The Full Story:

Late at night, cable TV channels broadcast a seemingly endless trove of limited-edition coin and safe-haven gold infomercials. Underlying the shiny appeal is the notion that the US dollar will soon lose its reserve status and plummet in value. Given that gold has no practical application other than adornment, its primary security characteristic is to serve as the anti-dollar. Bitcoin has also been stylized as a financial safe harbor, but industrywide corruptions have revealed Bitcoin this year as a semi-lethal gateway drug. Conversely, gold remains gold, a yellow metal that society prizes as a store of value, without the leverage and pop-up “decentralized finance” Ponzi schemes bedeviling Bitcoin.

So far, 2022 has delivered nearly all the catastrophic promises prophesized by the late-night infomercials. The world has descended into border wars and culture wars. Government debt has exploded while hardcoding escalating deficits. Stock and bond markets have logged their worst combined first halves in over 100 years. Inflation at 9% has hit 40-year highs. It really is as dire as the Bitcoin and gold infomercials predicted! Except for the payoff. Year-to-date, Bitcoin has fallen 50%. Year-to-date, gold has fallen 6%. Year-to-date, the US dollar has gained over 11%. When times get really tough, the King Dollar mattress gets stuffed.

Safety in Numbers

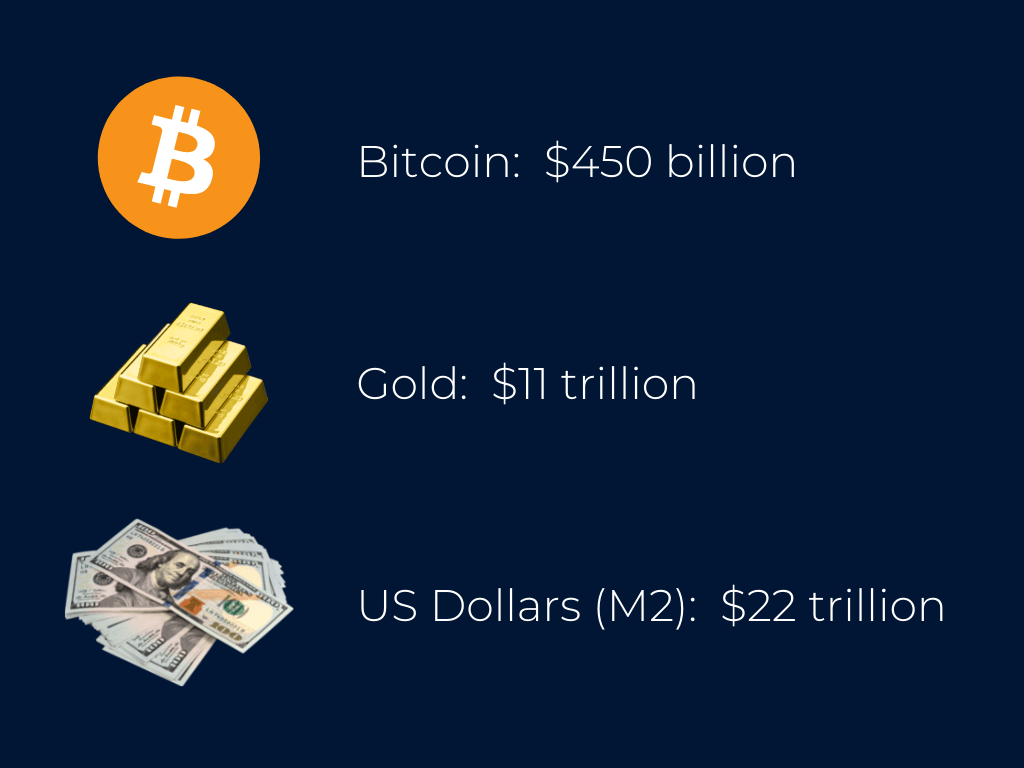

While the theory of gold and Bitcoin as safe havens resonates, in practice things get complicated. The US dollar is a currency because it passes the three determinant tests. 1) It’s a medium of exchange, as you can buy things with dollars. 2) It’s a store of value, as you can buy things today with dollars or wait until later. 3) It’s a unit of account, as things are priced in dollars. While gold may act as a store of value, it does not act as a medium of exchange or as a unit of account. Bitcoin may act as a store of value if you hold it offline, but it does not act as a medium of exchange or as a unit of account. Therefore, if you want to exchange your bad currency for good currency temporarily as a haven, neither Bitcoin nor gold will suffice. For global market participants at size, the biggest limiting factor in the search for safe haven is liquidity. Consider the size of the following liquidity pools:

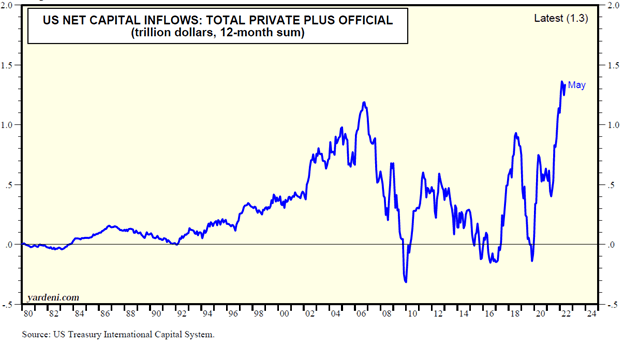

But that is just the units themselves. These numbers do not include denominated securities, like the value of the US stock market at $48.2 trillion or the value of the US bond market at $52.9 trillion. I am not even including the notional value of dollar-based derivative contracts (options, futures, swaps, etc.) which reach stratospheric levels. The US dollar liquidity pool is miles deep and miles wide. Globally, the value of all currencies approximates $100 trillion and total wealth approximates $360 trillion. Should the world want to shift 1% of assets, that amounts to $3.6 trillion. Only one marketplace can accommodate that size, the USD marketplace. Consider international asset flows into US markets year-to-date:

Over the past twelve months, a net $1.3 trillion has poured into the United States of America. Remember, before you can buy something with a US dollar, you must sell your host currency and buy that dollar first. This puts upward pressure on the value of the purchased dollar and downward pressure on the sold host currency. The largest US dollar pairs are the euro and the yen, down 10.5% and 15.5% year-to-date, respectively. More than gold. Less than Bitcoin. The dollar is where you go when it rains.

