The Full Story:

I spoke with two reporters to close out last week who seemed baffled by the market’s strength amidst the recent tumult. Highly understandable. With deposits spilling out of small and regional banks choking off consumer, business, and real estate credit, with the Fed raising rates to use recession to fight inflation, with war ever escalating in Ukraine, with the US declaring a commercial cold war on China, with debt ceiling brinkmanship brewing in DC and Trump indicted in Manhattan… shouldn’t this market be falling? One would think, and yet the first quarter ended with the Dow flat, the S&P 500 up 6%, and the NASDAQ up 15%. Bulls, explain thyselves!

What Fuels Rallies?

You may have heard that bull markets always climb the wall of worry. Investors are natural skeptics. Psychologically, pessimism feels much safer and justifiable than optimism. Cash buys certainty; investment, uncertainty. Therefore, bull markets require the constant conversion of the skeptical and their cash. Remember, at the root of it all, cashflows determine market performance. When cash flows in, markets rise; when cash flows out, markets fall. High cash reservoir levels imply high rally potential. Low cash reservoirs imply rally exhaustion. Tell me what’s in the reservoirs and the mood of investors, and I can quickly calculate rally potential.

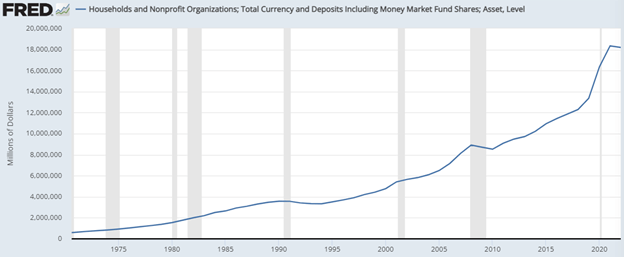

Each quarter the Federal Reserve releases its Flow of Funds reports providing insight into US financial conditions. The above chart accounts for household currency, checking accounts, savings accounts, and money market fund levels. At the end of 2022, US Households held $18 trillion in cash equivalents versus $13.3 trillion at the end of 2019. We saw a slight drawdown in cash levels toward the end of 2022. Where do you guess that went?

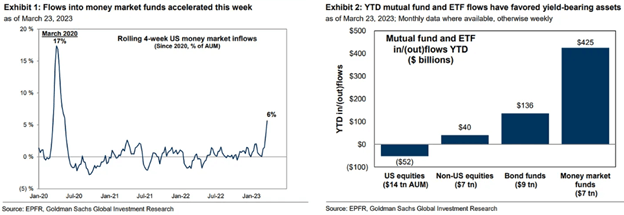

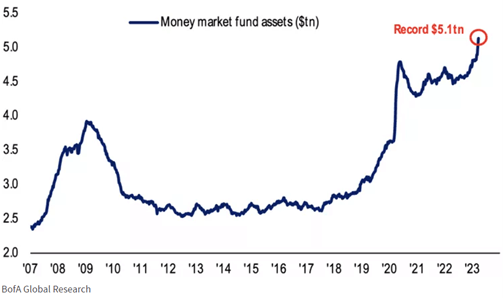

While checking and savings balances have migrated into money market funds, they have also migrated into bonds and bond funds, given the robust yields on offer. Conversely, negative US equity outflows offset foreign equity inflows leading to net negative flows for stock market mutual funds and ETFs. So, any depletion in cash has only increased bond holdings, not stock holdings. For one last reservoir look, Money Market Fund holdings overall have now reached record levels:

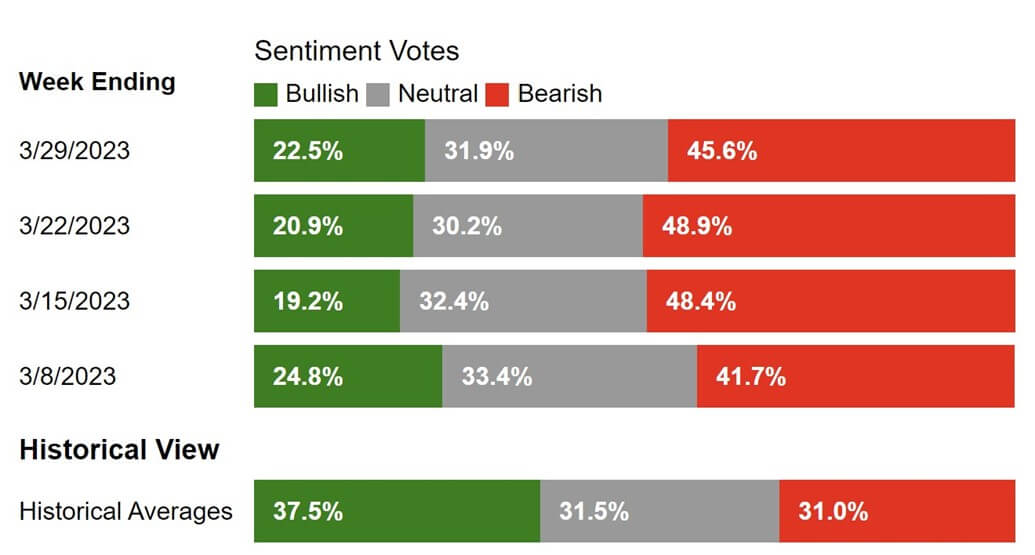

Clearly, the cash reservoirs overfloweth! Now, let’s check in on mood. As referenced a couple of weeks ago, investors have rarely been less optimistic, with only 19% of those surveyed by the AAII (American Association of Individual Investors) on March 15th anticipating gains ahead:

On average, since 1986, 37.5% of respondents typically see gains ahead, making the 19% level reached on March 15th roughly half of historical norms. In my anecdotal experience, Bullish sentiment below 20% signals rallies ahead. Since March 15th, bullish sentiment has increased nearly three percentage points to 22.5%. Over the same period, the S&P 500 rose 7%. Yet, at 22%, optimism remains far below normal leaving plenty of worry wall to scale.

So how can markets rally with deposits spilling out of small and regional banks choking off consumer, business, and real estate credit; with the Fed raising rates to use recession to fight inflation; with war ever escalating in Ukraine; with the US declaring a commercial cold war on China; with debt ceiling brinkmanship brewing in DC, and Trump indicted in Manhattan? Because based upon historic cash levels and despondent sentiment levels, these horribles have already been accounted for! It DOES NOT MATTER whether reality is good or bad for stocks to advance, only that reality arrives better than expectations. And while the bank panic over the last few weeks signaled crisis, the Fed’s response signaled a bailout. With the crisis threat neutralized by the bailout promise, markets recalibrated to the base case for 2023 of a mild recession, a 10% earnings drawdown, and perhaps one more hike from the Fed as inflation slowly deflated into year-end. Remember, we accounted for these variables last year. In 2023, no crisis means no reason to decline further. With cash reservoirs full and optimism scarce… it doesn’t take much!

Enjoy your Sunday!