The Full Story:

Markets have rallied strongly off their October lows. The inflation “pivot” from hot surprises to cool surprises in the recently released consumer price index (7.7% vs. 8% expected) and the producer price index (8% vs. 8.3% expected) triggered technical as well as fundamental buying. For this welcome advance to become a true Santa Claus rally into year-end, we need a few key measures to comply. If they do, we will have ample rally reasons for the season!

The U.S. Dollar < 110

I cannot overstate the financial importance of the U.S. Dollar. Each day $7 trillion changes hands in the foreign exchange markets globally; seventy-one percent of those transactions occur in U.S. dollars. Additionally, the U.S. dollar accounts for 60% of the $12 trillion in foreign exchange reserves held by central banks worldwide. Because of the Fed’s tough talk and breakneck rate increases, the U.S. dollar surged nearly 30% against its foreign currency pairs over the past year. This relentless climb higher began agitating sovereign credits worldwide. Currency and interest rate stress began appearing in the UK, China, Japan, and less credit-worth Euro lands as the DXY dollar index approached 115. Every tick higher increased the risk of a global credit event. A global credit event would quickly amplify recessionary conditions, turning a soft landing for the global economy into a hard one. The markets have not priced this in. A hard landing would drive earnings down 20% and push the S&P 500 towards 3000, down from 3950 today. Fortunately, cooler language from the Fed suggesting a 0.50% hike in December rather than the 0.75% once projected and cooler CPI and PPI inflation reports drove a dramatic sell-off in the U.S. dollar, relieving a significant amount of financial stress worldwide. For Santa to arrive sleigh-full, we need the DXY index to remain at or below 110.

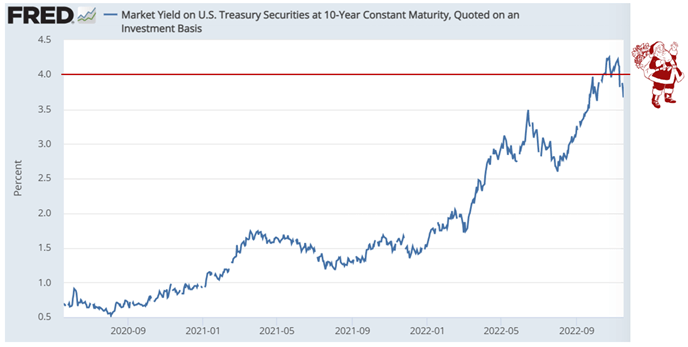

The 10-Year Treasury < 4%

The Fed controls the overnight rate, currently 4%, but does not control longer-term rates. Market participants determine longer-term yields by factoring in policy decisions, economic projections, inflation expectations, and myriad other variables. Most economic actors do not traffic in the short-term interest rate markets; they finance projects and invest with longer-term debt instruments. Rising longer-term rates lead to higher interest expenses, reducing project sizes and viability. Additionally, rising rates lead to falling bond values. The Barclays Aggregate Bond index has fallen 20% as long-term rates have surged over the past two years. Big losses on bond portfolios create significant issues for institutional actors like pension funds. Recall that when long-term rates spiked in the UK after an ambitious budget proposal, pension fund pain led to the removal of Prime Minister Truss! Fortunately, as inflation rates have cooled and “soft landing” recession odds have risen, longer-term bond yields have fallen, reducing economic funding stress and investors’ losses. For Santa to arrive sleigh-full, we need the 10- year Treasury Bond index to remain at or below 4%.

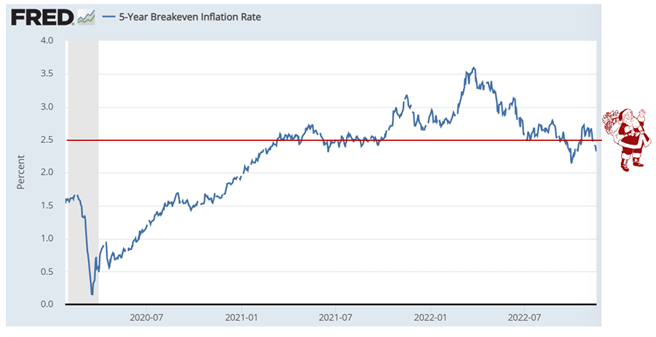

5-Year Inflation Expectations < 2. 5%

The Fed has drawn everyone’s attention to current inflation measures to justify their monetary austerity. However, it’s inflation expectations that drive longer-term financial decisions within the marketplace and reflect the inflation-fighting credibility of the Fed. By this measure, the Fed’s disinflationary campaign is working. Inflation expectations over the next five years recently fell to 2.32%. This lies well below the 3.6% expected at the end of the first quarter and within range of the Fed’s 2% target. As current inflation measures cool, inflation expectations should continue to descend towards the Fed’s 2% target, giving them valuable feedback that their policies are sufficiently restrictive. Any rise in expectations from here would prompt a significantly more restrictive policy. For Santa to arrive sleigh-full, we need the 5-year breakeven inflation index to remain at or below 2.5%.

Should these three conditions be met, the rest of the market year should feel festive with one caveat. We have already rallied 13% off the October low, and initial legs higher after washout lows tend to be the most dramatic. Do not expect that 13% surge to repeat. Gains will likely be moderate from here as investor sentiment, my favorite contrarian indicator, has entered the neutral zone, reducing rally fuel. Nonetheless, with the dollar, interest rates, and inflation expectations in check, we have our rally reasons for the season!

Have a great Sunday and a very Happy Thanksgiving!