The Full Story:

Supply constraints across the global economy have drawn significant attention. Supply chain bottlenecks, labor shortages and soaring commodity prices have created frustrating product delays and scant inventories amidst record levels of stimulated demand. Businesses must maximize their resources to win customers, deliver service, and retain clientele. Cost pressures lead to agonizing pricing decisions, scrutinous spending decisions and carefully vetted investment decisions. Just as a shortage of demand (also known as recession) tests management’s mettle, this global shortage of supply tests mettle just the same. Amidst this “supply shock,” how are American corporations doing?

Enlarging the Margins

All business leaders must decide what matters the most. For some it’s clicks, for some it’s market share, for some it’s dividend distributions, for some it’s number of stores; in all, the targets are limitless. But ultimately, irrespective of their initial strategy, businesses exist to create profits. Some may forestall profit realization during hyper-growth phases, but they too must eventually produce profits to survive (Tesla earned $1.6 billion last quarter, Amazon earned $8 billion). Additionally, astute long-term investors allocate capital towards higher profit endeavors in pursuit of returns. Economies do as well. If you want to judge the health of a business, measure its profits. If you want to assess the health of American corporations, measure all the profits.

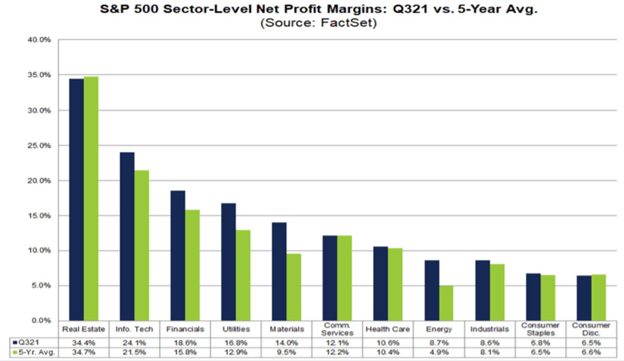

Over the last 30 years, the profits across the US companies within the S&P 500, which account for 80% of US stock market value, have increased tenfold. Over this period, the US economy evolved from an asset-intensive, manufacturing-based economy into an asset-light, service and information-based economy. As the economy evolved, profit margins (profits/revenues) rose. For instance, in 1990, high profit margin industries like financials and technology comprised only 7.5% and 6.3% of the S&P 500, respectively, while low profit margin industries like industrials and consumer staples comprised 13.6% and 14%, respectively. Today, financial and technology companies comprise 14% and 28% of the S&P 500 while industrials and consumer staples comprise 8% and 6%, respectively. This doesn’t even account for the recent creation of the “communications” category, which adds another 11.3% to the technology weighting and increasing its total to nearly 40%, nor the inclusion of technology names like Amazon into the “consumer discretionary” category adding even more. The growth in the economy and the pivot toward higher margin industries accounts for the exponential leap in profits. Consider the profit margins reported so far this quarter for each of the sectors below:

Note that the highest profit margins reside across the technology and financial sectors, which dominate the S&P 500, while the lowest profit margin sectors like industrials and consumer goods have been phasing out. While product delays, commodity costs and blue-collar labor shortages greatly impact goods manufacturing and retail, they barely impact technology and financial services. So, the “supply shock” headlines have less impact on corporate profits due to industry weightings…. but there is more. Look at the historical margin comparisons for the industries that should be impacted the most. The current 6.5% profit margin for the consumer discretionary sector meets its 5-year average while the 6.8% for consumer staples and 8.6% for industrials exceeds their 5-year averages. Not only has the economy migrated to higher margin capacities, but so has corporate management!

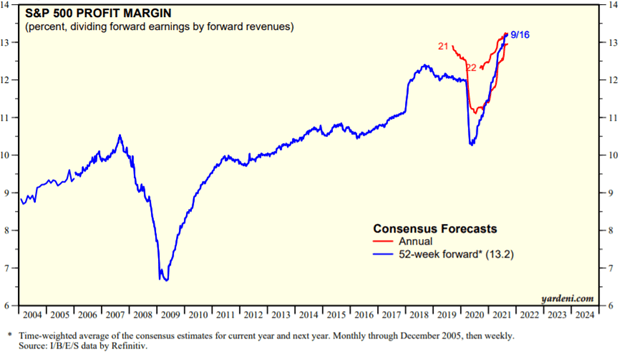

In sum, the supply chain issues are real and certainly create pressures and frustrations across the economy. However, based upon our economy’s asset-light structure and the outstanding abilities for our corporate management teams to adapt, profit margins remain at record levels… and as shown below, analysts suspect these trends will continue into 2023 (blue is year ahead forecast, red shows the progression of forecast revisions).

At least so far, the “supply shock” across the economy has not created a “profits shock” within corporations. In fact, thanks to the dynamism of our economy and our executive leadership… American corporations are doing great!

Have a great Sunday!

David S. Waddell

CEO, Chief Investment Strategist