The Full Story:

The Fed continued their vociferous bully tactics against inflation expectations this week. The release of minutes from the last Fed meeting revealed near consensus on raising rates .50% but-for-Ukraine and a strategy for shrinking their $9 trillion balance sheet by $95 billion starting in May. This onslaught of tough talk and policy signaling have driven market rates dramatically higher. The 10-year Treasury bond yield has vaulted up from 1.5% at the beginning of the year to 2.73% today, while the 30-year mortgage rate has hurtled to 5% from 3% to begin the year. This has led to significant pressure on equity and bond valuations and a 40% decline recently in mortgage applications. Since quantitative tightening targets increased long-term rates, the prospect of more rapid and significant bond sales has also led to an un-inversion of the yield curve. Kudos to the Fed for meaningfully tightening monetary policy while un-inverting the yield curve, with only one rate hike!

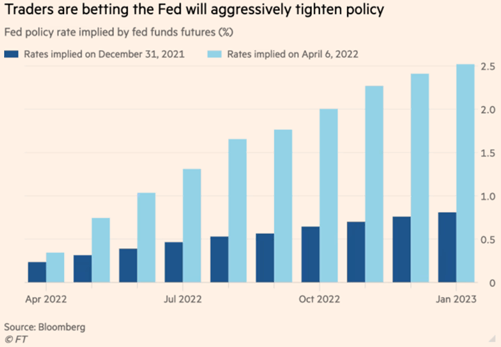

The more the Fed can accomplish via “conversational” tightening, the less “actual” tightening they will need to do. While the current policy rate sits at .5%, the futures now forecast rates of 2.5% before year end:

The Fed has yet to shrink their $9 trillion balance sheet, but traders now expect the Fed to shrink its balance sheet by $2 trillion+ over the next two years, three times the pace the Fed tightened in 2018. To punish investor sentiment even further, former NY Fed President Bill Dudley espoused Wednesday that the Federal Reserve will need to inflict “more losses” on the stock and bond markets to meaningfully rein in inflation. For those who argue that Fed policy has fallen far behind the curve, that may be true, but Fed speak has rapidly caught up, and so have interest rates.

The Fed’s campaign to talk rates up has been the most aggressive on record, and it’s working precisely as designed. Longer term inflation expectation measures remain cozy with the Fed’s 2% target and near-term measures have come off boil. By tightening without tightening, the Fed has availed itself of much greater policy flexibility. Should the economy stall or inflation cool, removing tough talk will be far easier than removing rate hikes or reversing quantitative tightening. Investors may not like what they are hearing, but it’s far more benign to markets than the actual doing.

Style Check

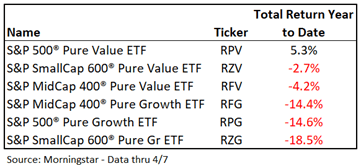

I review “pure style” indices frequently for exaggerated style performance distinctions. The pure style indices contain the growthiest of growth stocks and the valueiest of value stocks. In theory, a rising rate environment should adversely impact higher P/E “growth” stocks more than lower P/E “value” stocks. With rates rising dramatically, the performance differentials should also be dramatic. Let’s check:

True to text, investors equally weighted across the three pure value indices have seen declines of .5% on the year while investors equally weighted across the three pure growth indices have seen declines of 16%. Recall that the situationally low P/E’s across Europe and the emerging markets confer value status on them as well. Year to date, Europe (ticker: IEV) and the emerging markets (ticker: EEM) have each fallen 8% despite war in Europe and Russia’s inclusion and elimination from the emerging market index. This analysis supports our global value bias and our contention that Powell matters more than Putin to markets.

Have a great Sunday!