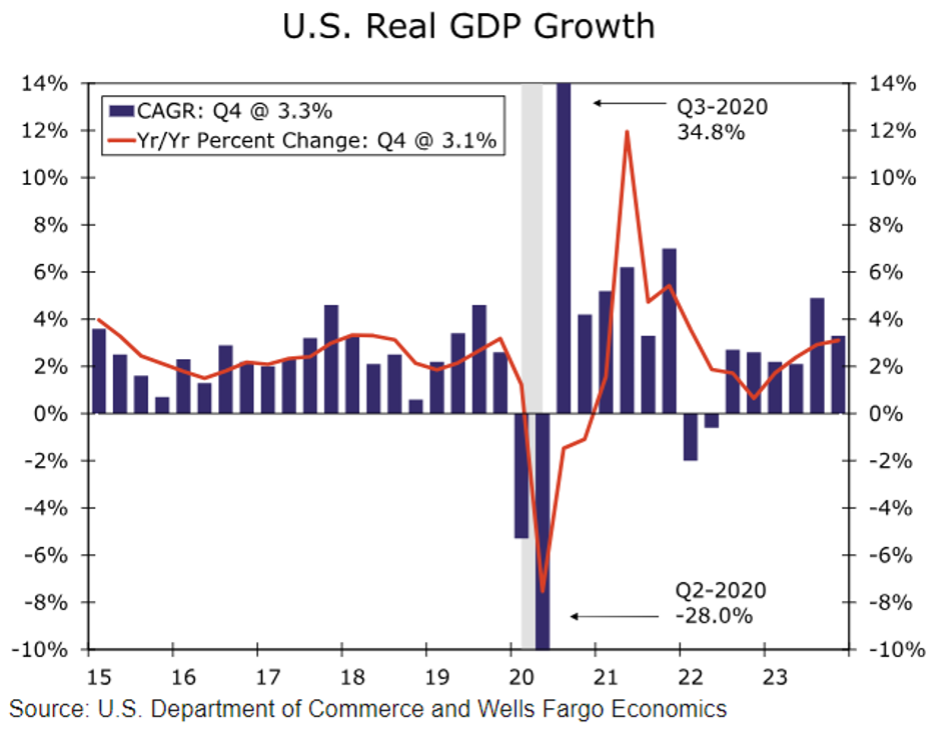

On Friday, January 26th, the S&P 500 closed at 4890, above the average year-end targets for Wall Street strategists. This week, we learned that the chronically underestimated US economy grew 3.3% in the 4th quarter vs. estimates of 2% growth.

For the full year, the US economy grew at a 2.5% pace, despite substantial monetary restraint from the Fed, and well ahead of consensus. Additionally, inflation data contained within the GDP report landed right on the Fed’s target of 2%, clearing the path for rate cuts. Markets, in turn, rallied to fresh all-time highs. More economic growth than expected suggests more earnings than expected, and less inflation than expected suggests lower rates than expected. So far, 2024 looks a lot like 2023: Low expectations, rosy reality!

What should you expect when Wall Street expects a bear?

It’s a bull!

Have a great week!

-David

Sources: Bloomberg, Carson Research, Financial Times, US Department of Commerce, Wells Fargo Economics

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.