The Full Story:

Markets continued to punish the pessimists this week with the S&P 500 now over 4% higher in 2023. Last Friday’s wage disinflation report helped set the trajectory, while this week’s CPI report and better-than-expected earnings from the major banks helped maintain our course. Throughout the year, markets will fixate on the interplay between inflation and earnings. Remember, inflation actually boosts corporate earnings as higher prices drive higher revenues. When inflation falls, revenues fall, leading to corresponding compressions in earnings and, ultimately, stock prices. Analysts calling for disinflation and recession have marked down corporate earnings considerably. We are more optimistic, as corporate executives have had months to prepare for recessionary threats. Proposing that even in light of inflation and a potential recession, earnings resilience could surprise to the upside. This week provided two main data points to help resolve our dispute.

The Consumer Price Index Plunge

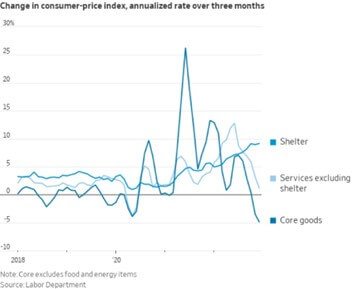

The U.S. Bureau of Labor Statistics released its December CPI report on Thursday morning. For the month of December, Consumer Price Inflation fell .1% versus November while gaining 6.5% over the past year. This stands well below the 9% reached in June but still well above the Fed’s 2% target. However, a deeper dig into the report reveals more weakness than the headlines might suggest. Consider the following 3-month average across the goods, services, and shelter components:

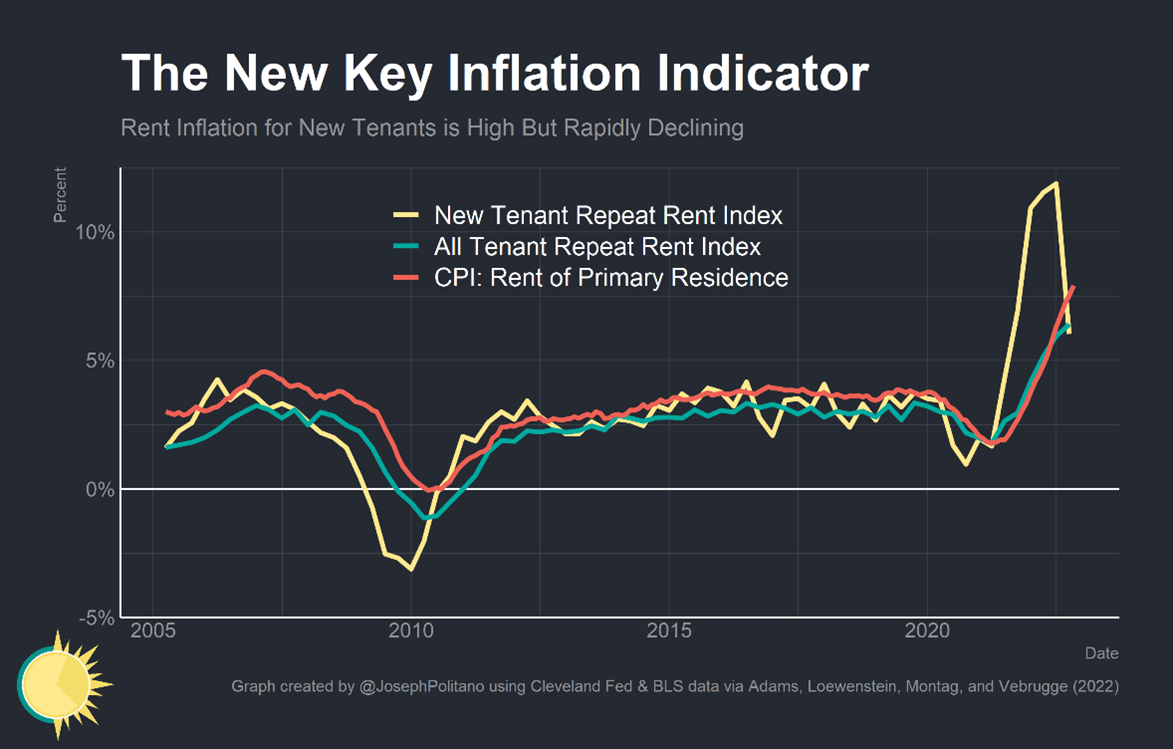

Core goods prices have slipped into deflation as new and used auto prices have collapsed, with auto semiconductors more prevalent and logistics bottlenecks cleared. Services excluding shelter inflation have legged lower as COVID revenge travel and dine-outs moderate. Only rent inflation remains truly problematic, but of all the indicators, this lags the most. In fact, if we look at more concurrent indicators like the New Tenant Rent Index and the All Tenant Repeat Rent Index, we find rapid disinflation in rents that will ultimately register in CPI:

In sum, with goods inflation deflating, services ex-rents inflation dis-inflating, and rent poised to fall based upon more current indicators, inflation has clearly committed to a downward trend. Inflation gains over the last three months, annualized at closer to 3%, get us pretty close.

4th Quarter Earnings Yearnings

Earnings season began in earnest on Friday as the major money center banks released their fourth-quarter results. Analysts project S&P 500 earnings to fall 4%, the first quarterly decline since 2020. Only a small portion of the S&P 500 has reported results to date, but so far, the results have proven promising. Of the 29 companies that have reported, 79% have beaten estimates by 7.7%, on average. Should S&P 500 companies grow earnings in the fourth quarter rather than shrink them despite inflation declines, investors may see this as positive foreshadowing for 2023. If so, earnings resiliency spells investment opportunity, which will recalibrate expectations and rerating indices higher.

Have a great Sunday!