The Full Story:

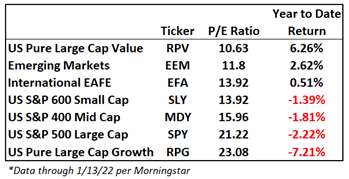

Markets often begin the year with powerful crosscurrents as strategists refresh their models. The cacophony of hawkishness blasting out of the Fed has added urgency to the assignment. While we entered the year expecting the Fed to tighten monetary policy given the rise in some “sticky” inflation measures like wages and rents, we too have been surprised by their more aggressive signaling. Not only has the Fed formally accelerated their “taper” but they have openly debated three to five rate hikes before year-end while also initiating quantitative tightening. This has led to a jolt higher in rates and lower in risk assets. While we prefer being contrarians, we believe the consensus has it right. In response, on Monday we swapped out a higher valuation investment with our equity portfolio for a lower valuation version, further reducing our overall portfolio valuation metrics. This does not suggest we have turned bearish, but only that for 2022 we even more highly favor lower valuation areas of the global equity markets. The market has clearly rendered its concurrence, given the following year-to-date metrics:

Note the perfect inverse correlation between valuation and returns. This reinforces our belief that markets have become functionally algorithmic, and that today’s macro money flows trump yesterday’s micro fundamental analysis. This perspective baselines our investment strategies. We study macro currents, anticipate shifts, deploy capital accordingly, and await money flows to follow. In the current environment of higher-than-anticipated Fed hawkishness, lower valuations should provide investors portfolio insulation. As such, we added even more insulation to our portfolios this week.

For trade details feel free to contact your strategists as SEC compliance prohibits providing specifics here.

Earnings Yearnings

Earnings seasons happen four times a year as companies release their results and guidance. Non-earnings seasons also happen four times a year and consist mostly of earnings speculation. Markets typically rally before or during earnings season, but not usually both. Given the selloff prior to this earnings season, will Q4 earnings revive our spirits and the market’s upward trend?

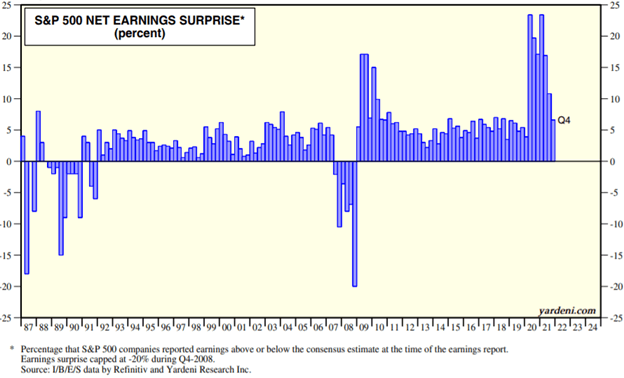

According to FactSet, S&P 500 companies should report an aggregate 21.7% rise in earnings overall. Over the past four quarters, earnings have outpaced estimates significantly more than usual. Of the 20 companies that have reported Q4 earnings so far, 70% have outpaced estimates by an aggregate 6.6%. Those numbers are historically high, but lower than they have recently been, as seen below:

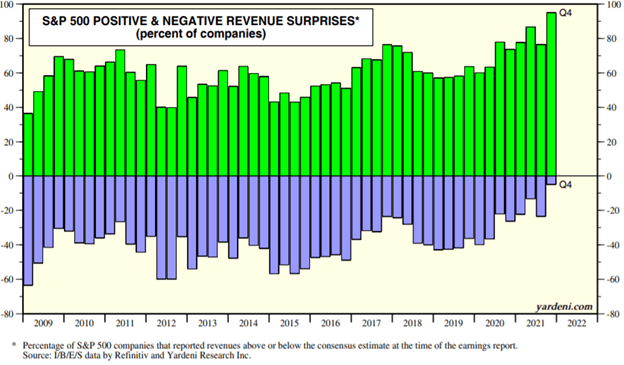

However, of the 20 companies that have reported Q4 revenues so far, 95% have outpaced estimates with a 12.8% sales growth rate overall. These are very high numbers, historically, as seen below:

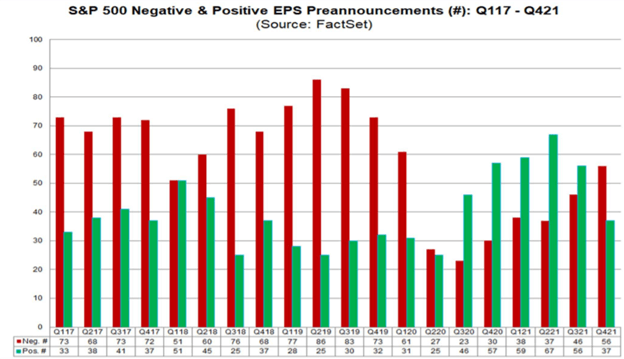

This indicates that companies sold their products and services into a highly receptive economy, boosting the case for better-than-expected earnings. However, the heightened uncertainty around supply chains (more COVID shutdowns), labor availability (10.6 million job openings + mandatory quarantines), wage pressures (average hourly earnings up 5.8%), and interest rates could dampen outlooks. In fact, for the first time since Q2 2020, more companies have issued negative forward guidance than positive forward guidance:

The conflict between strong revenues and negative earnings guidance may cancel each other out despite better-than-expected earnings results. We suspect that this Q4 earnings season may not reignite the rally but will set the stage for more positive surprises and returns next earnings season.

Have a great Sunday!

David S. Waddell

CEO, Chief Investment Strategist