The Full Story:

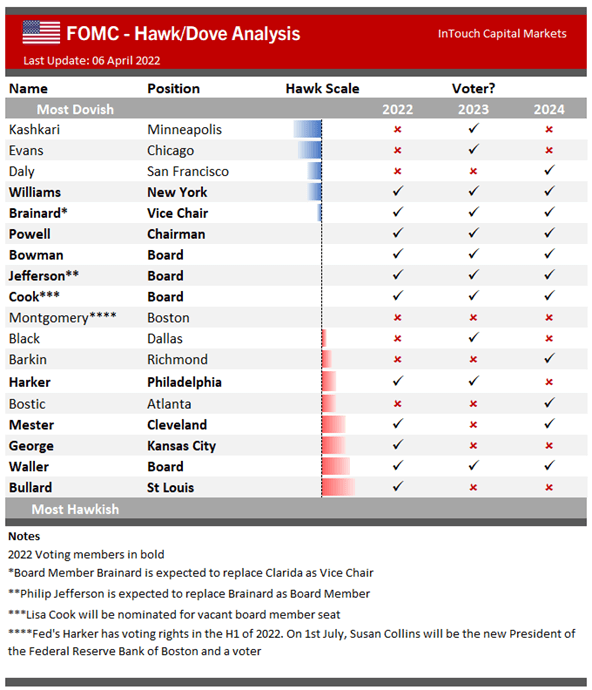

On Wednesday of this week, the Memphis Economic Club hosted its annual economic outlook luncheon with St. Louis Federal Reserve President James Bullard (Click here to view Jim’s presentation). I look forward to this event every year as it provides the opportunity to dialogue with one of the most important decision-makers within the Federal Reserve system. However, this year, I believe Jim to be THE most important figure within the Federal Reserve system. Why? Because not only is Jim a voting member of the FOMC that sets monetary policy, but he is also the most hawkish of all the Federal Reserve Presidents right now as seen in the rankings below:

Jim earned this distinction by calling for a Fed Funds rate of 3.5%-4% by year-end. In fact, at the March meeting, Jim cast the only dissenting vote in favor of more aggressive action. In Jim’s own words:

I dissented with the Federal Open Market Committee (FOMC) decision announced on March 16, 2022, to raise the target range for the federal funds rate by 25 basis points to 0.25% to 0.50%. In my view, raising the target range to 0.50% to 0.75% and implementing a plan for reducing the size of the Fed’s balance sheet would have been more appropriate actions.

Therefore, in my opinion, any softening of Jim’s hawkish stance would indicate a dovish pivot committee-wide. This would indicate that the valuation rerating across equity markets might be near completion, clearing the way for economic and earnings growth to propel stock prices higher once again. So, I hit the lunch with the mission of testing Bullard’s hawkish resolve and asked him three questions, shared below.

Question 1:

You have been strongly in favor of “front-loading” rate hikes. If you had unilateral policy control, would you raise the Fed Funds rate to your chosen level of 3.5%-4% tomorrow? And if so, how would this impact the economy?

Clearly, I was trying to call Jim’s bluff. I believe Bullard has talked tough to manage inflation expectations but knows that spiking rates 2-3% would negatively shock the system and rapidly raise recession risks. Jim communicated that while he believes rates will ultimately need to rise above 3.5%, he supports the Fed’s measured strategy of raising rates .5% in June, .5% in July, and then adjusting as conditions warrant. Furthermore, he stated that if rates reached 3.5% in 2022, a decrease in inflation in 2023 could warrant rate CUTS. In my judgment, this was a dovish turn for Jim, suggesting that he has chosen to play the fiercest hawk role to anchor inflation expectations and that he is more dovish in practice. BUT… just to be sure, I asked him question #2.

Question 2:

Do you view recession as an inflation-fighting policy tool?

