The Full Story:

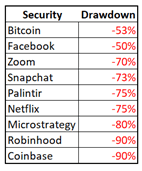

In another anxious week for investors, a series of Crypto collapses spilled over into sympathetic tech stocks and into the broader market as forced sellers searched for liquidity. For the market newbies with “diamond hands” who have never experienced a downturn, this has been a painful experience. Consider the declines in the following fan-favorites:

These names all have similar characteristics: great growth, high valuations, and in most cases, no earnings. Goldman Sachs actually created an index of companies known as the Non-Profitable Tech Index to isolate their performance. See (and look-out) below:

I have been asked several times over the past week whether this technology washout made a compelling buying opportunity. Perhaps, for traders looking for a violent short covering rally, but for longer-term investors this requires more thought.

Companies that do not power their expansion with profits must power it through continuous capital raises. Amazon did not earn a dime for a decade, neither did Tesla, but each managed to fundraise their way through, using brute force and sheer will, with multiple near-death experiences along the way. With investors becoming more discerning and profit-minded, this current class of profitless tech firms may find themselves gasping for cash. Those that supply it will certainly take advantage of desperation by diluting the value for existing shareholders.

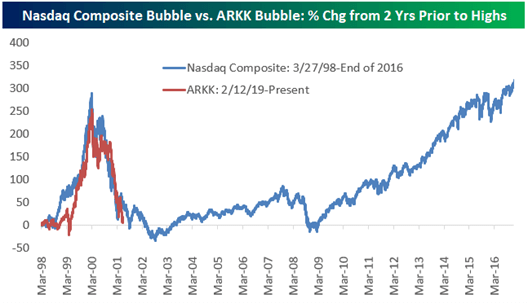

Those of us old enough to remember the early 2000s recall the challenges the newly minted NASDAQ dotcoms faced at the time. It took 15 years for that index to recapture new highs with very few of the dotcom darlings in tow. As a modern analog, the ARK Innovation Fund (ETF ticker: ARKK) holds 35 “disruptive” and mostly unprofitable technology stocks. The recent performance path eerily resembles the Nasdaq’s path at the turn of the century. For those non-profitable tech investors hoping to quickly reclaim even, beware the following chart:

Where the Earnings Are

Fortunately, while there are many publicly listed companies that don’t make money, there are many more that do. And while the world has been preoccupied with other considerations, Q1 2022 earnings season has come and gone.

For the quarter, 79% of S&P 500 companies beat their earnings expectations while 75% beat their revenue expectations. At the beginning of the quarter, analysts expected earnings growth of 4.6%. Finalized earnings growth will likely double that amount to between 9-10%.

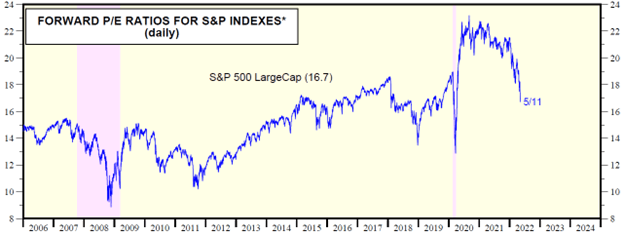

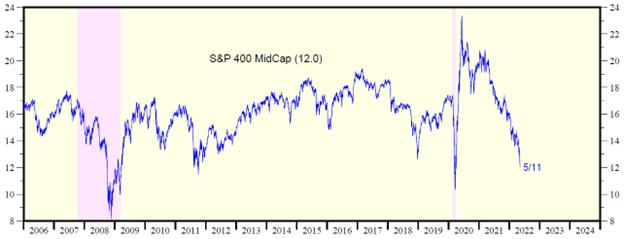

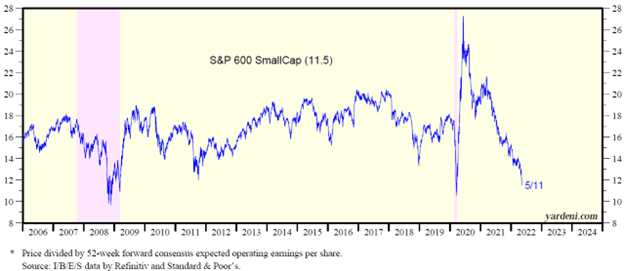

For the coming quarters, analysts expect earnings to grow 4.8% in Q2, 10.6% in Q3, and 10.1% in Q4. For the full year, analysts expect earnings growth overall of 10.1%. When earnings grow and prices decline, valuations can compress quickly. Here are the valuation trends across the S&P 500 large cap index, the S&P 400 midcap index, and the S&P 600 small cap index:

As shown, large cap stock valuations have declined to their pre-pandemic averages, while mid cap valuations have fallen near their pandemic lows and small cap valuations have fallen to their Great Recession lows.

While there likely remains work to be done to bring the profitless back to reality, the profitable have certainly rationalized their valuations. This market may have a lot of problems, but at this point, valuation isn’t one of them.

Have a great Sunday!