The Full Story:

On Thursday, after an abysmal inflation report that drove the market down 600 points at the open, stocks went on one of the largest one-day rallies in history. What drove the rally remains a mystery. We have explained that with cash levels high, sentiment levels low, short interest (betting against stocks), and options hedging at extremes, the market has stockpiled barrels of rally powder awaiting a match. It doesn’t matter whether that match was the UK backing off its fiscal plans, the jobless claims ticking higher, silver linings in the inflation report, a decline in the VIX volatility index, recognition that peak inflation has passed, or rates on the 10-year holding below 4% (our best guess). Investors received a reprieve and re-learned some very valuable lessons:

1) Volatile markets move in both directions.

2) Trying to game this market almost entirely driven by policy proclamations, sentiment, and technical, is a fool’s errand.

3) Those who have weathered the big moves down better not miss the big moves up!

Don’t

Miss the Best Trading Days

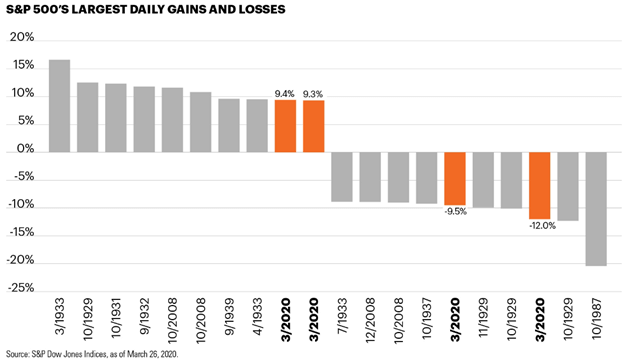

I loved seeing this tweet early Friday morning from former Goldman Sachs CEO Lloyd Blankfein. Lloyd clearly described the maelstrom that is this market right now, proving that high volatility periods like this leave even the wisest of the Wall Street wizards dumbfounded. Perversely, peaks in volatility make great buy points and terrible sell points. In fact, the largest daily gains often appear alongside the largest daily losses. Consider this array:

During the period of maximum COVID market panic, the S&P registered daily losses of 9.5% and 12%, as well as daily gains of 9.3% and 9.4%, all within the same month! Similar dynamics appeared during the market bottom in 2008 and even during the Great Depression lows. As Lloyd attests, trying to “trade” highly volatile markets can be hazardous to your wealth!

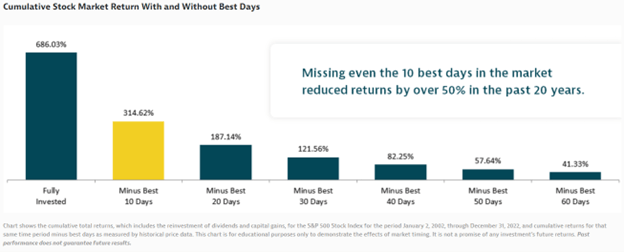

Those who panic sell in times of stress risk quickly fall behind when recovery rallies ignite, locking in their returns disadvantage. The following chart analyzes market returns over the past 20 years and calculates the returns deduction from missing just a handful of the best-performing days. Within the study, the intrepid who remained fully invested over the entire period received total returns of 686%. Those who bailed and missed the ten best days (often clustered around market lows) received 315%. Those who habitually sold into stress diminished their returns further still.

I do not know if the current market volatility marks the low in this Fed vs. everybody contest. What I do know (as Lloyd knows) is that investors who sell into mayhem like this have a high historical probability of getting left behind.

Earnings Season Support

While we contend that fundamental realities currently ride behind policy, sentiment, and technical perceptions, earnings season should provide reassurance. Recall that despite the economy losing 1.1% annualized for the first half of the year, corporate earnings grew 9%. Of course, the GDP results adjust for inflation, while the corporate results do not. Therefore, inflation perversely supports corporate performance as price hikes boost revenues.

For the third quarter, analysts expect S&P 500 companies to collectively report revenue growth of 8.5%. Absent a collapse in profit margins, earnings should register well above the 2.4% currently guesstimated. According to Factset, based on historical earnings surprise rates, we could see earnings for the third quarter rise 6-7% overall.

Fourth-quarter earnings growth will slow, but earnings should remain positive as they have throughout 2022. Therefore, declines in the market have been entirely valuation-related to date, as inflation and interest rates weigh on multiples. Should peak inflation have passed, then trough valuation has likely passed as well. We currently trade at 15.5 times earnings estimates, and 18 times trailing earnings. Both stand well below their 10-year averages (17.1 and 20.4) and within inches of their cycle lows. While we suspect most of the vigorous buying Thursday represented short covering (traders buying back shares they had previously borrowed and sold), perhaps longer-term investors also realized that after a bout of relentless selling and volatility, extreme downside moves historically unlock extreme upside moves and for returns’ sake… do not miss out!

Have a great Sunday!