Paul Volker intentionally forced the US economy into a painful recession in the early 1980s to extinguish the inflation that burned through the 1970s. In some ways, Jim’s aggressive rhetoric recalls a Volker-like commitment to de-flame inflation “at all costs.” Jim responded to my question tangentially, stating that he believed the economy is resilient enough to withstand any oncoming rate hikes. He didn’t bite on whether the Fed would intentionally induce recession to break inflation, but he did communicate his view that the economy isn’t on the verge of recession. Jim clearly does not see recession on the horizon and doesn’t portray a Volker-like desire to incite one.

Question 3:

Does the historic decline in the US deficit alter how aggressively the Fed needs to fight inflation?

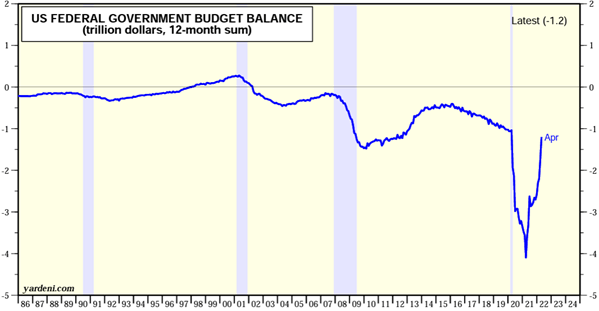

While everyone seems to blame the Fed’s monetary policy decisions for inflation, I believe that Congress’s fiscal policy decisions bear much more responsibility. Consider the Federal budget balance pictured below:

Pre-COVID, the Federal deficit ran between $500 billion and $1 trillion for a decade. During COVID, the deficit swelled to over $4 trillion due to various stimulus packages. Biden’s last and largest stimulus attempt, the $5 trillion Build Back Better bill, failed to pass and lead to rapid budget compression as the COVID stimulus expired. Today, the deficit has returned to the same approximate level it held pre-COVID. Therefore, while the Federal Reserve may be slowly “normalizing” monetary policy, the federal government has already “normalized” fiscal policy. If fiscal stimulus largely created inflation, shouldn’t its removal also remove inflation? Furthermore, if the Fed agrees, shouldn’t they be less aggressive with monetary tightening given the historic degree of fiscal tightening?

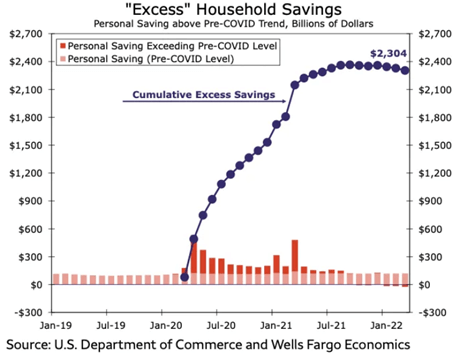

Jim threaded his response carefully. Fed officials are directed to avoid commenting much on fiscal matters. While the coordination of fiscal and monetary policy makes sense, Congress and the Fed rarely coordinate policy decisions. Unfortunately, this often puts the Fed in a reactionary role. While I couldn’t get Jim to blame Congress directly for the inflation problem, he did acknowledge that “some” contend that Congress overdid it. He also highlighted that while the deficit has declined, over $1 trillion of stimulus funds remain appropriated but undisbursed. Additionally, households still hold much of their stimulus windfall which will continue to support consumer spending despite fiscal stimulus withdrawal:

Therefore, Jim still sees plenty of fiscal stimulus sloshing around the economy, unaltering his views on monetary policy restraint.

Overall, I found Jim’s body language more dovish than his spoken language as he attacks inflation expectations while supporting the economy. Jim’s bark will ultimately prove worse than his bite. He does a masterful job as a communicator and policymaker. We are very fortunate to have President Bullard on the job.

P.S. I want to acknowledge Douglas Scarboro, who leads our Memphis branch of the St. Louis Federal Reserve, for granting me such generous access to President Bullard. Thank you, Douglas – I feel much better now!

Have a great Sunday!