The Full Story:

On Wednesday, the Federal Reserve raised the benchmark interest rate by .50%. This fell in line with market expectations as Powell widely signaled this hike weeks ago. What accompanied the rate hike seemed to surprise the markets but fell right in line with our expectations. While Jerome Powell acknowledged that the drift lower in Consumer Price Inflation released Tuesday was nice, he asserted that it’s the drift lower in wage inflation that’s necessary. The mechanism for reducing inflation is a reduction in demand. Unfortunately, the mechanism for reducing wages is recession.

Survey Says

In last week’s email,

The Drive for 5

, we profiled the current labor dynamics and suspected that the December revision of the Fed’s

Summary of Economic Projections

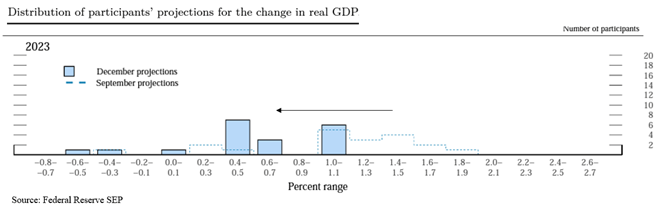

would call for even lower economic growth, higher interest rates, and higher unemployment. Note the changes below:

In the September version of this report, the survey’s consensus projected economic growth of 1.2% for 2023. The Fed downgraded its economic growth outlook to .5% in this most recent report. That’s a 60% decrease in their growth outlook.

Yikes!

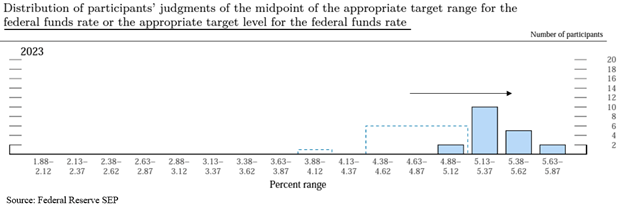

Simultaneously, the Fed increased its interest rate policy projection:

In September, the Fed projected a peak in the policy rate of 4.6%. They now project a peak policy rate of 5.1%, an 11% increase to their interest rate outlook.

Double Yikes!

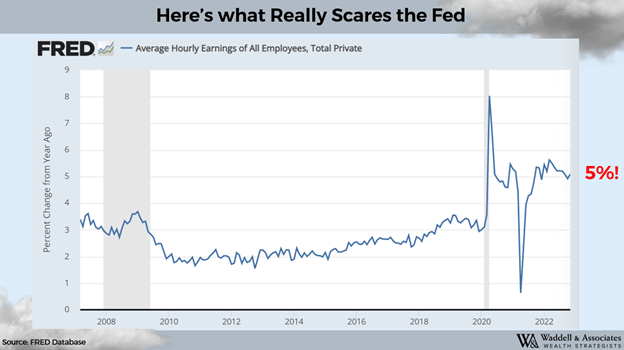

What would make the Fed raise interest rates, knowing that the economy will likely recess? THIS:

Jerome Powell said many things on Wednesday (

click here for transcript

), but the most important soundbite of the day was this one (reacting to the committee’s view that consumer price inflation will fall to 3.5% next year):

“…that’s a pretty significant drop in inflation. And… where’s it coming from? It’s coming from… the goods sector, clearly. By the middle of next year, we should begin to see lower inflation in the housing services sector. And then… the big question is… how much will you see from the largest, the 55 percent of the index, which is the non-housing services sector. And, you know, that’s where you need to see — we believe you need to see a better balancing of supply and demand in the labor market… — it’s not that we don’t want wage increases. We want strong wage increases. We just want them to be at a level that’s consistent with 2 percent inflation. Right now… if you factor in productivity estimates, standard productivity estimates, wages are running, you know, well above what would be consistent with 2 percent inflation.”

Translation: We see goods inflation falling now, and we will see rent inflation falling mid-year next year, but since wages account for 55% of consumer price inflation and they are not falling, we must use recession as a policy tool to decrease wages to achieve our 2% inflation target.

This prescription led to an instant and dramatic recalibration of the market’s expectations with the Fed’s. Hope for a lockstep reduction in Fed austerity with reductions in headline inflation indices was dashed. The Fed has now coupled policy decisions with the Average Hourly Earnings measure highlighted in the chart above, NOT the consumer price index. That’s a significant change of focus for the markets, which precipitated immediate sales and reassessments.

While this shift in posture obviously disappointed the markets, it hasn’t led to violations of our key factors for rally resilience going into year-end. Let’s revisit our Santa Clause criteria:

1. The S. Dollar Index remains below 110 – Check

2. The 10-Year Treasury Bond Yield remains below 4% – Check

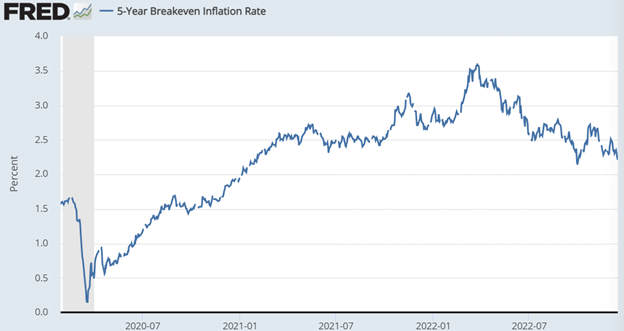

3. The 5-Year Inflation Expectations remain below 2.5% – Check

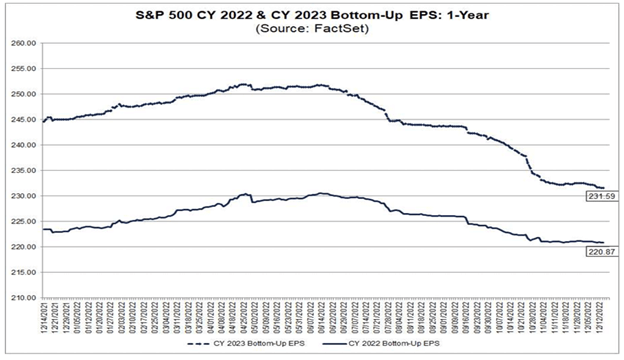

Fortunately, each of these factors remains constructive. The weakness in the dollar reduces systematic risks and supports earnings. The softness in the 10-year reduces valuation pressures. The softness in the inflation expectations index should comfort the Fed. This adds rally resilience above the October lows. Still, for a rally to continue from here, we need analysts to recast earnings models, factoring higher recession probabilities without significant earnings impairment. Note that analysts have already trimmed their 2023 earnings estimates by 8% but still expect earnings to grow by 4.5% in 2023 over 2022.

These estimates will fall further as recession calculations commence. But, as expectations reset lower, the potential for upside surprises grows. Right now, analysts expect S&P 500 earnings will fall 2.8% in the fourth quarter. Should they fall less than that, it will reveal that corporate management also watches the news and has the power to properly prepare for the Powell recession to come.

Have a great Sunday!