The Full Story:

Markets rallied strongly this week on a weakening in Fed rhetoric. To this point, Chairman Powell has taken every open mic opportunity to terrify investors as a tactic to talk down inflation.

Any market rally over the past six months prompted a battalion of Fed speakers to parrot Powell’s talk tough to swat down investment indexes. Austere guidance has limited risk appetites, reset valuations, and increased corporate vigilance in anticipation of an economic softening called for by the Fed.

Because it’s easier to tighten words than policy, Powell tightened guidance well before he tightened rates. It worked. But at this point, policy has clearly caught up with the rhetoric, as chronicled in the charts below:

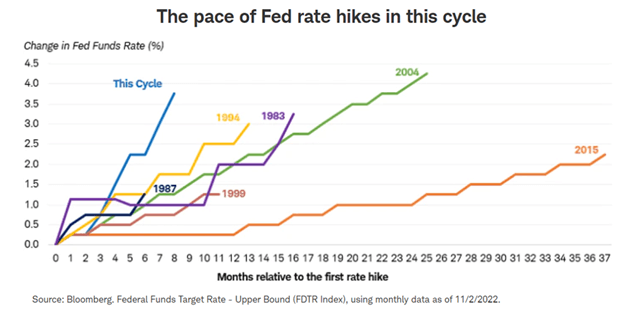

The benchmark interest rate has risen at an historic pace:

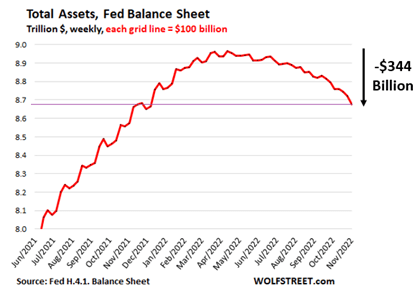

The Fed’s balance sheet has shrunk at an historic pace:

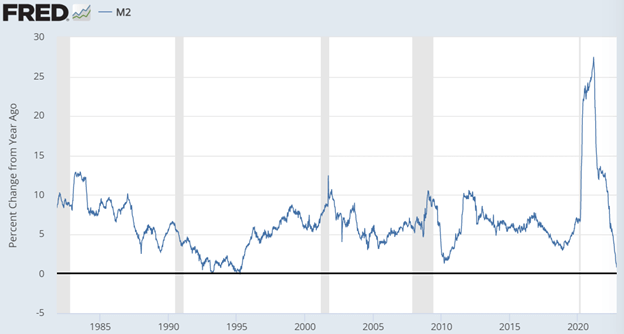

Leading to an historic collapse in money supply growth:

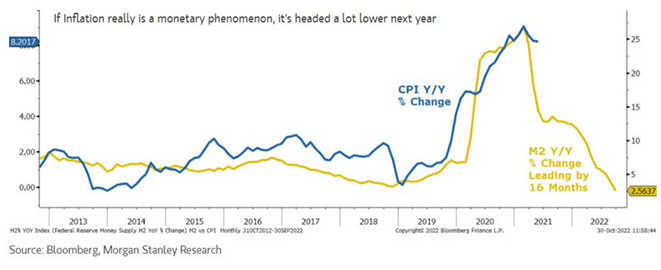

Which could be a precursor to an historic collapse in inflation:

Whether inflation collapses at an historic pace is not important. What is important is that policy has tightened monetary conditions to the point that inflation has started, and will continue, falling. Therefore, the Fed no longer needs to double up on tight rhetoric and tight policy.

In Powell’s own words on Wednesday, “the time for moderating the pace of rate increases may come as soon as the December meeting.” Clearly, the Fed will RAISE rates again (.50%), but this statement is a CUT in forward guidance. By doing so, Powell only improved the levels on our Santa Claus rally gauges discussed last week (US Dollar Index<110, now 105; 10-Year Treasury Yield<4%, now 3.6%; 5-Year Inflation Expectations< 2.5%, now 2.3%).

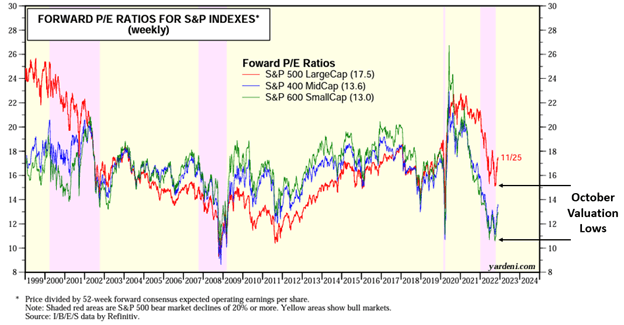

Powell’s guidance cut certifies October’s valuation lows and provides opportunity for further expansion, even more so for small-cap and mid-cap stocks:

Now that Powell has released his vice on valuations, we just need corporations to contribute earnings, which will greatly depend upon the depth of the oncoming downturn.

On this, there is a wide range of opinions. According to the bottom-up analysts, corporations will grow earnings by 5% next year. According to top-down strategists, earnings will fall. This disagreement will drive continued volatility, but with inflation falling and the Fed softening, the market now has newfound and welcome support.

Have a great Sunday!