What if the Sun Comes Out?

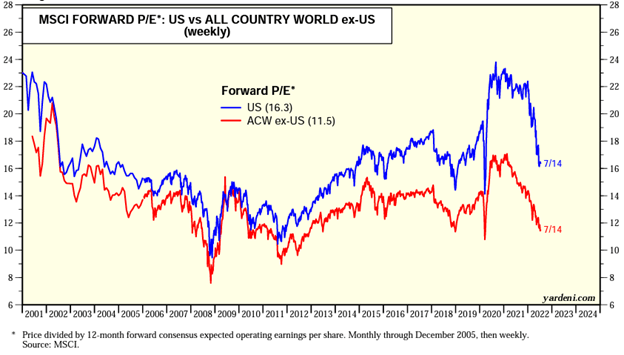

Now that we have established the US dollar as the ultimate safe haven in times of global stress, we should search for any asset class distortions. Since COVID began, US assets have substantially outperformed international assets as dollar-seeking currency flows enhanced returns. Over the past three years, the MSCI USA index has returned 11.83% annually, while the MSCI Ex-USA index has returned 1.69% annually. Given the trauma of 2022 and the strength of the US dollar, one might expect even larger differentials. Let’s see. In US dollar terms, the MSCI USA stock market index fell 21.29% through 6/30/22. The MSCI ex-USA index fell 18.76%. While you may be surprised that the offshore markets outperformed the USA, if we denominate the comparison in domestic currencies rather than the US dollar, things get even more surprising. In domestic currency, the MSCI USA fell 21.29% while the MSCI Ex-USA fell 11.18%. So, while the US dollar has clearly acted as a haven, this analysis reveals another haven as well: low valuation. Consider the forward P/Es of the MSCI USA stock index and the MSCI Ex-USA index:

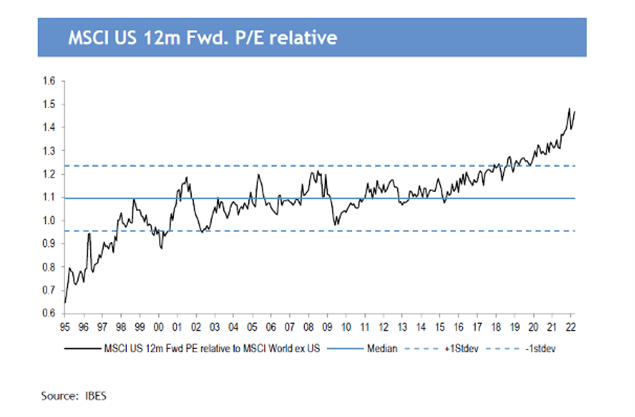

The US stock market trades at 16.3x earnings, while the world ex-USA market trades for 11.5x earnings, making the USA 42% more expensive. For those who might suggest the “USA is just better” spread is warranted, review the following:

As seen above, while the US trades at a 40% advantage today, it traded at a 40% disadvantage in 1995. Over the entire time period, a “USA is just better” valuation premium does appear, but it’s 10%… not 40%.

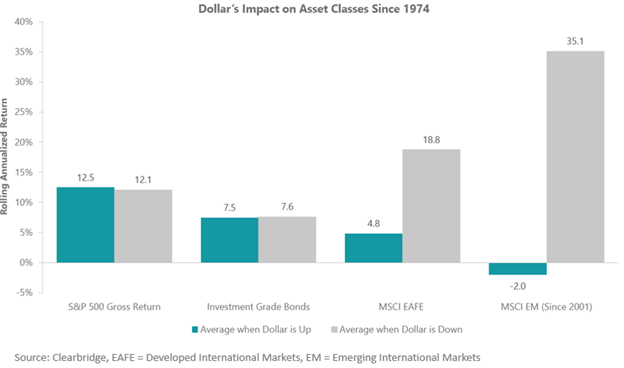

The COVID/Russia/China crisis money flows into the USA have been a boon for the US dollar and a boon for US equities vs. ex-US equities, but the worm may be turning. Ex-USA markets have shown surprising resilience this year, with positive relative returns emanating from washed-out valuations. Should the world return to its more normal risk-on sensibilities, the US dollar should weaken and reanimate the moribund ex-US markets. History agrees:

LASTLY: Before the gold and Bitcoin zealots prepare their rebuttal emails, allow me to intervene. I am not arguing that gold does not provide a store of value. I believe it does. I am arguing that in times of severe global stress, major money will flow into the USD because it is the deepest and most liquid pool. Gold cannot provide the liquidity or handle the size when the world gets the scaries. For my Bitcoin brethren, your quest for global reserve currency status has clearly derailed. Bitcoin is not a unit of measure, and it is not a unit of account. Its value depends on anti-confidence in the US dollar and the global financial system. You have the greatest marketing machine in the history of asset markets, but at $450 billion you simply cannot compete with the incumbents systematically. Bitcoin remains a speculative asset backed by dreams. Those dreams may get realized, and I find much of the thesis appealing, but for now and for years to come… the US dollar remains king.

Have a great Sunday!