The Full Story:

Russia Takes Ukraine

Ukraine could not repel Russia’s invasion this week without international military support. This was not on offer. Therefore, sanctions remained the only available allied strategy for deterrence or reprisal. Russia sells oil, gas, wheat, and industrial metals, most of these directly to Europe.

Indirectly, since Russia is the world’s 2nd largest natural gas producer and the 3rd largest oil producer, any interruptions within those markets would levy even more inflation on nations (like the US) struggling to contain it. As such, Europe and the US developed a sanctions package that does not affect energy markets or the financial transaction systems that support them. Minimal military damage and minimal sanctions result in minimal global economic consequences from Russia’s Ukrainian invasion.

The post-invasion geopolitical consequences remain significant, but from an economic standpoint, if the allies do not have the resolve to disrupt the energy and transactions networks, it’s basically a non-event.

Buy Fear

There are 1805 weeks of data within the AAII Investor Sentiment Index. This index polls retail investors weekly and measures the number of Bulls (markets will rise!) and Bears (markets will fall!) and Neutrals (no clue!). For the week ending 2/24, 23.4% of those surveyed were bullish and 53.7% were bearish for a “Bull-Bear Spread” of -30%. Of the 1805 weeks in the database, only 30 weeks had lower investor sentiment readings. For that data set, the S&P 500 median price return one year later was 22%.

Of the 30 readings lower than today, 13 coincided with the Iraqi invasion of Kuwait in 1990. The “Bull-Bear Spread” averaged -39% during that period as investors dealt with the surprise invasion, the doubling of oil prices overnight, the initiation of Operation Desert Shield to protect our oil interests in Saudi Arabia, and the mobilization of US forces during Operation Desert Storm… which we all watched live on TV. Yikes!!

One year later, across those 13 occurrences, the S&P 500 price index gained 23%, on average… and that figure does not include reinvested dividends, so go ahead and tack on a few more percentage points. The lowest sentiment reading in the entire database occurred on 10/19/90 at -54%, with markets 26% higher a year later. The second-lowest sentiment reading occurred on 3/5/09 at -51%, with markets 57% higher one year later. The best buying opportunity comes not when people are euphoric, but when they are despondent.

Surprise!

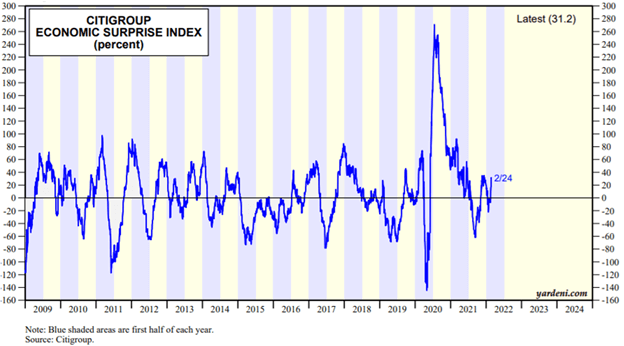

The Citigroup Economic Surprise Index pairs economic releases (reality) against economist forecasts (expectations). Without digging into the details, the recent upward surge in the Citigroup Economic Surprise Index indicates that while investor anxieties boil over inflation, Fed hawkishness, and Russian aggression, recent economic data releases have OUTPERFORMED economist’s expectations.

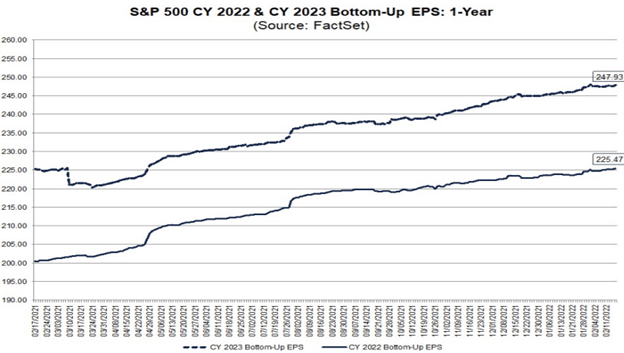

This chart from FactSet chronicles the path of analysts’ S&P 500 earnings estimates for 2022 and 2023. While estimates are not currently rising at the same pace they rose last year, the slope remains positive. Therefore, the continued upward slope indicates that while investor anxieties boil over inflation, Fed hawkishness, and Russian aggression, S&P 500 earnings estimates continue to RISE.

Have a great Sunday!